India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Views On News

- Oct 15, 2022 - Top 5 FMCG Companies in India by Growth

Top 5 FMCG Companies in India by Growth

Every consumer looks for products that will help make their lives easier. Most of us don't just want something that works well; we want something that will save us time or trouble in some way as well.

From our snack cravings to beauty care, we need FMCG products at our back and call. Hence, when businesses over the world are struggling due to recession concerns, the FMCG sector barely moves an inch because people will spend on goods of daily needs.

People cannot stop spending on necessities and the FMCG sector forms a majority of our daily needs. Hence it is safe to say, FMCG stocks are recession proof stocks. This also makes FMCG, one of the highly competitive sectors.

FMCG companies are fighting tooth and nail with each other to make into a consumer's list of favourite brands. From Starbucks to Magic Hand wash, to hair fall shampoos, our daily life is surrounded by FMCG products.

But have you wondered which company is really making to the consumer's trolley?

In this article, we list out the top 5 FMCG companies in India which have seen the fastest growth in sales and revenues.

#1 Tata Consumer

From selling salt that has quite literally become 'Desh ka namak' to selling green tea that's 'Andar se clean and bahar se active', Tata Consumer has a range of products that answers various consumer needs.

In fact, Tata's Tetley is the second largest tea brand globally!

Even when we talk about innovations, Tata Consumer is leading the game. With Tetley it introduced the round tea bags in 1989. With Tata Salt it brought iodised salt to India in 1989 to fight iodine deficiency. With Tata Tea it revolutionised India's packaged tea industry with its flavour-locking poly pack 30+ years ago.

For the financial year 2022, Tata Consumer's total revenues stood at Rs 125,654 m. This is 7.2% higher compared to previous year.

On a CAGR basis, Tata Consumer is leading the sales growth chart. In the past five years, its sales have grown by 12.9% on a CAGR basis.

The net profit for the financial year ended 2021-22 was Rs 10,789.5 m. This is 8.6% higher compared to last year.

On a CAGR basis, in the last five years, the company's operating profit and net profit have grown by 16.3% and 18.4%, respectively.

Financial Snapshot

| Particulars (Rs m) | FY18 | FY19 | FY20 | FY21 | FY22 |

|---|---|---|---|---|---|

| Total Income | 69,095.0 | 74,086.3 | 97,490.1 | 117,234.1 | 125,654.3 |

| Growth | 0.7% | 7.2% | 31.6% | 20.3% | 7.2% |

| Operating profit | 9,330.6 | 9,430.4 | 14,037.4 | 16,651.4 | 18,588.4 |

| Operating profit margin | 13.5% | 12.7% | 14.4% | 14.2% | 14.8% |

| Net profit | 5,672.6 | 4,738.3 | 5,351.9 | 9,937.9 | 10,789.5 |

| Net profit margin | 8.2% | 6.4% | 5.5% | 8.5% | 8.6% |

For the financial year 2022, Tata Tea premium recorded its highest growth in sales volumes in a decade. Tata Consumer's total e-commerce sales contributed to 7.3% of the total sales in the said period as compared to just 2.5% in 2020.

The company's domestic business has seen a growth in the past three years, while international business has remained subdued.

Revenue Segmentation

To know more about Tata Consumer, check out its factsheet and quarterly results.

#2 Marico

Second on the list is Marico.

This is a company of which at least one product is being used by you, was used by your parents, and will be used by your children.

For years this product has been used like a one stop solution for all hair problems.

I'm talking about Parachute hair oil. Marico started its production in 1993 and ever since that Parachute has been one of the popular products in Marico's basket.

Apart from Parachute, Marico also boasts of famous brands like Nihar (hair oil), Set-wet (men grooming product), Saffola (edible oil). Its product portfolio comprises of beauty and wellness.

For the financial year 2022, Marico's total revenues stood at Rs 96,130 m. This is 18% higher compared to previous year's revenues. The revenue growth rate for financial year 2022 doubled at 18% compared to growth rate of 9.4% in the previous year.

On a CAGR basis too, Marico's sales growth has been quite good. On a CAGR basis, in the past five years its sales have grown by 9.8%.

The net profit for the financial year ended 2021-22 was Rs 12,550 m. This is 4.5% higher compared to last year.

On a CAGR basis, in the last five years, the company's operating profit and net profit have grown by 7.2% and 9.1%, respectively.

Financial Snapshot

| Particulars (Rs m) | FY18 | FY19 | FY20 | FY21 | FY22 |

|---|---|---|---|---|---|

| Total Income | 64,070.0 | 74,370.0 | 74,420.0 | 81,450.0 | 96,130.0 |

| Growth | 6.5% | 16.1% | 0.1% | 9.4% | 18.0% |

| Operating profit | 12,180.0 | 14,290.0 | 15,930.0 | 16,850.0 | 17,790.0 |

| Operating profit margin | 19.0% | 19.2% | 21.4% | 20.7% | 18.5% |

| Net profit | 8,270.0 | 11,320.0 | 10,430.0 | 12,010.0 | 12,550.0 |

| Net profit margin | 12.9% | 15.2% | 14.0% | 14.7% | 13.1% |

In 2022, Marico added 10 new products to its basket.

