India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 2, 2016

Global markets weaken Sat, 2 Jan RoundUp

Majority of the global markets ended the week on a sombre note. The US markets were the biggest losers, down by 2% on weak macroeconomic data. While the weekly jobless claims rose sharply since February, the Chicago Purchasing Manager's Index plunged to its lowest level since July 2009 at 42.9 in December. A level below 50 denotes contraction.

The Chinese market was also down 2% on account of contraction in the manufacturing sector for the fifth month in a row in December. Even European markets remained subdued with France registering a dip of 0.5%. Weak commodity prices and concerns of slowdown in China, the major consumer of commodities, continued to weigh down the indices in these markets.

However among Asian indices, the Japanese index was up by 1.3% driven by a weaker yen as well as Bank of Japan's asset purchases. Even the Indian markets managed to end the week higher by 1.2%.

Key world markets during the week

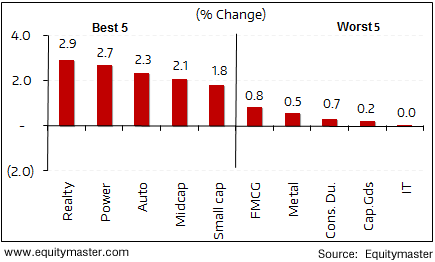

Metal stocks were the top gainers this week. Barring, consumer durables all sectoral indices ended the week in the green.

BSE indices during the week

Now let us discuss some key economic and industry developments during the week gone by.

The price of non-subsidised kerosene has been cut by Rs 1.50 per litre to Rs 43.19 per litre. Even the price of jet fuel has been slashed by 10%. However the rate of non-subsidised LPG has been hiked by Rs 49.50 per cylinder. The three fuel retailers namely Indian Oil Corporation, Hindustan Petroleum and Bharat Petroleum revise these rates on the first of every month based on international price in the preceding month. The Oil Ministry has announced that subsidy benefit on kerosene will directly be credited to the recipient’s accounts from 1st April 2016. This will prevent misuse of subsidy benefits and check diversion of kerosene for adulteration of diesel.

Domestic automobile companies saw a mixed trend in sales performance in December. The year-end offers and new models boosted offtake as buyers advanced purchases in anticipation of price hike in January. On the other hand, ban on sale of diesel vehicles of engine capacity of 2,000 cc and above in national capital region and floods in Chennai impacted sales of some companies. Maruti Suzuki and Hyundai Motor recorded sales growth of 13.5% YoY and 28.8% YoY , respectively. However, Mahindra recorded a muted sales growth of 1% YoY because of a partial ban on diesel vehicles.

Movers and shakers during the week

| Company | 28-Dec-15 | 1-Jan-16 | Change | 52-wk High/Low |

|---|---|---|---|---|

| Top gainers during the week (BSE-A Group) | ||||

| Reliance Infra | 491 | 591 | 20.4% | 596/382 |

| Jet Airways | 637 | 761 | 19.3% | 779/249 |

| Astrazeneca Pharma | 1,120 | 1,262 | 12.7% | 1325/796 |

| Adani Power | 30 | 34 | 12.6% | 60/20 |

| Opto Circuits | 13 | 14 | 12.5% | 27/11 |

| Top losers during the week (BSE-A Group) | ||||

| Cadila Healthcare | 389 | 332 | -14.6% | 454/285 |

| Pipavav Defence | 98 | 91 | -7.0% | 114/40 |

| Thermax Ltd | 944 | 890 | -5.7% | 1315/287 |

| Future Retail | 156 | 149 | -4.2% | 173/87 |

| GSK Consumer | 6,586 | 6,362 | -3.4% | 6800/5500 |

Source: Equitymaster

Now let us move on to some of the key corporate developments of the week gone by.

Tata Motors, is reportedly planning to assemble Automated Manual Transmission (AMT) kits in India on the back of growing demand and increased waiting period for the AMT variant models. Earlier this year, the company had launched the new generation Nano in India, which in addition to various styling and feature offerings, also had an AMT unit. Furthermore, the company also wants to launch the AMT version of the much-awaited Tata Zica hatchback.

Maruti Suzuki is planning to export its new Baleno hatchback to the European Union markets in a bid to revive its export market share in the region. The company will start exporting the premium hatchback to Europe in January 2016. With this first shipment, the company is targeting several markets such Italy, France, Germany, Netherlands, Belgium, Denmark and Spain, among others. The company also exports Ertiga, Celerio, Ciaz and the Swift Dzire models to various markets.

The government has infused Rs 22 billion in to IDBI Bank in lieu of preferential allotment of over 296 million equity shares at a price of Rs 75.28 per share. . It had declared a capital infusion of Rs 200 billion in 13 public sector banks (PSUs) that include Punjab National Bank, State Bank of India, IDBI, Bank of Baroda and Canara Bank. The capital infusion is one of the measures to resolve the long ongoing woes in the public sector banking space such as high levels of non-performing assets (NPAs), poor growth, and poor capital adequacy.

With an aim to reduce its interest burden, Tata Power has refinanced its term loan of Rs 38 billion for its 4,000 MW ultra mega power project at Mundra in Gujarat. The refinancing scheme will help in extending the tenure of the rupee facility and assist in reducing the interest burden of the plant by Rs 770 million a year. The Mundra project is being implemented by Coastal Gujarat Power (CGPL), a wholly-owned subsidiary of Tata Power.

Pharmaceutical companies see no respite from the increased stringency of USFDA laws pertaining to manufacturing facilities of domestic drug firms. Cadila Healthcare has received a warning letter from the US Food and Drug Administration (USFDA) relating to its Moraiya formulation facility and Ahmedabad API facility. The company stated that it would respond to USFDA to address the observations within the statutory time permitted in the letter.

Dr Reddy's Laboratories has announced the re-launch of its Esomeprazole Magnesium delayed-release capsules in the US market. The capsules are a generic version of AstraZeneca AB Corporation's acid reflux drug Nexium. The company's generic version was banned after the innovator of the drug had filled a temporary restraining order (TRO) as Dr Reddy's drug used the similar colour purple colour in its drug. The re-launched version by Dr Reddy's is of different shade and not purple.

Going ahead, domestic equity markets will track the corporate earnings performance for the September 2015 quarter and the status of the reforms agenda of the government. While these events might result in short term market fluctuations, investors should utilize the opportunity in cherry-picking fundamentally strong stocks with robust growth potential.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Global markets weaken". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!