My Top 3 Algo Trading Strategies

Algo trading has come to dominate markets around the world.

Everyone has either studied them or will have to study them in the future to make profits as a trader.

But how can you get started?

In this video, I'll help you by presenting the top 3 algo strategies I use to make big trading profits.

Let me know your thoughts in the comments. I love to hear from you.

Hello viewers. Welcome to the Fast Profits Daily. Myself, Brijesh Bhatia.

In this video, I'll be discussing various algo strategies and one strategy which I do from a medium to long term perspective. I show how it has performed on Nifty, Bank Nifty, and one stock. So let's look at what is an algo.

Basically, an algo is you define a system using various indicators, oscillators, price action, price hitting new highs, and there are vendors who provided with the various strategies as well. Algo help them to execute mechanically. There is no human intervention. You just give the system the right entries, right exits, stop loss, trailing in case you want, and the amount of money you want to deploy.

Must See: These Segments are Witnessing Incredible Growth with Modi's Push

So it will automatically flash the trade or put the trade into the system when the criteria triggers out what you have input. As I said, it's been done mechanically. I have done various videos on algos but in this video, I'll be discussing my strategy which I use generally from medium to long term prospective. You can use it for an intraday perspective, 10 minute charts, 5 minute charts, daily charts.

So algos offer you a variety of systems which can be implemented mechanically. So the main advantage over here is that there is no human intervention. Error is less. Emotions are not there. That's the best part, which can't really help you out.

The disadvantages. There could be technical glitches which can hit your alco system. So again, advantages and disadvantages both are there. So you need to think, do you want algos. Well, I think algos are the new era and most of the people now might shift from manual trading to algo trading.

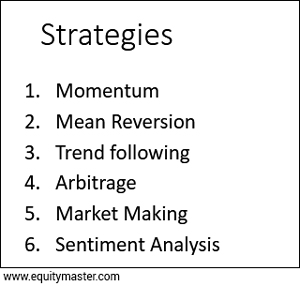

Here what is important is the strategy. So let me come on to the strategies which are generally being traded into the algos. First is the momentum indicator and mean reversion. I've done a previous video where I have gone in detail about these strategies.

Momentum is where the price action is there for an hour, there for a day and you play just momentum. Mean reversion is where the prices say, for example, you make a system when prices go away by 15% from the 200-days average, on the downside you will buy and on the higher side you will go short.

So what does this mean? When the prices go 10%, 15% what number you have entered, when it goes higher you are playing that they price might come back towards the 200-days average and you are playing for the mean reversion.

Sometimes people trade like when the prices of a stock on a daily basis is going up by 3%, they look for a short on an intraday basis. So that's the mean reversion strategy people follow on an intraday basis.

Trend following systems. I'll be showing one of the trend following system where I just want to play the trend if it's bullish. There are various trend following systems. Golden cross, which means that 50 taking over 200 and you go long till it gives you a negative crossover, which is called death cross which is where 50 average goes below 200. So there are long the systems, algos, which highlights when the Golden cross happens or the death cross.

Arbitrage where generally people make the calendar spreads of, for example, cash to futures. For example, say HDFC ltd cash and HDFC ltd futures. So generally it's been said that the premium is slightly higher. It goes about 1%. So people go short in futures and buy the cash.

Some people play the Nifty premiums. So if the premium of the Nifty goes up by 1% to more than 1% or say 0.75%, whatever you decide based on what the back testing results could be, and then you go short on the futures, buy the Nifty Bees and vice versa.

So that's the way people play arbitrages. There are calendar spreads going into one contract to another contract, which is a largely done in the commodity space, where you buy the near future and go short on the next future or vice versa depending upon the spreads you find attractive.

Fifth is market making where people create volumes into some script or options, I would say the strike price. So there are market making strategies as well on the algos which most people do.

The last is the sentimental indices where people are sharing views on Twitter, on social media. Here algos will gather those stocks and show you the percentage of people going long or whatever the number of people who you have been following or the hashtag you are following.

So they will highlight that the X number of persons are going long. Either you play where the sentiment is going or you play against the sentiments, demanding upon what type of algos you are using.

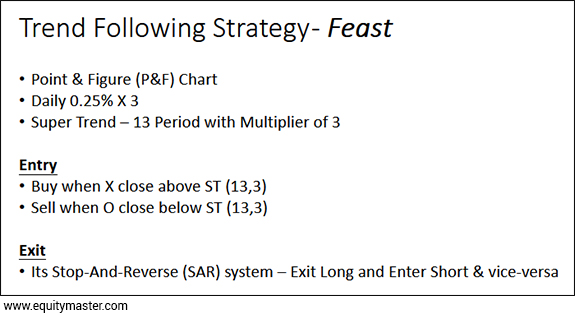

Let me come to one strategy which I follow. I call it FEAST. This is slightly medium to long term. Let me first explain what the strategy is. I'm using the point and figure chart over here. Point 2% by three on daily scale.

Second I'm using super trend over here. I'm using 13 period. Generally, people they use default on 10 period. I'm using a 13 period. Why 13? 13 is a Fibonacci number if I look at the average trading days, which is around 21-22 days a month, around 61% of that is around 13. So I'm just again playing the Fibonacci number over here. So 13 being Fibonacci number on a monthly scale, if I look at the monthly again 61.8 is 13-13.5 days in a month. So I'm playing 13 over here and again with the 3 multiplier.

