India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Views On News

- Aug 11, 2024 - Best Specialty Chemical Stock UPL vs Aarti Industries

Best Specialty Chemical Stock UPL vs Aarti Industries

UPL logo source: https://www.upl-ltd.com/

UPL logo source: https://www.upl-ltd.com/Aarti Industries logo source: https://www.aarti-industries.com/

The chemicals sector is of strong economic importance to the Indian economy. It contributes nearly 7% to India's GDP.

It is also the 6th largest chemicals producer in the world and third in Asia.

The Indian chemicals industry is extremely diversified, with over 80,000 commercial products across various chemical segments, such as agrochemicals, petrochemicals, and speciality chemicals.

Out of all the segments, the speciality chemicals segment is experiencing robust growth driven by increasing demand in end user industries, technological advancements, and favourable government policies.

All this is expected to drive the growth of this segment at a compound annual growth rate (CAGR) of 12% over the next years.

Of all the companies present, two are leading the race in the speciality chemicals industry: UPL and Aarti.

Let's look at how these two industries compare against each other against various parameters.

Business Overview

#UPL Industries

UPL is primarily engaged in the production of agrochemicals, industrial chemicals, chemical intermediaries, speciality chemicals, and field crops and vegetable seeds.

It has an extensive portfolio of products, with over 14,000 products registered under its name, which it supplies to over 140 countries.

The company has 43 manufacturing facilities across the world and has a network of over 85,000 retailers and 25,000 dealers.

UPL also has 30 research and development (R&D) facilities and has been granted over 1,800 patents.

It is the 5th largest agrochemical company, 6th largest global crop protection company, and number 1 speciality chemicals company in India.

#Aarti Industries

Aarti Industries, the flagship company of the Aarti group, manufactures organic and inorganic chemicals.

It has a strong position in speciality chemicals segment especially in the nitro-chlorobenzene (NCB) and di-chloro benzene (DCB)-based specialty chemicals.

The company supplies its products to a diverse range of industries, including dyes, paints, pharmaceuticals, agrochemicals, FMCG, and pigments.

It has 16 manufacturing facilities, 2 R&D plants, and five co-gen power plants through which it manufactures over 100 products and supplies them to over 60 countries.

The company also undertakes contract manufacturing for leading chemical companies around the globe.

| Particulars | UPL | Aarti Industries |

|---|---|---|

| Market Cap (in Rs billion)* | 410.6 | 270.8 |

| Market Share | 13.0% | 25-40% |

If we compare the two companies in terms of marketcap, then UPL is leading with a marketcap of Rs 410.6 billion (bn), followed by Aarti Industries at Rs 270.8 bn.

In terms of market share, both companies have a strong presence in the chemicals industry.

Aarti Industries is the largest producer of benzene derivatives in India, and a major player among global manufacturers. It has a global market share of around 25-40% across all its products.

UPL, on the other hand, is the number one crop protection player in India, with a 13% market share.

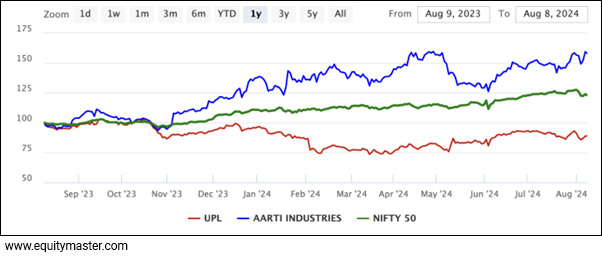

If we compare the two companies in terms of their performance on the stock market, then Aarti Industries has clearly outperformed the market index (Nifty 50) and UPL with a 57% return.

UPL, on the other hand, underperformed, and its shares fell by 11% in the last year.

#Revenue

UPL, through its wholly owned subsidiary, supplies speciality chemicals to over 600 B2B clients. It is the only Acrolein manufacturer in India, and is a leading manufacturer of sulphur derivatives in India.

At present, the company derives about 7% of its revenue from the speciality chemicals business. However, it aims to increase this share in the future.

In the last five years, UPL's revenue grew by a CAGR of 3.8%. The company's dominant presence in the agrochemical business has supported the revenue growth.

However, in financial year 2024, the company's revenue fell by 19% on account of destocking, pricing pressure, and increased supply from China at cheap prices.

With the likely revival of the chemicals industry, the revenue is expected to go up in the medium term.

