Ultimate Guide to Hedging Your Portfolio

This video will go in depth into a great strategy to protect your portfolio.

It's called hedging. You may have heard of it. But have you ever tried it?

It's very effective at preventing losses when the market crashes. In fact, as you will see in this video, you can even profit from a market crash using this time tested strategy.

Watch the video and let me know if you will use hedging to protect your portfolio.

Hello viewers. Welcome to the Fast Profits Daily. Myself Brijesh Bhatia.

Markets were roaring higher and as an investor, you should be thinking, should I book the profits or what should I do?

So there are three possibilities. Either you keep holding your positions and wait in case market dips. If in case market goes higher and higher and you think that still there is room into the markets, you hold to your positions and wait for markets going higher and higher.

Dear Reader: If You Invest in Midcap Stocks, this is for You

The second option is sell your positions, book profits, move out of the positions and wait for markets to dip to enter a fresh positions and you're in cash.

The third option is hedging. Well, what is hedging? For me buying an insurance. Buying a medi-claim is a hedging because there is a risk of in case there's an hospital bill of around 10 lakh rupees and I'm unable to pay. So there is a risk where I buy insurance, and this is called hedging the risk over here.

When you are into the stock markets, there are various ways to hedge the markets. In this video, we will be discussing how you could hedge using futures.

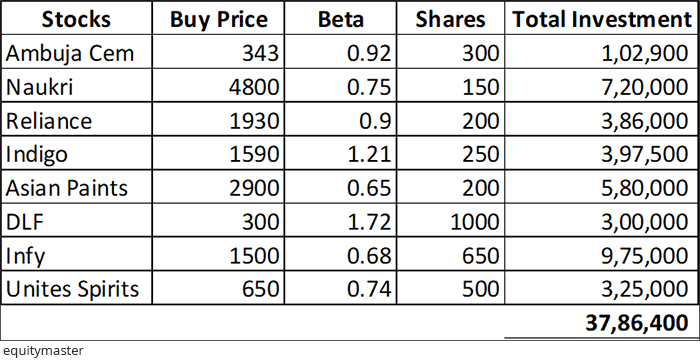

So first just a portfolio, a dummy portfolio I have created of Mr ABC. So if you look at the screen, there are a number of stocks over years.

So there is Ambuja Cement, there is Naukri, there is Reliance, Indigo, Asian Paints, DLF, Infy, United Spirits and what I've done is I've taken buy prices of each and every stock. I've taken the beta. I'll share with you from where I got the beta and what is beta.

But look at the number of shares and the total investment. So what I've done is I've multiplied the buying price with the quantity to get my investment amount. Now if you look at the beta, you can see on the screen some are 0.92, 0.75, 0.9, 1.2. So what is the meaning of beta and where can you get it? Let's understand what beta is first.

So beta is a percentage of the move against the benchmark index. So in this case, let's take a benchmark index as Nifty 50. So, as you know, the Nifty 50 is known to find the market trend, bullish or bearish. So every 1% move of Nifty, if you look at Ambuja Cement which is around 0.92%, Ambuja Cement moves 0.92%.

Similarly look at DLF. For every 1% move for Nifty, rise on fall, DLF rises or falls by 1.72%. Now the high and the higher the beta, the volatility is higher in the stock. If you are a high risk trader, high risk investor, you can look for a high beta stocks.

Now the best way to play the beta is when the markets are at lower levels. Look for these high beta stocks where you still think that the company is excellent, the company can do very well.

Low beta are generally, you can say, slightly slow movers against the Nifty. So if you look at Infy over here 0.68 versus the Nifty. What does it mean? For every 1% move on Nifty, Infosys moves by 0.68%.

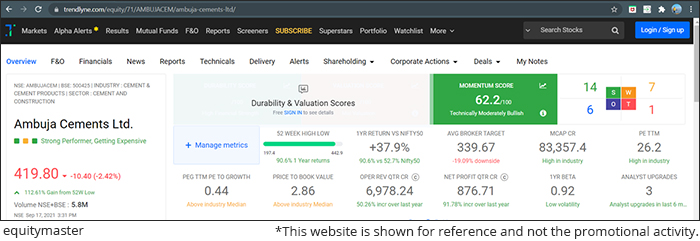

Where can you get it? So if you look at it right now, this is the website called trendline and again we are not promoting any website this video. But just to showcase where can you find the beta?

So if you type any quote over there, any stock over there, so I've circled over there the beta of one year. So can check this beta and you can write in the column against your stock. So that's the trend line.