What will be the entries? When the price of X or the X close moves above the super trend, I'll take a long. When the O which in the P&F is known as bearish, goes below the super trend, I'll go short. Again 13 and 3 is there. 13 is the period ST super trend and 3 is the multiplier.

Exit is the stop and reverse. When my long turns to short, I'll go exit the long and go short. When my short turns to long, it means that I'll exit my shorts and go long. So always you are there into a trade.

Now the data which I'll be sharing is the Nifty, Bank Nifty, and one stock and let go through the Nifty first.

This is a spot chart and I have taken the performance data based on this spot chart. So there could be a difference between the rollovers and the premium adjustment which could be a plus and minus. So you need to back test that in case you are back testing the Nifty system.

So here I've taken a cash data. I didn't have the futures long term date, and this is since the inception of the Nifty 1994-95 to 20 December 2021. The last trade is not calculated which is going on. Apart from that, I have the data.

So what I've done is just a manual interpretation for you on the charts. If you look at these lines the red, blue and the yellow, so basically, that's the super trend line. 13 period, 3 multiplier.

When the X forms above the super trendline, I'll go long. When the O forms below the super trendline, I'll go short. The yellow line which you're witnessing, orange, or yellow, is the flat line. General when the super trend goes flat, there is no volatility. It generally goes flat and it forms the flat line. But depending upon the trade you are into it doesn't matter much over here.

So again when prices go above the super trend and forms the X closes, I'll take a long. On the short side, when the O forms above the super trend, I'll go short.

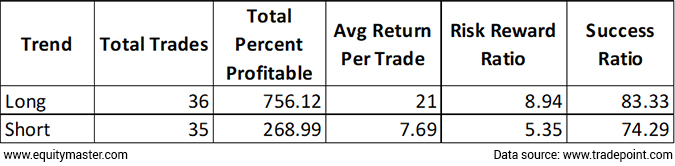

So look at the performance over here, how it has been for the Nifty. Again I've explained, this is a spot chart. So you need to look at the rollovers and the premium might differ into the performance of Nifty futures when you are testing it out.

So long side, we got around 36 trades. Average return per trade is around 21%, and the most of them we got around 2020. We got somewhere around 9,700-9,800 long and it exited somewhere around 17,000 plus. So that was a big trade. One of the biggest trades I've seen this into this system. Risk-reward is 1:9. 8.94. It's very, very favourite. Th success rate is around 83.33%.

On the short side, we have got around 35 trades to 69% total, 7.69% average on shorts. 5.35% to 1 is the risk reward ratio. This means I'm taking 1% percent risk and I am getting the reward of around 5.35% and the success rate is about 74%.

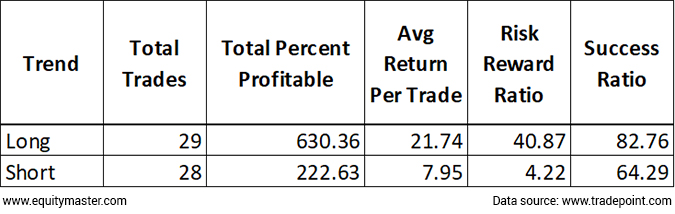

Let's look at the Bank Nifty over here. The system remained same. Buying above the super trend and going short below it.

If I look at the percentage, longs 29 trades, 630%, 21% average return. 41 is the long side Bank Nifty risk reward. The ratio is huge because if you look at the volatility in the Bank Nifty, it's slightly higher. Success rate around 83%. Short side, 28 trades, 8% average trade return, 1:4 is the RR and 64-65% is the strike rate.

Voltas. Again the system remains the same. I've just shown a chart over here.

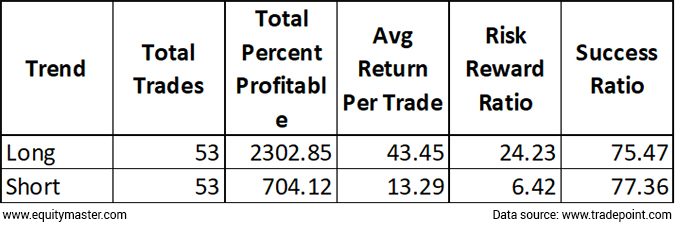

53 trades on the long, 53 on the short. On the long side, we got an average of 43%. Short side we got around on average of 13%. RR is 1:24 on long and 1:6 on short and success rate has been around 75% on the longs and shorts.

So in case you want any stocks, with the back tested result, do send me a comment. I'll share the back testing data. It would be a helpful if you share your email id into the comment section so that I can mail you all the trades which has gone through your stock request. I can share if available with us and I can mail it to you if you share your email id.

So signing off, Brijesh Bhatia. Thank you.

Warm regards,

Brijesh Bhatia

Research Analyst, Fast Profit Report

Equitymaster Agora Research Private Limited (Research Analyst)

Recent Articles

- Pyramiding PSU Bank Stocks September 22, 2023

- How to trade PSU banking stocks now.

- 5 Smallcap Stocks to Add to Your Watchlist Right Now September 12, 2023

- These smallcaps are looking good on the charts. Track them closely.

- Vodafone Idea - Can Idea Change Your Life? September 6, 2023

- What is the right way to trade Vodafone Idea?

- Repro Books Ltd: The Next Multibagger Penny Stock? August 28, 2023

- Is this the next big multibagger penny stock? Find out...

Equitymaster requests your view! Post a comment on "My Top 3 Algo Trading Strategies". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!