India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 4, 2017

Sensex Trades Marginally Higher; Metal Stocks Witness Buying Wed, 4 Jan 11:30 am

After opening the day on a flat note, the Indian share markets registered marginal gains and continued to trade near the dotted line. Sectoral indices are trading on a mixed note with stocks in the metal sector and capital goods sector witnessing maximum buying interest.

The BSE Sensex is trading up 17 points (up 0.1%) and the NSE Nifty is trading up 11 points (up 0.1%). The BSE Mid Cap index is trading up by 0.6%, while the BSE Small Cap index is trading up by around 0.8%. The rupee is trading at 68.20 to the US$.

It's no unknown fact that troubles at public sector banks (PSBs) are mounting day by day. 2016 was another year of struggle for PSBs with more bad loans piling up and recovery remaining elusive.

The above situation was also highlighted by the Reserve Bank of India (RBI) in its bi-annual Financial Stability Report (FSR) for 2016. The report raised red flag on quality of loans in public sector banks and diagnosed their key pain points. Some of these points include rise in non-performing assets (NPAs), low off-take of credit, liquidity mismatches, diminishing profitability with negative return on assets in FY16.

The above key points coupled with low average return on equity can mean as a negative development for the shareholders in PSU banks. As one of our recent editions of The 5 Minute WrapUp highlighted...

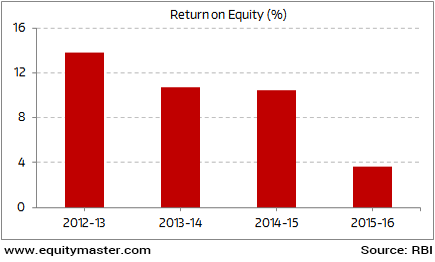

- 'As a shareholder in banks, if the NPA number does not worry you, here is something that should. The sector's average Return on Equity (RoE) has crashed from 10.4% in FY15 to just 3.6% in FY16. All thanks to the profits written off on account of NPA provisions. 70% of them in the books of public sector banks. More importantly, the drag in the ROE is likely to persist in FY17 too. So shareholders of public sector banks have a reason to re-think the margin of safety required to invest in such stocks.'

Continuous Deterioration in Banks' Return on Equity

Yesterday, Tanushree Banerjee, co-head of Research at Equitymaster, wrote how India's largest banks are once again peddling teaser loans. As per Tanushree, teaser loans could be the last nail in the coffin of banks reeling under bad loan problem. And this should worry depositors in PSBs.

The recent correction in banking stocks shows that investors are testing the safety of their stocks... and finding the banking sector lacking. As an aside, Tanushree will be speaking about safe stocks at the Equitymaster Conference 2017, and you're invited. Mark your calendar for 21 January 2017. More details here.

In another news update, the Income-Tax (IT) department has roped in forensic experts from three of the Big Four accounting firms to investigate suspected money launderers.

As per an article in the Economic Times, experts from EY, KPMG and PricewaterhouseCoopers are working with tax officials to examine evidence collected by the department during raids conducted since November 8.

The purpose behind this exercise is to cull out the black money by targeting the accounts that were misused to deposit black. We would like to see how this move will pan out in the coming days.

Speaking of black money, it's no secret that political parties are a kind of black hole to black money. Much of these donations to political parties, being below the limit of Rs 20,000, happen in cash and remain unaccountable (one must note that political parties are currently not required to publicly disclose contributions of up to Rs 20,000). So while you and I need to show an identity proof while depositing our old Rs 500 and Rs 1,000 notes into a bank account, political parties can continue to receive donations of up to Rs 20,000 in cash. And they need not declare who gave those donations.

There is a scope that we as citizens of India can put an end to this discrimination. My colleague Vivek Kaul is on a mission to get us EQUAL RIGHTS. Vivek has initiated a petition to the President of India to request him to set things right. Thousands have already signed the petition. He needs 25,000 signatures before 6th of January to kick this off. In case you haven't, it's time to do your bit now. Sign the petition, and become an agent of change.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades Marginally Higher; Metal Stocks Witness Buying". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!