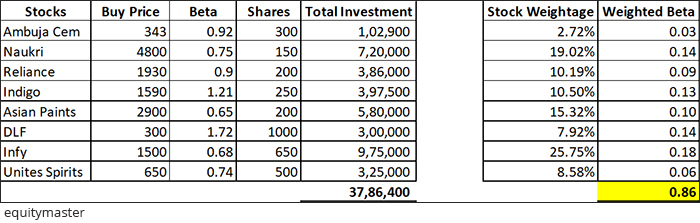

Coming on the next, which is the second step. It's very, very important to calculate stock weightage. Now how to calculate stock weightage?

What I've done is, if you look at the Ambuja Cement total value, which is somewhere around 102,900 and if you look at my total investment on the lower panel, 3,786,400. So I have divided Ambuja Cement of one 102,900 with 3,786,400, which gives me around 2.7% weightage of Ambuja Cement in my portfolio.

Similarly Naukri is around 19%. Reliance is somewhere around 10%. I have taken the weightage of my portfolio, total of my investments.

Now the next step is calculate beta. What I've done is the beta which we got from the website trendline which is the default one, which is generally one year. It changes accordingly with the market's momentum and I have been multiplied with my stock weightage of my portfolio.

If you look at the first, I got 0.03 which was 2.72% * 0.92, which is around 0.03 and I have taken some of that weightage. It is 0.86. This is the third step you have to calculate.

First, your portfolio. Second, your stock weightage. You have to find the beta of your portfolio of each and every stock. Second, we have we have to find stock weightage over here. So this is the third step, you have and I've mentioned the formula below the table as well in cases you get confused on how I have calculated.

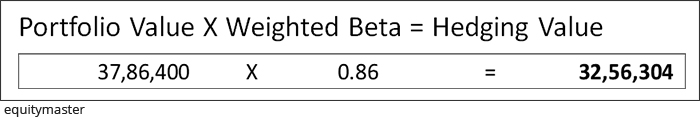

Now the fourth is most important step that you need to understand. The hedge value. What is the hedge value? Your investment value, which was 37 lakhs, I've multiplied with the weighted beta, which I've got for my portfolio which is around 0.86. If you multiply 3,786,400 in to 0.86, it comes to 3,256,304.

This is my hedging value. I repeat. This is my hedging value. So you got these steps. Now have got the hedging value. Now we will hedge with the Nifty over here in this hedging strategy.

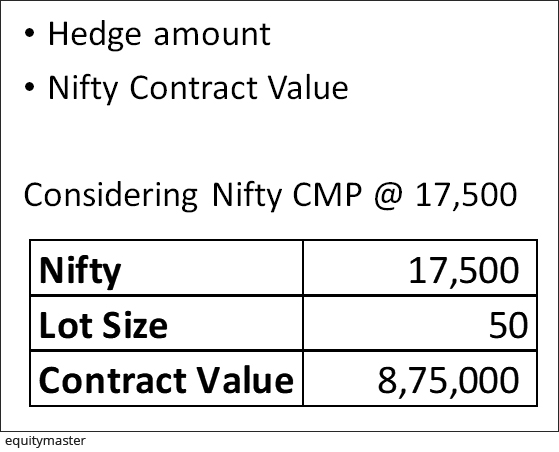

So what I'm doing is, if you hedge your portfolio with Nifty futures, first you need to find Nifty contact value. Say for an example, I've taken Nifty current market 17,500 roughly. So it might change when you execute any trade. So you need to calculate this contract value. So I've taken 50 as a contract size. Your contract value is somewhere 875,000.

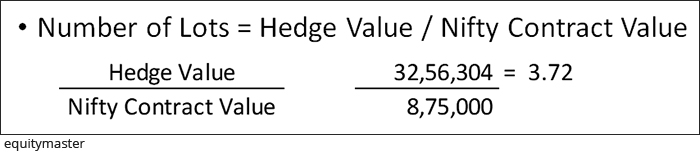

The next step. If you remember, our hedge value was Rs 3,256,000. So now you have 50 as a lot size for the Nifty. So you can't go in to decimals in the futures. So you need to understand what quantity or what lot size you need to trade.

So next step is to calculate the lot size. So what we have done is, we have taken 3,256,000, divided it by 876,000 which is the contract value of the Nifty futures So we got some where around 3.72. So I'm taking roughly on the higher side, it's 4 lots. Again, I am taking 3.72 as 4 lots. If you get sometimes, if to get an answer from around 3.13, you can consider it as 3 lots which is not a full hedge. It's generally known as 'under hedge' and 'over hedge'. So we are doing over hedge because we got 3.72 and we are doing 4 lots. So for contract value slightly go higher.