For Aarti Industries, the majority of the revenue (around 84%) is generated from speciality chemicals.

In the last five years, its revenue grew at a steady rate of 8.8% (CAGR) on account of volume growth across various products.

However, in the last year, its revenue fell by 4% on account of lower volumes and a decline in realisation due to inventory correction by global agrochemical players due to a slowdown in the overseas market.

Being a dominant and established player in the market, it has long-term supply contracts with several customers ensuring long-term revenue visibility.

Between the two companies, clearly, Aarti Industries is leading in terms of revenue growth.

Revenue

| Net Sales (in Rs m) | Mar -2020 | Mar -2021 | Mar -2022 | Mar -2023 | Mar -2024 | 5-Year CAGR |

|---|---|---|---|---|---|---|

| UPL | 357,560 | 386,940 | 462,400 | 535,760 | 430,980 | 3.8% |

| Aarti Industries | 37,519 | 39,889 | 53,000 | 59,545 | 57,326 | 8.8% |

#Profitability

The two metrics to check while analysing profitability are earnings before interest tax depreciation and amortisation (EBITDA) and profit after tax (PAT).

A growing EBITDA and net profit indicate healthy operations.

In the last five years, the EBITDA of UPL industries fell by a CAGR of 8.7%, and it reported a negative net profit of Rs 18.7 bn in the financial year 2024.

Aarti Industries, on the other hand, reported a muted growth in EBITDA, and a negative growth of 5.3% in net profit.

The primary reason for fall in profits is primarily due to lower sales volumes and fall in price realisations due to global destocking, and cheaper alternatives from China.

However, with the industry expected to revive in the second half of the financial year 2025, the profits are expected to improve in the medium term.

Profitability

| EBITDA (in Rs m) | Mar -2020 | Mar -2021 | Mar -2022 | Mar -2023 | Mar -2024 | 5-Year CAGR |

|---|---|---|---|---|---|---|

| UPL | 6,772 | 8,352 | 9,529 | 10,196 | 4,297 | -8.7% |

| Aarti Industries | 9,862 | 9,822 | 17,209 | 10,898 | 9,850 | 0.0% |

| PAT (in Rs m) | Mar -2020 | Mar -2021 | Mar -2022 | Mar -2023 | Mar -2024 | 5-Year CAGR |

| UPL | 21,780 | 34,950 | 44,370 | 44,140 | -18,780 | -197.1% |

| Aarti Industries | 5,468 | 5,352 | 11,859 | 5,452 | 4,165 | -5.3% |

| Gross Profit Margin | Mar -2020 | Mar -2021 | Mar -2022 | Mar -2023 | Mar -2024 | |

| UPL | 1.9% | 2.2% | 2.1% | 1.9% | 1.0% | |

| Aarti Industries | 26.3% | 24.6% | 32.5% | 18.3% | 17.2% | |

| Net Profit Margin | Mar -2020 | Mar -2021 | Mar -2022 | Mar -2023 | Mar -2024 | |

| UPL | 6.1% | 9.0% | 9.6% | 8.2% | -4.4% | |

| Aarti Industries | 14.6% | 13.4% | 22.4% | 9.2% | 7.3% |

#Debt Management

It is important to understand the debt-to-equity ratio of a company to know what are its fixed financial obligations. A high debt indicates high obligations.

UPL's debt-to-equity ratio is 1.1x, whereas Aarti Industries' is 0.3x.

Aarti Industries is planning to invest Rs 30 bn in capex for financial year 2025 to complete its ongoing expansion plan.

The company majorly relies on debt to fund its capex and working capital.

UPL, on the other hand, hasn't planned any major capex. It has a maintenance capex of Rs 20 bn, which it plans to fund through internal cash accruals.

The company's debt repayment in the financial year 2026 and 2027 will be around Rs 70 bn, which might lead to partial refinancing.

However, if the company goes with its rights issue plan to deleverage its balance sheet, then its debt is expected to significantly reduce.

Debt Management

| Debt to Equity Ratio (x) | Mar -2020 | Mar -2021 | Mar -2022 | Mar -2023 | Mar -2024 |

|---|---|---|---|---|---|

| UPL | 1.4 | 1.1 | 1.1 | 0.9 | 1.1 |

| Aarti Industries | 0.2 | 0.4 | 0.2 | 0.1 | 0.3 |

#Financial Efficiency

The two important metrics to measure a company's financial efficiency are return on equity (RoE) and return on capital employed (RoCE).