Out of its total revenue for 2021-22, 23% came from international business. There have also been some changes in its capital inputs.

Financial Ratios

To know more about Marico's, check out its factsheet and quarterly results.

#3 Hindustan Unilever (HUL)

As a kid, I remember wondering what the big 'U' was at the end of also many famous ads. From detergents to soaps to ice creams to toothpaste, it was everywhere.

It's the logo of the FMCG giant HUL.

HUL has 50 plus brands under its roof. Their products are spanned across 15 categories. HUL is a subsidiary of Unilever, one of the world's leading suppliers of food, home care, personal care and refreshment products.

The company is present in 9 out 10 Indian households. Forbes rated HUL as the most innovative company in India and #8 globally.

For the financial year 2022, HUL's total revenues stood at Rs 527,040 m. This is 11.1% higher compared to previous year's revenues.

On a CAGR basis , in the past five years, its sales have grown by 9.4%.

The net profit for the financial year ended 2021-22 stood at Rs 88,870 m. This is 11% higher compared to last year.

On a CAGR basis, in the last five years, the company's operating profit and net profit have grown by 14.4% and 14.6%, respectively.

Financial Snapshot

| Particulars (Rs m) | FY18 | FY19 | FY20 | FY21 | FY22 |

|---|---|---|---|---|---|

| Total Income | 359,340.0 | 398,600.0 | 404,150.0 | 474,380.0 | 527,040.0 |

| Growth | 6.9% | 10.9% | 1.4% | 17.4% | 11.1% |

| Operating profit | 78,850.0 | 94,300.0 | 104,870.0 | 120,360.0 | 131,150.0 |

| Operating profit margin | 21.9% | 23.7% | 25.9% | 25.4% | 24.9% |

| Net profit | 52,270.0 | 60,600.0 | 67,560.0 | 80,000.0 | 88,870.0 |

| Net profit margin | 14.5% | 15.2% | 16.7% | 16.9% | 16.9% |

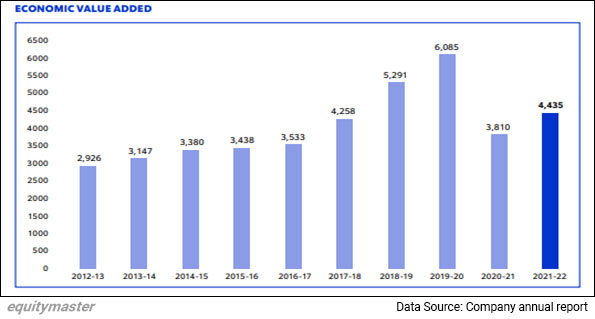

Over the past few years, HUL's economic value added (EVA) has increased substantially. However, a clear impact of covid-19 can be seen on its business in the last two years.

EVA is a modern measure used for measuring shareholder's value creation. EVA is residual income after charging the company for the cost of capital provided by lenders and shareholders.

It represents the value added to the shareholders by generating operating profits in excess of the cost of capital employed in the business.

Economic Value Added Chart

To know more about HUL's, check out its factsheet and quarterly results.

#4 Dabur

Medical science and medicines evolve as the civilisation advances and as the disease pattern changes.

One of the popular medical system - Ayurveda - evolved in India with a rational foundation and it has survived as a distinct entity from remote antiquity to the present day.

Developing and selling its products in the home grown medicine system, Dabur has come a long way in becoming one of India's well know FMCG companies.

Using organic, ayurvedic components to manufacture various products is Dabur's unique selling point (USP). Dabur is globally acclaimed company for its ayurvedic and natural health care products. It has over 250 products in its product portfolio.

From tasty 'hajmola' to bitter yet effective 'sudarshan ghanvati' medicine to trusted 'chyawanprash', Dabur has a lot of products where it has left a strong impression.

For the financial year 2022, Dabur's total revenues stood at Rs 112,818.4 m, which is 14.1% higher compared to previous year's revenues.

On a CAGR basis, Dabur's sales growth in the past five years stood at 7.3%.

The net profit for the financial year ended 2021-22 was Rs 17,441 m. This is 3% higher compared to last year.

On a CAGR basis, in the last five years, the company's operating profit and net profit have grown by 7.9% and 6.4%, respectively.