If I am doing 4 lots of Nifty 17,500, so I am hedging my portfolio of 37 lakhs and shorting Nifty futures, 4 contracts, which is 4 lots. I repeat. To hedge my portfolio, we are shorting Nifty futures 4 lots over here in this example. Depending upon your portfolio, depending upon the hedge value, you can accordingly hedge your positions in those manners.

Sometime it might happen, you might have the midcap stocks, but you need to keep that beta in mind, and you have to calculate the weighted bets to get the exact number of lots you want to trade.

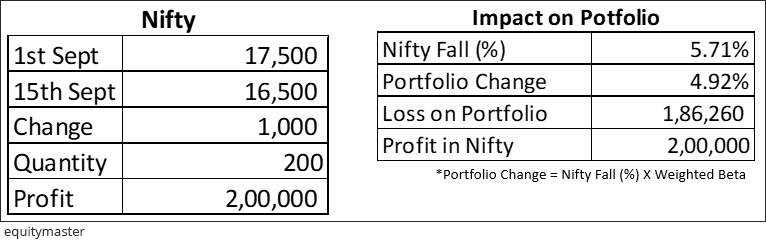

So now you have taken a hedged position against the Nifty. So let's take an example. In case on first of September you have taken a hedge on going short on 17,500 four lots of futures of Nifty. Now on 15 September, say, for example, it went to 16,500, which is 1,000 points lower. So what profits I'd be making in Nifty futures because you are short over here and market is in you favour in futures?

Not in your cash portfolio but in futures market is in your favour. You're making 1,000 into 200 quantity because we've taken four lots 50*4 is 200 and we made a profit of Rs 2 lakh a gross profit of Rs 2 lakh on Nifty futures.

At the same time let's look at how our portfolio performed. If I look at the 1,000 points fall on Nifty, which is equivalent to 5.71% of fall in Nifty. What have I done? I've taken 1,000 divided by 17,500. So it gives you around 5.71% fall in Nifty.

Now, if you remember, we have hedged 0.86 weighted beta. So I will multiply 5.71*0.86 which comes to around 4.92%. So as per our weighted beta, Nifty falls 5.71%, if Nifty falls 1% our portfolio will fall by 0.86%. So in this case, 5.71% fall is equal to 4.92% in our portfolio fall.

Let's look at the profit you made in Nifty futures which was around Rs 2 lakh. Considering 0.86 as our weighted beta, our portfolio loss was somewhere around 186,000. So still, when the markets had fallen by 5.7% because you've taken a hedge, you are still making money somewhere around 13-14 thousand rupees.

You're not into a loss because we have over hedged. If you remember, we got a 3.72 as a lot size, but due to decimals, we can't go in decimals, so that's the reason we've taken 4 lots over here and we have slightly over hedged and that's the reason you're looking at 13,000-14,000 as in gain.

Sometimes, in case you might get 3.99 or 4.01, and you've done 4 lots, you might not see those profits. But yes, your loss has been hedged over here. So you're not making loss when you are hedging your positions.

So you need to remember this. Sometimes, it may happen you're having midcaps and smallcaps, which might be slightly volatile, but your weighted beta will equally play. So this is just an example. You need to hedge. With a strategy you can hedge with Nifty futures to your portfolio, and sometimes it might defer on the markets momentum or the stocks section as well. So you need to keep those parameters into consideration that sometimes it might happen that some of the mid cap you are holding might be down with some bad news but your index is not down. So you need to keep in mind such kind of scenarios.

Signing off but before a sign off, I request, in case you are liking our videos, click on the like button and do comment how do you think our videos are or how our contents are.

Signing off. Brijesh Bhatia. Thank you.

Warm regards,

Brijesh Bhatia

Research Analyst, Fast Profit Report

Equitymaster Agora Research Private Limited (Research Analyst)

Recent Articles

- Pyramiding PSU Bank Stocks September 22, 2023

- How to trade PSU banking stocks now.

- 5 Smallcap Stocks to Add to Your Watchlist Right Now September 12, 2023

- These smallcaps are looking good on the charts. Track them closely.

- Vodafone Idea - Can Idea Change Your Life? September 6, 2023

- What is the right way to trade Vodafone Idea?

- Repro Books Ltd: The Next Multibagger Penny Stock? August 28, 2023

- Is this the next big multibagger penny stock? Find out...

Equitymaster requests your view! Post a comment on "Ultimate Guide to Hedging Your Portfolio". Click here!

2 Responses to "Ultimate Guide to Hedging Your Portfolio"

Prashant Babar

Sep 18, 2021It will be awesome for indian economy if your excellent analysis come true ! Lets hope and pray

Premkumar R

Sep 19, 2021Welcome update.