- Home

- Archives

Archives... Don't Miss Anything, Ever!

Here you will find all the research and views that we post on Equitymaster. Use the tools to customize the results to suit your preference!

3 Little Known Stocks Involved in the Futuristic Plastic Recycling Industry

3 Little Known Stocks Involved in the Futuristic Plastic Recycling Industry

Nov 23, 2024

As plastic waste piles up, these three stocks are ready to clean up the mess. Read on for more...

Top 5 Worst Performing Sectors of 2024. Will These Turnaround in 2025?

Top 5 Worst Performing Sectors of 2024. Will These Turnaround in 2025?

Nov 23, 2024

These are the top 5 sectors that have underperformed but may show a turnaround in 2025.

Nykaa: The Next Mamaearth?

Nykaa: The Next Mamaearth?

Nov 22, 2024

The curious case of Mamaearth and the importance of quality and valuation.

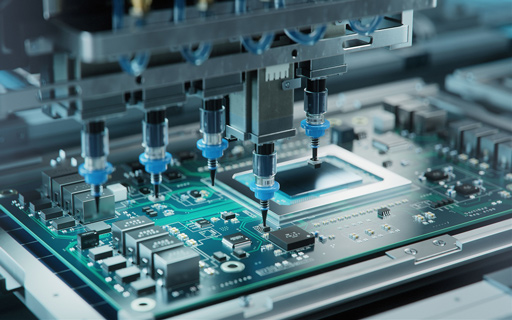

Top 10 EMS Stocks Targeting Over 20% Revenue Growth in FY25

Top 10 EMS Stocks Targeting Over 20% Revenue Growth in FY25

Nov 22, 2024

With the EMS sector boom in full swing, these stocks are positioned for robust revenue growth in FY25.

Why Protean eGov Technologies Share Price is Falling

Why Protean eGov Technologies Share Price is Falling

Nov 22, 2024

Here's why Protean eGov Technologies share price tumbled 10% in a single day.

Why KNR Construction Share Price is Rising

Why KNR Construction Share Price is Rising

Nov 22, 2024

This construction company is creating a buzz in the market after declaring quarterly results. Read on to know more...

Shakti Pumps: Is a Potential Demerger on the Cards?

Shakti Pumps: Is a Potential Demerger on the Cards?

Nov 22, 2024

With its diverse business segments, Shakti Pumps could be looking at a demerger to sharpen its focus and unlock greater growth potential.

A Unique Smallcap Stock for Your AI Watchlist

A Unique Smallcap Stock for Your AI Watchlist

Nov 22, 2024

AI is the future, whether or not you are ready for it. To avoid missing out, here is a stock for your watchlist.

Is Copper the New Oil? 5 Stocks Poised to Profit from the Copper Boom

Is Copper the New Oil? 5 Stocks Poised to Profit from the Copper Boom

Nov 22, 2024

The green economy is hungry for copper and demand is outpacing supply at a rapid pace. Here are the companies involved in mining and extraction of copper in India.

Pros and Cons of Investing in Kaynes Technology

Pros and Cons of Investing in Kaynes Technology

Nov 21, 2024

Should investors consider the stock of Kaynes Technology? Find out...

Why Kiri Industries Share Price is Rising

Why Kiri Industries Share Price is Rising

Nov 21, 2024

Good quarterly numbers along with progress in a long time legal dispute drives a rally in Kiri Industries. Read on to know more.

Explained: Why Adani Group Stocks Are Falling

Explained: Why Adani Group Stocks Are Falling

Nov 21, 2024

Here's why all Adani group stocks are locked in a lower circuit on the same day.

8 PSU Stocks with Exposure to Adani Group Companies. Should Investors be Worried?

8 PSU Stocks with Exposure to Adani Group Companies. Should Investors be Worried?

Nov 21, 2024

Indian lenders, including banks and NBFCs, have provided 37% of Adani group's total debt as of March 2024.

Why the Stock of Sanghvi Movers Should be on Your 2025 Watchlist

Why the Stock of Sanghvi Movers Should be on Your 2025 Watchlist

Nov 21, 2024

This smallcap stock is a good proxy play for the wind energy megatrend.

Top 5 Fundamentally Strong Railway Stocks Down up to 50% from 52-Week Highs

Top 5 Fundamentally Strong Railway Stocks Down up to 50% from 52-Week Highs

Nov 21, 2024

Railway stocks are witnessing sustained selling pressure. Is it finally time to board the train?

Why UPL Share Price is Rising

Why UPL Share Price is Rising

Nov 20, 2024

Unpacking UPL's massive rights issue, latest quarterly earnings, and more.

Why CE Info Systems Share Price is Falling

Why CE Info Systems Share Price is Falling

Nov 20, 2024

Here's why this mapping company's share price is in trouble after declaring quarterly results.

Is Innovation Already Priced into Siemens India's PE Ratio of 100?

Is Innovation Already Priced into Siemens India's PE Ratio of 100?

Nov 20, 2024

Siemens India's 100x PE an indicator of economic buoyancy or market froth?

Pros and Cons of Investing in PG Electroplast

Pros and Cons of Investing in PG Electroplast

Nov 20, 2024

Should investors consider the stock of PG Electroplast? Find out...

10 Luxury Ecosystem Stocks to Watch Out For in 2025

10 Luxury Ecosystem Stocks to Watch Out For in 2025

Nov 20, 2024

India's luxury market is rapidly expanding, fueled by rising disposable incomes and changing consumer preferences. These companies could win big in 2025.