India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Equitymaster Wealth

- Oct 14, 2021 - When SIPs Don't Always Lead to Wealth Creation...

When SIPs Don't Always Lead to Wealth Creation...

All of us endeavour to accomplish our envisioned financial goals. And we have often heard that Systematic Investment Plan (SIP) -- a mode of investing in mutual funds --- is an effective medium for wealth creation.

We are also made to understand the following benefits of SIPs...

- Enable you to invest smaller amounts at regular intervals (daily, monthly or quarterly), which in turn reduces the burden of devoting a lumpsum from your bank account.

- Enable rupee-cost averaging, i.e. you typically buy more mutual fund units when the equity markets are trading low and similarly buy fewer units when markets are scaling up.

- Make timing the market irrelevant, and instead helps you focus on the 'time in the market'.

- Enhance the power of compounding, whereby you compound your wealth leaps and bound over the long-term, and help realise your dreams.

But are you aware that SIPs may not always lead to wealth creation?

Yes, SIP is not necessarily a Safe Investment Plan or a sure shot way to create wealth.

Here are the factors when effective wealth creation via SIPs does not happen:

Inappropriate mutual fund scheme selection

The mutual fund schemes you choose should ideally match your risk profile, investment objectives, financial goals, and the time in hand to achieve those goals.

If you get the scheme selection wrong and invest in an ad hoc manner, you may not be able to achieve your envisioned financial goals.

For example, if you have a short-term financial goal to achieve and are a low-to-moderate risk-taker, an equity-oriented mutual fund scheme may be unsuitable for you. Similarly, for a high-risk profile and to earn capital appreciation over a long term horizon of more than 3-5 years away, SIP-ping into various equity-oriented mutual fund schemes may be a worthwhile proposition.

You see, once you have assessed your needs and risk profile, then choosing the category of mutual funds and sub-categories becomes a simple exercise.

Thereafter, you also need to take care that your mutual fund scheme selection within the category and sub-category is among the best. A host of quantitative and qualitative parameters such as the following need to be carefully evaluated:

- Returns over various time frames (6-months, 1-year, 2-year, 3-year, 5-year, 10-year, since inception);

- Performance across market phases (i.e. bull and bear phases);

- Risk ratios (Standard Deviation, Sharpe, Sortino, etc.);

- The expense ratio of the scheme;

- Portfolio characteristics (the top-10 holdings, top-5 sector exposure, how concentrated/diversified is the portfolio, the market capitalisation bias, the style of investing followed - value, growth, or blend, the portfolio turnover. In the case of debt funds, the average maturity, modified duration, and the quality of debt papers);

- The quality of the fund management team (the experience of the fund manager, the number of schemes he/she manages, the track record of the mutual fund schemes under his/her watch, the experience of the research team);

- And the overall efficiency of the mutual fund house in managing investors' hard-earned money (i.e. the proportion of AUM actually performing)

Analysing a mutual fund scheme in the above manner helps gauge the risk-return potential of a fund, i.e. how it would perform in the future.

Besides, over time you also ought to prudently review and rebalance the portfolio to cull out the underperformers and invest in better alternatives so that you are well on track to accomplish the envisioned financial goals.

Insignificant monthly SIP Contributions

Even though you may have the best mutual fund schemes in your investment portfolio, you could still fall short of reaching your goal, if you do not invest an adequate amount.

The amount that you need to contribute as the SIP instalment should essentially be based on the corpus you desire to build and the time-to-goal. Additionally, you will need to adjust the investment amount for inflation.

Particulars Short-Term Goal Long-Term Goal Goal Buying a Car Child's Higher Education Time-to-goal (in years) 3 10 Present Value of the Goal (in Rs) 700,000 2,500,000 Future Value of the Goal (in Rs) 833,711 5,397,312 Monthly SIP required to achieve the Goal(in Rs) 20,567 24,086 Inflation Rate (assumed on average basis)# 6% 8% Expected Rate of Return (compounded annualized) 8% 12% #Inflation in education assumed higher than on a short-term goal.

*To address the short-term goal, the assumed investment rate is that of a short-term debt fund and for the long-term goal of a large-cap equity fund.

(Table above is for illustration purposes only)

Say, you want to purchase a car 3 years from now and fund your child's higher education expenses 10 years from now, the details of which are depicted in the table above; you would require starting a monthly SIP amount of around Rs 20,500 today preferably in short-term debt fund yielding around 8% p.a. to realise the financial goal of a new car.

And to address your child's higher education expenses a decade away; you will need to invest approximately Rs 24,000 monthly starting today preferably in a 'Large & Mid-cap Fund' assuming a compounded annualised return of 12% p.a.

If you contribute random and insignificant sums for your monthly SIPs, there are chances that you may not accomplish your financial goals. You must make meaningful contributions to your SIPs depending on the corpus you wish to build.

Ideally, it makes sense to make your payday your SIP day. This will enable you to save and invest first, and contribute meaningfully towards SIPs.

