Fintech: Theft at Internet Speed?

- "Facebook and @RobbinHoodApp are the same. They both trick you into thinking you are the customer. But, in fact, you are the product and your data is the asset. These assets are then sold to their true customers who pay them money and always at your expense"

Chamath Palihapitiya, Sri Lankan - American venture capitalist and former executive at Facebook, as quoted in Bloomberg.

The fumes from the anger over millennial trading app RobinHood have engulfed much of the internet world.

Briefly: Many of the pandemic, locked-at-home, what-can-I-do-now millennials signed up to apps like RobinHood and began punting in shares.

They have had a great run in 2020 as markets in the US soared to record levels. With 13 million accounts, RobinHood is one of the favoured platforms.

All was hunky-dory and cruising along at internet speed, until recently.

A chat group, searching the data on "short" positions relative to trading volumes realised that a stock call GameStop was shorted by the professional hedge funds of Wall Street to the extent of 150% (no typo error!) of the amount of shares issued by the Company.

Now GameStop is not just any stock.

It happens to be the temple of technology where many millennials bought their first video gaming hardware or software. It is etched in the mind of every millennial. At its peak, GameStop was present pretty much in every mall in USA. While Mom and Dad bought their clothes, the children hung around GameStop. But children outgrow soft toys and dolls and, with the age of high speed internet, GameStop saw its stock drift from the USD 20 levels to below USD 5 by January 2020.

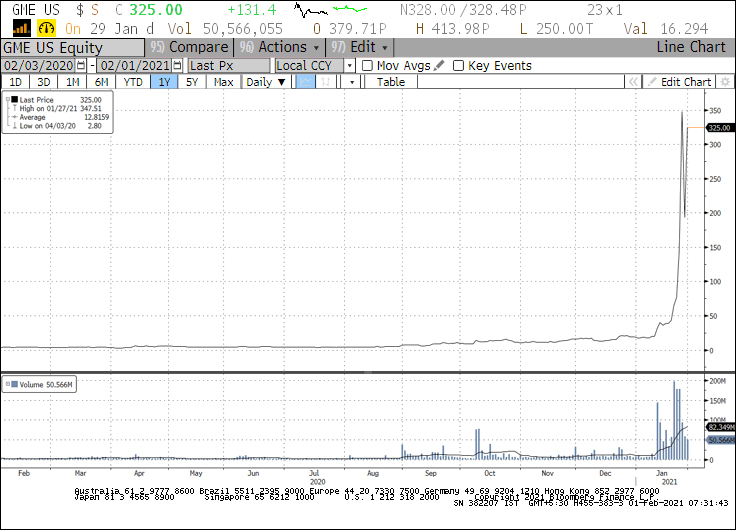

With the pandemic and the closure of malls, GameStop reached a low of USD 2.8 by April 2020. And it kind of drifted there, bouncing around the bottom until the end of last year when it surged to nearly USD 20 for the rest of the year because the founder of Chewy.com, Ryan Cohen, amassed a large holding and then in January joined the board. Ryan Cohen had managed to create an e-commerce juggernaut out of thin air so he had credibility for GameStop's hoped-for move away from physical towards digital. Furthermore, expectations that the vaccinations against COVID and the opening of malls would bring people back in to GameStop physical locations probably added to sentiment.

The hedge funds were obviously not impressed with that thesis and went "short" on the stock and waited for the share price of GameStop to collapse again where they could buy at the low and make a handsome profit. With more lockdowns and changes in technology, it looked like a good bet.

Until a chat group on Reddit raised a war cry to fight the shorts that were attacking the temple.

A person who is short, does not own the stock. They sell what they do not own (and had to borrow shares at a financing cost) and hope that the price will decline further. When the share price declines, they buy back the stock price at the lower price, return the borrowed shares and square their "short" position.

Meanwhile, if the share price increases the person who shorted can "cover" their position at a higher price buy the shares in the market to return to the lender of the shares and swallow the loss. In the US a majority of people who go short have to "borrow" the stock from a long term owner (via a custodian) and pay an interest cost.

Given that interest rates in USA are low, under normal circumstances such a cost of borrowing may be nominal and the person who went short may "borrow stock for a financing cost" and believe they are buying time to allow the share price to return to a lower level in the future, cover their short at the lower level, and make a profit - even after paying the nominal interest cost.

Imagine a cockroach, sitting on a pile of half-eaten rotten food, having a feast.

Now imagine a million ants coming charging at that pile of half-eaten rotten food with the cockroach sitting on the top, bathing in the tropical sun.

Note that the cockroach is about 10,000 times larger than any one ant.

Still, when a million ants come charging at you, the cockroach is in deep trouble. He needs to flee and abandon the prize.

The cockroaches, in this case, were the hedge funds that went short on GameStop.

