India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Views On News

- Sep 8, 2022 - Why Cement Stocks are Rising

Why Cement Stocks are Rising

Three months ago, we wrote to you about why cement stocks were falling.

Back then, cement stocks were under intense pressure because of UltraTech Cement's massive capex plan.

Back then, analysts were of the view that in times of weak demand and high fuel costs, any significant capacity announcement is a negative.

Three months later, the scenario has changed, and cement stocks have started to rise.

Yesterday, cement stocks were top gainers despite the fall in broader share markets.

Read on to find out what suddenly changed in the cement industry, that is pushing cement stocks higher.

#1 Falling Input Costs

Pet coke and coal are the key ingredients for manufacturing good quality cement. In recent months, pet coke and coal prices had shot through the roof.

Hence the input costs were very high because power and fuel expenses constitute about 25-30% of the cement sector's total input cost.

Cement manufacturers could not increase the cost of their output due to tough competition in the sector. Hence, the burden of increased cost was borne by the companies and their margins were impacted.

But since the beginning of August 2022, international and domestic pet coke prices have started to soften. Coal prices in the exporting countries have also come down.

As a result, the overall input cost of manufacturing cement might get reduced, which has boosted the near-term sentiment for cement stocks.

#2 Changing seasons

Cement industry is seasonal in nature. Basically, you can say cement stocks are cyclical stocks.

Cement prices fall around monsoon as there is reduction in construction activity during monsoon. Resultantly, cement stocks fall.

Since monsoon is almost over around the country, cement prices are on the rise again.

Also the festive season is around the corner, which will boost the construction activity. Hence cement prices are back on the rise.

#3 Growing economy

Earlier this a week, a news headline went viral:

"India overtakes UK to become the fifth largest economy in the world"

This headline had made every Indian swell with pride, even those who made zero contribution to the economy.

Jokes apart, it is clear from the headline that India's economy is growing at a rapid pace.

When an economy is growing, people invest more in infrastructure because the living standard rises. Hence, a growing economy suggests a boom in infrastructure sector.

And a booming infrastructure sector suggests increasing demand of cement.

So, it could be that cement stocks are rising owing to the sentiment that India will upgrade its infrastructure, in the near future.

#4 Ban on Mining Sites

Raw materials for manufacturing cement is mined form limestone quarries. Hence mining sites are crucial to cement manufacturing.

The Indian government has been strict regarding the rules around the mines because of ESG concerns.

In 2020, a western zone bench of the National Green Tribunal quashed two environmental clearance (EC) certificates granted by the Gujarat state environment impact assessment authority (SEIAA) to Ultratech Cement and its subsidiary Narmada Cement Company (NCC) for limestone mining at Babarkot village in Amreli's Jafrabad.

If existing mines are banned, cement manufactures will be under trouble.

According to a report there is a mining ban at a few sites around the country. This could mean higher cement prices, which is good for top cement companies..

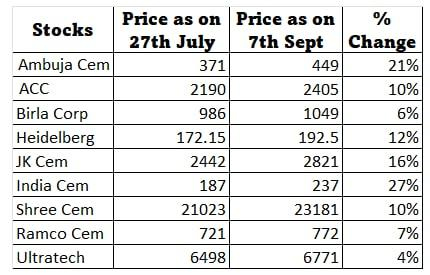

Performance of cement stocks

In July this year, Chartist Brijesh Bhatia recorded a video on cement stocks and explained why cement companies are expected to see some consolidation.

Take a look at the image below to see how cement stocks have performed since Brijesh recorded the video.

Performance of Constituents of Equal Weighted Cement Index

Investment Takeaway

It seems that headwinds for the cement sector may finally be going away. However, rising cement price is anticipatory.

The price of inputs have come down a little, but there is no substantial downfall yet. If the prices do not go down more, the margins will continue to be under pressure.

If mining sites are banned, the increase in cement price may come as a temporary benefit. But in the long run, the increased cost of cement will ultimately reduce the demand of cement, which might not be good for the whole industry.

However, cement as a raw material will always be in demand because it is crucial to construction. Tanushree Banerjee - Co-Head of Research at Equitymaster, says,

"While the long-term story of Indian cement companies remains intact amid massive infrastructure outlay, near-term uncertainties about a change of management among others could cloud valuations"

Happy Investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Equitymaster requests your view! Post a comment on "Why Cement Stocks are Rising". Click here!

1 Responses to "Why Cement Stocks are Rising"

metamatrix.club

Jan 1, 2023Any reason why the green movement might be altering this stock?