Legendary investor, Warren Buffet, once said, "Don't save what is left after spending, but spend what is left after savings".

Making your payday your SIP day also eliminates the risk of SIP instalments not getting debited due to insufficient funds if there is a long gap between the payday and SIP day.

Also, when you are doing well in your career earning respectable increments, consciously step up your SIPs. This will adduce the following benefits:

- Ensures that your readiness to save and invest increases every year with a rise in income and inculcates discipline.

- Help you counter inflation better.

- Boosts up the power of compounding

Keeping your SIP instalment constant year after year, may not be the best approach for effective wealth creation.

Not following the investment discipline

Do not panic or rush to redeem your investments, discontinue SIPs, or pause SIPs when markets turn volatile.

Discontinuing your investments due to market noise and volatility can derail your path to achieving your financial goals. You see, volatility is the very nature of the equity market. It is how we use it to our advantage, perceive the situation sensibly, and devise an efficient strategy that decides our investment success. In fact, in volatile market conditions, SIPs will help you mitigate the volatility better.

As long as you are SIP-ping into some of the best mutual funds, you need to stay put and follow the necessary financial discipline.

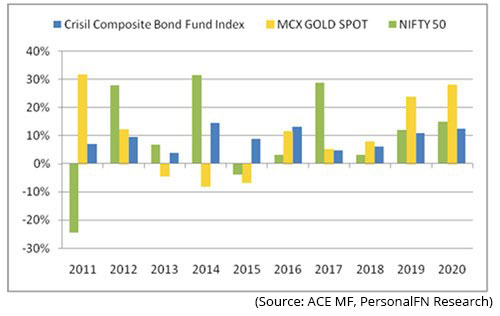

Notwithstanding the above, there are certain market conditions when SIPs do not lead to wealth creation.

If you have started your monthly SIPs amidst the market rally, there are chances that your SIP investments may disappoint you. This is because, during a market uptrend, you are purchasing units at a higher price, pushing your average purchase cost higher than the initial NAV of the first instalment or had you invested a lump sum.

As seen in the graph above, as the market moves higher, the subsequent investments of the SIP were made at a higher NAV, increasing the purchase cost. In such a case, the lumpsum investment of Rs 1 lakh generated a higher gain.

That said, identifying market bottoms or market peaks, is not an easy task. No one, not even the seasoned investors and/or market experts, can forecast for sure where the markets could be headed. One could employ market-timing strategies, but these may not always work.The S&P Sensex recently hit a peak of 60,000. Could anyone have predicted that the market would touch this level when it touched the 40,000 or 50,000 mark?

The journey hereon of the Indian equity markets is uncertain. But currently, the valuations for sure look expensive. At this time going all out and making lump sum investments, may not be a prudent approach.

When valuations look expensive and the future trajectory of the equity market cannot be predicted, SIPs would, undoubtedly, be a sensible and better route s compared to investing your corpus as a lump sum.

If the market turns volatile or corrects from the present level, SIPs would help you average out your investment cost better (with the in-built rupee-cost averaging feature) and deal with the intermittent volatility. More units will be added on during the corrective phase of the equity markets, and when the market begins to ascend again, this strategy will compound your wealth. The graph above depicts how in the corrective phase of the Indian equity markets from March 2015 to February 2016, SIP investments were rewarded better than a lump sum investment.

Keep in mind, if the markets do not turn out in your favour and your SIP investment delivers disappointing returns, do not panic or be dismayed. You can harness market volatility as an opportunity to add more units at lower costs.

Note that the equity market witnesses various events throughout the year. Most of these events do not have any long-term impact on the indices. Therefore, your SIP investment can always deliver positive returns in the long run. The graph above is a proof of it.

It is important to have a long-term investment horizon of five to seven years or more, even if you are investing via a SIP. During certain periods SIP returns maybe a few percentage points lower compared to a lumpsum investment, but over a period it will still be sufficient to meet your financial goals.

To conclude...

SIP can prove to be a rewarding strategy provided you are choosing your mutual fund schemes appropriately, contributing a meaningful sum in line with your financial goal/s, following the necessary financial discipline, and making a point to timely review and rebalance your mutual fund portfolio prudently.

When it comes to investing in mutual funds, there is no such thing as a 'one-size-fits-all portfolio'. A fund could be right for one investor and (despite its stellar performance) be completely unsuitable for another.

Therefore, when you invest via SIP in mutual funds, make sure it is optimally and strategically structured to meet your requirements. Construct your SIP portfolio in such a way that it works under all market conditions. This will not only help you sail through market downturns but also reward you during the growth phase.

When you are nearing your goal horizon, gradually reduce exposure in equity to invest in a more stable and less risky investment avenue, such as debt mutual funds and bank deposits.

Remember, your investment approach, strategy, and asset allocations decide your success in investing.

This article has been authored by PersonalFN - a Mumbai based Financial Planning and Mutual Fund research firm known for offering unbiased and honest opinions on investing.

Equitymaster requests your view! Post a comment on "When SIPs Don't Always Lead to Wealth Creation...". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!