The ants were the temple-worshipping millennials and small traders on new-age trading platforms like RobinHood.

GAMESTOP is a show stopper!

The share price of GameStop surged from USD 19 on January 12, 2021 to USD 31 the next day while the volume of shares traded surged from 7 million shares on January 12 to 144 million shares on January 13. To put this in perspective GameStop has 70 million shares in issue and the free float is 50 million shares. The short interest at that time was 150% of the shares issued by the company. This resulted in a classic short squeeze and the share price spiked to USD 469 by January 28. Of course in that rise from USD 20 to USD 460, some shorts would have taken their loss and other new shorts may have emerged, convinced that they would get the story right. If the original shorts were still holding on to their position, they were losing (USD 469 - USD 19 assumed price at time of short = price difference) x (100 million shares short) = USD 45 billion.

Creepy Technology.

The allegation is that cockroaches have friends - some of them potentially in the technology sector. And the allegation is that RobinHood, the platform which was used by the army of ants comprising the millennials to attack the cockroaches, was one such friend.

Unknown to many users of the trading platform, RobinHood takes the orders it gets from all its buyers and sellers and places them on a transaction platform for execution. That platform, Citadel Securities, is owned by a financial firm called Citadel. This platform pays RobinHood an estimated USD 70 million in annual revenues as its share for routing the orders of customers. RobinHood is a new-age fintech. It charges its clients "nothing".

Well, nothing visible.

RobinHood collects money from the execution platform.

It uses the data it has of its clients and, effectively, sells it.

What makes the story more interesting is that, according to Bloomberg, Citadel and its founder (along with some other investor groups) has invested USD 2 billion in a hedge fund called "Melvin Capital, which lost 53% in January after being bloodied by a short squeeze on shares including GameStop".

On January 28, RobinHood announced that no client could buy shares of GameStop (and some other companies). They could only sell the shares they had.

RobinHood claims that this was done because the clearing house asked for more margins from RobinHood given the sharp increase in the share price. RobinHood had to raise USD 1 billion in a few days to fund the demand for added cash from the clearing house. (Not sure where they got the money from.)

That announcement of "no buys allowed" from RobinHood caused a wild swing.

Intra-day the share price of GameStop had surged to USD 469 at the opening then plunged to USD 132 and closed at USD 230.

If you were on the short end of that trade, you just saved USD 23 billion out of the theoretical loss of USD 45 billion as per the calculation above.

The cockroach is still in trouble but less bruised to the tune of USD 23 billion.

The ants, of course, just saw a potential USD 23 billion of profit swiped from right under their noses by the actions of trading platforms like RobinHood which were supposed to work for the "democratisation" of investing.

The political-financial complex cobweb is being spun on chat groups across the internet (as per Bloomberg: Janet Yellen has received USD 600,000 in speaking fees from Citadel in the past 2 years and is now the equivalent of the Minister of Finance, the fund manager of the hedge fund is a second cousin to President Biden's press secretary, the founder of Citadel is a large donor to the Republican Party).

Which leads to the role of technology - and how it can trick you into believing you are being well-looked after, when you are offered a "free" product.

We have seen the movies and documentaries about how the large tech firms like Facebook can sell your data after you click the "I Agree" button.

We are seeing how companies like RobinHood are now being accused in chat groups of potentially being influenced by their largest source of revenues - a company owned by Citadel - to possibly introduce a rule that eased the pressure on the share price of GameStop and possibly helped Melvin Capital shave some of its losses if it still was a shareholder in GameStop at that time.

The Humming Bird.

Closer to home, India's financial markets have blossomed with the use of technology, not only in the past few years with the launch of fintechs and adoption of technology by many firms (including Quantum Mutual Fund managed by Quantum AMC, which I helped set up and have an economic interest in).

Take the case of the National Stock Exchange. Set up in 1994 as an alternative to the opaque, higher cost BSE, the NSE has introduced low-cost, high-speed trading for the benefit of millions.

But, sometime over the past decade, there have been allegations by a whistle blower and later written about by Sucheta Dalal, the award-winning financial journalist, that the NSE was benefitting a few people by letting them have a peek into the order flow in the markets a few milliseconds in advance.

Time is money in finance. And milliseconds can make you a handsome fortune.

To take an example: In theory, if thousands of investors have, collectively, placed an order to buy 1 million shares of TCS at Rs. 3,200 per share a broker who gets this information a second before can assume that a large order to buy 1 million shares, when the average daily trading volume is 1.5 million shares per day, can happily estimate that this large order will cause the share price of TCS to rise.

Knowing this order flow, the broker can "front-run" and place an order for 1,000 shares at 3,200 or lower before the large order comes in and - when that large order hits the screens of many less privileged brokers one second later - chances are that the share price of TCS has risen by, say, Rs. 50.

The front-running intermediary sells his shares at a profit.

