India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Views On News

- Aug 19, 2022 - 2022's Biggest Dividend Payers. Take a Look...

2022's Biggest Dividend Payers. Take a Look...

The last three years have been challenging for investors as lockdowns, rising interest rates, sky high inflation, and the Ukraine - Russia war caused markets to turn volatile.

So where must one invest to ensure some stability in their portfolio?

Investing in high-quality dividend-paying stocks is one tried-and-tested approach. Such stocks offer stable income and are an excellent means for beating inflation.

Here are five stocks that have delivered the highest dividends this year.

Let us take a look.

#1 Trent

First on the list is Trent with a dividend payout ratio of 205.1.

For the financial year 2022, the company declared a final dividend of Rs 1.1 per share. This payout was on the back of revenues from the franchises.

Trent has been a consistent dividend payer. Since 2001, the company has declared 26 dividends.

The five-year average dividend payout ratio stands at 57.4%. The dividend yield over the past five years has been 0.2%.

Trent is one of the leading players in the branded retail industry in India. It is a subsidiary of the conglomerate Tata Group.

The company operates retail stores under the brand names, Westside, Zudio, Star, and Landmark.

Westside and Zudio have ramped up store counts by 30% and 50% in the financial year 2022.

Recently the company has forayed into emerging sectors like beauty and personal care. It will help drive topline growth.

The company has a healthy cash balance of Rs 821.6 m as of 31 March 2022 up 8.6% YoY.

To know more, check out Trent's factsheet and latest quarterly results.

Trent's Dividend History

| Mar-18 | Mar-19 | Mar-20 | Mar-21 | Mar-22 | |

|---|---|---|---|---|---|

| Dividend per share (Adj.) (Rs) | 1.08 | 1.22 | 1 | 0.6 | 1.7 |

| Dividend payout ratio (%) | 34.8 | 40.6 | 26.1 | -19.4 | 205.1 |

| Dividend Yield (%) | 0.3 | 0.4 | 0.2 | 0.1 | 0.1 |

#2 Torrent Pharma

Second, on the list is Torrent Pharma, with a dividend payout ratio of 104.5%.

For the financial year 2022, the company declared a final dividend of Rs 8 per share. The board also declared an interim dividend of Rs 25 and a special dividend of Rs 15.

So, the company has announced a total dividend of Rs 48 per share for the financial year 2022.

Since 2001, the company has declared 35 dividends. The five-year dividend payout ratio of Torrent Pharma stands at 61.1%.The five-year average yield of the company is 1.3%.

Torrent Pharma is the fifth largest pharma player in India. It is the flagship company of the Torrent Group.

The company is a dominant player in the therapeutic areas. It has a strong international presence spread across 40 countries.

The company is currently planning to expand its insulin production capacity. It is expanding a plant site near Ahmedabad for it.

Its cash balance for the year stands at Rs 4.03 bn down 33% YoY.

To know more, check out Torrent Pharma's factsheet and latest quarterly results.

Torrent Pharma Dividend History

| Mar-18 | Mar-19 | Mar-20 | Mar-21 | Mar-22 | |

|---|---|---|---|---|---|

| Dividend per share (Adj.) (Rs) | 7 | 8.5 | 16 | 17.5 | 24 |

| Dividend payout ratio (%) | 34.9 | 65.9 | 52.8 | 47.3 | 104.5 |

| Dividend Yield (%) | 1.1 | 0.9 | 1.6 | 1.4 | 1.7 |

#3 Marico

Third on the list is Marico, with a dividend payout ratio of 95.3%.

For the financial year 2022, the company declared two interim dividends of Rs 3 and Rs 6.25 per share.

A total of Rs 9.25 was declared by the company for the year.

An 8-10% domestic volume growth and currency growth were the reasons for the profits.

Since 2001, the company has declared 59 dividends. The five-year average dividend payout ratio is 76%. The dividend yield over the past five years has been 1.8%.

Marico is one of the leading FMCG companies in India. It has a wide product range of haircare, and edible oils. Its brands include Saffola, Livon, and Nihar.

The company has grown through acquisitions over the past few years.

Going forward, the company is planning to launch new products. It will be in nutritional foods category.

The cash balance of the company for the financial year 2022 stands at Rs 2.9 bn down 58% YoY.

To know more, check out Marico's fact sheet and quarterly results.

Marico's Dividend History

| Mar-18 | Mar-19 | Mar-20 | Mar-21 | Mar-22 | |

|---|---|---|---|---|---|

| Dividend per share (Adj.) (Rs) | 4.24 | 4.74 | 6.74 | 7.49 | 9.25 |

| Dividend payout ratio (%) | 66.3 | 54.2 | 83.6 | 80.6 | 95.3 |

| Dividend Yield (%) | 1.3 | 1.4 | 2.5 | 1.8 | 1.8 |

#4 ITC

Fourth on the list is ITC, with a dividend payout ratio of 91.5%.

In the financial year 2022, ITC declared one final dividend of Rs 6.25 per share. Along with it declared an interim dividend of Rs 5.25 per share.

A total dividend for financial year 2022 stands at Rs 11.5 per share.