Financial Snapshot

| Particulars (Rs m) | FY18 | FY19 | FY20 | FY21 | FY22 |

|---|---|---|---|---|---|

| Total Income | 80,270.3 | 88,111.6 | 89,899.3 | 98,869.4 | 112,818.4 |

| Growth | 1.4% | 9.8% | 2.0% | 10.0% | 14.1% |

| Operating profit | 19,226.2 | 20,357.3 | 20,976.4 | 23,279.7 | 26,469.7 |

| Operating profit margin | 24.0% | 23.1% | 23.3% | 23.5% | 23.5% |

| Net profit | 13,575.0 | 14,452.9 | 14,479.3 | 16,959.6 | 17,441.0 |

| Net profit margin | 16.9% | 16.4% | 16.1% | 17.2% | 15.5% |

In the financial year 2022, for the first time Dabur crossed the Rs 100,000 m revenue mark. It reported the highest ever annual growth in the past eight years.

Dabur's ayurvedic products are sold all over the world. It eight international manufacturing locations and 13 state of the art manufacturing plants in India.

For the financial year 2022, its international business has grown 15.8% in constant currency terms. Out of its total revenue, revenue worth Rs 28,060 m came from the overseas market, in the same period.

Among the overseas markets, it has the highest sale in the middle east countries. It also sells its products in Europe, America, Africa, and other Asian countries.

Revenue Segmentation

To know more about Dabur's, check out its factsheet and quarterly results.

#5 Godrej Consumer Products

You know Diwali is around the corner when your mom hands you a bag and asks you to buy the red hit on a Sunday morning.

The famous Hit is a product of Godrej Consumer Products.

From quirky advertisements like 'happy bathrooms' (Godrej Aer Pockets) to effective products like Hit and Good Knight, Godrej Consumer Products has a bunch of known brands in its kitty.

Godrej Consumer is one of the leading FMCG companies in India. The company has five product segments namely household insecticides, soaps, hair colours, liquid detergents, and air fresheners.

For the financial year 2022, Godrej Consumer's total revenues stood at Rs 123,662 m. This is 11.5% higher compared to previous year's revenues.

On a CAGR basis, in the past five years, its sales have grown by 5.8%.

The net profit for the financial year ended 2021-22 was Rs 17,831 m, which is 4% higher compared to last year.

On a CAGR basis, in the last five years, the company's operating profit and net profit have grown by 4.7% and 6.4%, respectively.

Financial Snapshot

| Particulars (Rs m) | FY18 | FY19 | FY20 | FY21 | FY22 |

|---|---|---|---|---|---|

| Total Income | 99,631.2 | 104,231.0 | 100,231.0 | 110,956.9 | 123,662.1 |

| Growth | 6.6% | 4.6% | -3.8% | 10.7% | 11.5% |

| Operating profit | 21,870.4 | 22,403.3 | 22,660.5 | 24,663.4 | 2,4969.2 |

| Operating profit margin | 22.0% | 21.5% | 22.6% | 22.2% | 20.2% |

| Net profit | 16,331.0 | 23,409.0 | 14,957.7 | 17,208.3 | 17,831.1 |

| Net profit margin | 16.4% | 22.5% | 14.9% | 15.5% | 14.4% |

Recently, Godrej Consumer lowered the price of its soap Godrej No 1 by 15% owing to reduction in its raw material prices.

To know more about Godrej Consumer Product's, check out its factsheet and quarterly results.

Top FMCG Companies on Equitymaster's Indian Stock Screener

Take a look at the image below which lists out the above-mentioned companies on various important metrics.

Investment Takeaway

Being part of history is not always a matter of pride. We all agree to that after being part of the historic pandemic that took over the world in 2019.

Covid-19 shattered businesses and severely affected economies all over the world. The FMCG sector was no exception to the shocks of the pandemic. The sector lost a lot of business due to lockdowns. However, as the world moves away from the virus, the FMCG sector has recovered steadily.

Covid-19 changed the way the FMCG sector functions. A basic change was that people moved to online buying. E-commerce sales have been increasing and it is expected that by 2030, total e-commerce sales will form 11% of the total FMCG sales.

Increasing fund flow from foreign direct investment (FDI) and government initiative to boost FMCG sector has also supported the growth of FMCG sector.

In conclusion, India being a consumption economy has an advantage when it comes to FMCG sector.

If Taiwan is known for making semiconductors and Brazil is known for its commodities, then India has a unique selling proposition (USP) in the FMCG or consumption space.

Demand for quality goods and services have been going up in rural areas, on the back of improved distribution channels of FMCG companies.

Needless to say, a rising middle class with more disposable income and a shift towards incremental spending were the key factors (and will be in the future) in the steady growth of FMCG sector in India.

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Out Now

3 High Conviction Stocks

Chosen by Rahul Shah, Tanushree Banerjee and Richa Agarwal

Report Available

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Equitymaster requests your view! Post a comment on "Top 5 FMCG Companies in India by Growth". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!