- Home

- Archives

Archives... Don't Miss Anything, Ever!

Here you will find all the research and views that we post on Equitymaster. Use the tools to customize the results to suit your preference!

Why Easy Trip Planners Share Price is Rising

Why Easy Trip Planners Share Price is Rising

Nov 25, 2024

The company is expanding big time in sectors outside traditional travel. This reflects its strategy to diversify business and explore new growth areas.

Beyond the Hype: The Mamaearth Lesson and the Importance of Value Investing

Beyond the Hype: The Mamaearth Lesson and the Importance of Value Investing

Nov 25, 2024

Why valuation and business quality matters more than hype

Top 5 Stocks That Could Turnaround in 2025

Top 5 Stocks That Could Turnaround in 2025

Nov 25, 2024

These companies have big plans to improve their fortunes and turnaround their business in 2025.

Top 5 Adani Group Stocks Worth Looking at After the Recent Crash

Top 5 Adani Group Stocks Worth Looking at After the Recent Crash

Nov 24, 2024

Should you add Adani group stocks in your watchlist?

Prediction: Here's Where Deepak Fertilizers Share Price is Headed in 2025

Prediction: Here's Where Deepak Fertilizers Share Price is Headed in 2025

Nov 24, 2024

What is the outlook for the stock of Deepak Fertilisers? Find out...

Best AC Stock: PG Electroplast vs Amber Enterprises vs Epack Durable

Best AC Stock: PG Electroplast vs Amber Enterprises vs Epack Durable

Nov 23, 2024

Increasing urbanisation, rising disposable incomes and temperatures are increasing the demand for ACs in India, and this player company is set to lead the race.

3 Little Known Stocks Involved in the Futuristic Plastic Recycling Industry

3 Little Known Stocks Involved in the Futuristic Plastic Recycling Industry

Nov 23, 2024

As plastic waste piles up, these three stocks are ready to clean up the mess. Read on for more...

Top 5 Worst Performing Sectors of 2024. Will These Turnaround in 2025?

Top 5 Worst Performing Sectors of 2024. Will These Turnaround in 2025?

Nov 23, 2024

These are the top 5 sectors that have underperformed but may show a turnaround in 2025.

Nykaa: The Next Mamaearth?

Nykaa: The Next Mamaearth?

Nov 22, 2024

The curious case of Mamaearth and the importance of quality and valuation.

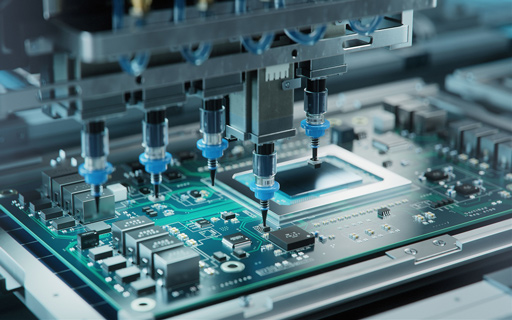

Top 10 EMS Stocks Targeting Over 20% Revenue Growth in FY25

Top 10 EMS Stocks Targeting Over 20% Revenue Growth in FY25

Nov 22, 2024

With the EMS sector boom in full swing, these stocks are positioned for robust revenue growth in FY25.

Why Protean eGov Technologies Share Price is Falling

Why Protean eGov Technologies Share Price is Falling

Nov 22, 2024

Here's why Protean eGov Technologies share price tumbled 10% in a single day.

Why KNR Construction Share Price is Rising

Why KNR Construction Share Price is Rising

Nov 22, 2024

This construction company is creating a buzz in the market after declaring quarterly results. Read on to know more...

Shakti Pumps: Is a Potential Demerger on the Cards?

Shakti Pumps: Is a Potential Demerger on the Cards?

Nov 22, 2024

With its diverse business segments, Shakti Pumps could be looking at a demerger to sharpen its focus and unlock greater growth potential.

A Unique Smallcap Stock for Your AI Watchlist

A Unique Smallcap Stock for Your AI Watchlist

Nov 22, 2024

AI is the future, whether or not you are ready for it. To avoid missing out, here is a stock for your watchlist.

Is Copper the New Oil? 5 Stocks Poised to Profit from the Copper Boom

Is Copper the New Oil? 5 Stocks Poised to Profit from the Copper Boom

Nov 22, 2024

The green economy is hungry for copper and demand is outpacing supply at a rapid pace. Here are the companies involved in mining and extraction of copper in India.

Pros and Cons of Investing in Kaynes Technology

Pros and Cons of Investing in Kaynes Technology

Nov 21, 2024

Should investors consider the stock of Kaynes Technology? Find out...

Why Kiri Industries Share Price is Rising

Why Kiri Industries Share Price is Rising

Nov 21, 2024

Good quarterly numbers along with progress in a long time legal dispute drives a rally in Kiri Industries. Read on to know more.

Explained: Why Adani Group Stocks Are Falling

Explained: Why Adani Group Stocks Are Falling

Nov 21, 2024

Here's why all Adani group stocks are locked in a lower circuit on the same day.

8 PSU Stocks with Exposure to Adani Group Companies. Should Investors be Worried?

8 PSU Stocks with Exposure to Adani Group Companies. Should Investors be Worried?

Nov 21, 2024

Indian lenders, including banks and NBFCs, have provided 37% of Adani group's total debt as of March 2024.

Why the Stock of Sanghvi Movers Should be on Your 2025 Watchlist

Why the Stock of Sanghvi Movers Should be on Your 2025 Watchlist

Nov 21, 2024

This smallcap stock is a good proxy play for the wind energy megatrend.