That is a profit of Rs 50,000.

Sounds small?

Do this side-trade every day for a few years and you can make a killing.

Just don't get too greedy.

Make sure that the order size is so small, you are always below the radar of the regulator.

It is noteworthy that many scams have come to light not because a regulator or surveillance software discovered the scam, but because an insider became a whistle-blower and alerted the regulator or the press.

Technology leapfrogs every year and is way ahead of the capacity of the regulators to discover a theft - before or after the theft has occurred.

How Quantum Mutual Fund can make me rich!

Take the example of Quantum Mutual Fund managed by Quantum AMC, an entity in which I have an economic interest.

An investor subscribing for new units of say, Quantum Long Term Equity Value Fund, has to do so by 2 pm to get the NAV of that day.

Let's assume the total Assets under Management of the Fund are Rs. 1,000 crore.

A large order of Rs. 100 crore comes in at 1 pm.

I know that the fund manager will take that new cash inflow of 10% of existing AuM and proceed to invest in the existing stocks that are there in the Fund's portfolio.

Let's assume that the largest holding of the Fund is TCS and the fund has a 10% weight in the stock of TCS. Which means it already owns Rs. 100 crore (10% of Rs. 1,000 crore) of TCS. With the new subscription, it will be ready to buy Rs. 100 crore of new inflow x 10% = Rs. 10 crore of TCS: this will allow the Fund manager to maintain the 10% weight in TCS which as there before the large inflow of AuM entered the Fund.

When building the software for Quantum Mutual Fund, I could have inserted a line of code which says:

- If any new subscription comes in, and if that new subscription results in Quantum Long Term Equity Value Fund having to buy any share that it currently owns in its portfolio which will:

- Require the fund to buy more than 10% of the average volume of shares traded in that share for the past 5 days,

- If past data shows that any order over 10% of daily trading volume results in a spike in price,

- Send Ajit's father a message on his mobile phone at 4 pm of that day, after all subscriptions for the Fund are tallied, and instruct him to call his broker and buy 100 shares of that company at market opening rates the next day.

- After sending this alert, self-destroy the message from the server.

THEN

My father would love me and shower me with gifts - tax free, mind you.

The poor folks in the movie, The Humming Bird (do see it on Netflix), had to dig for months to build a pipeline of wires to get an edge of speed over the old stock exchange technology platforms.

The poor folks in the alleged NSE scam had to find ways to get their servers co-located on the NSE to make profits and potentially leave footprints and fingerprints.

Today's technology in your mobile phone is apparently superior to the technology which took Neil Armstrong to walk on the moon in July, 1969. Imagine the power of the technology on a dedicated set of servers!

You don't need to waste time or money in digging trenches in snow or in risking the discovery of a server owned by a private broker is lying in a public institution.

Just use the power of technology to silently shave off a few thousand rupees every hour of any collective buy/sell orders.

Offer clients the low-cost mutual fund (as Quantum Mutual Fund offers!), offer financial services at low or zero cost - and make money via other (shady) means.

How will the regulator ever find out?

Or the customer?

As many have said and as has been stated by tech entrepreneurs and venture capitalists, the data you part with, the data you provide which you think allows you to get a service for free - may not be for free: someone can make a lot of money from it.

And, without knowing it, the person who the money is being made from is you.

As financial regulators allow the invasion of technology to disrupt the existing financial firms, they will need to realise that they are potentially placing the necks of the customers under a double-edged sword. If the unfit and the not-so-proper get in, the customer's wallet will disappear - at the speed of light!

Big tech has shown how it can topple governments, influence election results or cause continental rift and shifts, as with the Brexit vote.

Do you believe that picking your pocket is difficult?

Hang on to it tight!

Suggested allocation in Quantum Mutual Funds (after keeping safe money aside)

| Quantum Long Term Equity Fund, Quantum Equity Fund of Funds, Quantum ESG India Fund | Quantum Gold Savings Fund | Quantum Liquid Fund | |

|---|---|---|---|

|

Why you

should own it: |

An investment for the future and an opportunity to profit from the long term economic growth in India | A hedge against a global financial crisis and an "insurance" for your portfolio | Cash in hand for any emergency uses but should get better returns than a savings account in a bank |

| Suggested allocation | 80% in total in both; Maybe 15% in QLTEF, 10% in Q ESG and 75% in QEFOF | 20% | Keep aside money to meet your expenses for 12 months to 3 years |

| Disclaimer: Past performance may or may not be sustained in the future. Mutual Fund investments are subject to market risks, fluctuation in NAV's and uncertainty of dividend distributions. Please read offer documents of the relevant schemes carefully before making any investments. Click here for the detailed risk factors and statutory information" | |||

Equitymaster requests your view! Post a comment on "Fintech: Theft at Internet Speed?". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!