Due to the strong revenue driven by wheat, rice and tobacco exports, the company's profit shot up. This led to high dividends for the year.

Since 2001, the company has declared 24 dividends. The five-year dividend payout ratio of ITC stands at 76%. The five-year average yield of the company is 4%.

ITC is one of the largest FMCG companies in India. It has 78% of the share in the cigarettes business in India. The company is also present in the paperboard, printing, and packaging business.

ITC, for the upcoming year, is planning to expand its FMCG exports in 60 countries.

The cash balance of the company for the financial year 2022 stands at Rs 38.7 bn down 3% YoY.

To know more, check out the ITC company fact sheet and quarterly results.

ITC's Dividend History

| Mar-18 | Mar-19 | Mar-20 | Mar-21 | Mar-22 | |

|---|---|---|---|---|---|

| Dividend per share (Adj.) (Rs) | 5.008 | 5.69 | 10.07 | 10.68 | 11.44 |

| Dividend payout ratio (%) | 54.7 | 55 | 80.1 | 98.8 | 91.5 |

| Dividend Yield (%) | 2 | 1.9 | 5.9 | 4.9 | 4.6 |

#5 Nestle

The last on the list is Nestle, with a dividend payout ratio of 89.9%.

For the financial year 2022, the company declared a final dividend of Rs 65 per share and an interim dividend of Rs 25 per share. The total dividend per share for the year stands at Rs 90.

Since 2001, the company has declared 65 dividends. The five-year average dividend payout ratio stands at 97.3%. The dividend yield over the past five years has been 1.3%.

Nestle is one of the largest food and beverage companies in the world. The company is in the business of manufacturing milk and other food products.

Nestle holds leadership through its brand Maggi, Kitkat, and Munch.

For the financial year 2023, it will launch new categories. This will include the healthy ageing and toddler segment.

The company's cash as of December 2021 stands at Rs 7.3 bn.

To know more, check out Nestle's fact sheet and quarterly results.

Nestle's Dividend History

| Mar-18 | Mar-19 | Mar-20 | Mar-21 | Mar-22 | |

|---|---|---|---|---|---|

| Dividend per share (Adj.) (Rs) | 86 | 115 | 342 | 200 | 200 |

| Dividend payout ratio (%) | 67.7 | 69 | 167.5 | 92.6 | 89.9 |

| Dividend Yield (%) | 1.1 | 1 | 2.3 | 1.1 | 1 |

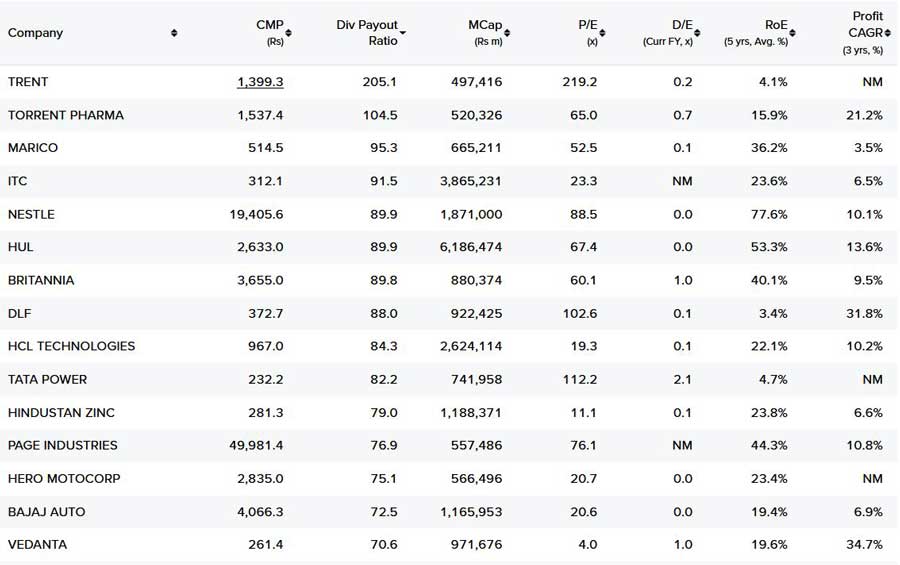

Snapshot of high dividend paying stocks from Equitymaster's stock screener

Here is a quick view at the above-mentioned companies based on some crucial financial parameters.

These parameters can be changed according to your selection criteria.

To conclude

High dividend-paying stocks tend to show low price volatility during inflation as they provide investors with steady cash flow over the long term. And when you reinvest dividend income, the magic of compounding can increase your earnings.

They also provide both appreciation and capital gains to offset rising costs.

However, not all dividend stocks have created wealth equally. For instance, a high dividend payout can be a trap to cover up erratic payouts.

Therefore, analysing free cash flows, debt levels, and corporate governance, is equally crucial.

If you are interested in investing in dividend stocks, you should investigate the company's history of dividend payments and their value before investing.

For more details on dividend stocks, check out our editorial - 10 Indian companies with the fastest growth in dividend payouts.

Also check out, 5 stocks paying more than 200% dividend in September.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Equitymaster requests your view! Post a comment on "2022's Biggest Dividend Payers. Take a Look...". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!