A high ratio is considered better.

The RoE and RoCE of UPL averaged 11.5% and 11.8%, respectively, whereas Aarti Industries' ratios averaged 15.8% and 17.6%, respectively.

Clearly, Aarti Industries is leading in terms of financial efficiency.

Financial Efficiency

| ROCE | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | Mar-2024 |

|---|---|---|---|---|---|

| UPL | 9.4% | 14.5% | 15.7% | 16.2% | 3.4% |

| Aarti Industries | 22.5% | 15.7% | 27.1% | 14.0% | 8.9% |

| ROE | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | Mar-2024 |

| UPL | 11.3% | 16.7% | 20.5% | 16.4% | -7.6% |

| Aarti Industries | 18.4% | 15.3% | 26.3% | 11.1% | 7.9% |

#Dividend

A company that pays regular and high dividends is considered stable as it indicates it is generating consistent profits.

To assess the dividend of a company we look at three metrics, namely, dividend per share, dividend yield, and dividend payout ratio.

In the last five years, both companies have reduced their dividend per share significantly to Re 1. This is primarily due to high capex, falling sales and profits, and debt obligations.

The dividend yield of UPL averaged 1.3%, whereas Aarti Industries averaged 0.4% in the last five years.

Both companies aren't dividend paymasters, and the dividend payout ratios of UPL and Aarti Industries averaged 14.6% and 11.4%, respectively.

Dividend

| Dividend Per Share (Rs) | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | Mar-2024 | 5-Year CAGR |

|---|---|---|---|---|---|---|

| UPL | 6.1 | 10.2 | 10.2 | 10.0 | 1.0 | -30.4% |

| Aarti Industries | 1.7 | 1.4 | 3.5 | 2.5 | 1.0 | -9.9% |

| Dividend Yield | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | Mar-2024 | |

| UPL | 1.8% | 1.6% | 1.3% | 1.4% | 0.2% | |

| Aarti Industries | 0.5% | 0.2% | 0.4% | 0.5% | 0.2% | |

| Dividend Payout Ratio | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | Mar-2024 | |

| UPL | 21.0% | 21.9% | 17.2% | 17.0% | -4.0% | |

| Aarti Industries | 11.2% | 9.8% | 10.7% | 16.6% | 8.7% |

#Valuation

It is important to understand a company's valuation metrics to know if it overvalued or undervalued when compared to its peers.

The two valuation metrics are price to earnings ratio (PE), and price to book value ratio (PB).

Aarti Industries' PE and PB are 64.5x and 5.2x, respectively, whereas UPL's PB ratio is 1.7x, and the PE is not measurable.

If we compare the three-year average, Aarti Industries' PE and PB are 34.5x and 4.6x, whereas UPL's ratios averaged 15.8x and 1.9x.

Clearly, Aarti Industries' shares are overvalued compared to UPL's shares.

| Valuations | UPL | 3-Year Average | Aarti Industries | 3-Year Average |

|---|---|---|---|---|

| PE (x) | NM | 15.8 | 64.5 | 34.5 |

| PB (x) | 1.7 | 1.9 | 5.2 | 4.6 |

Which Speciality Chemicals Stock is Better: UPL or Aarti Industries?

Aarti industries is leading in terms of revenue growth, profit growth, margins, debt management, and financial efficiency.

However, UPL is leading in terms of dividend payments and valuation.

UPL is a major player in the crop protection space and is taking various measures to grow its business, revenue, and profits.

The global destocking has severely impacted the company. Hence, it is currently concentrating on simplifying its operating model, optimising employee costs, and tightening discretionary spending.

For the financial year 2025, its focus areas are improving margins, cash generation, and focusing on the differentiated segment to drive sales.

It also plans to focus on expanding the customer base for its existing products in new markets and leverage its R&D facilities to develop new ones.

At present, it has a strong pipeline of products under development, which will help the company improve its margins in the future.

It is also concentrating on improving its speciality chemicals business to take advantage of the growing demand for them.

Aarti Industries' on the other hand, wants to improve its revenue and margin growth through a multi-pronged strategy.

It aims to collaborate with leading chemical companies to improve its contract manufacturing business.

The company is also focussing on expanding its product portfolio by entering new chemicals segments.

Overall, both companies are gearing up to benefit from the recovery in the chemicals sector.

Moreover, with China plus one, and government's product linked incentive scheme (PLI), the industry is getting a strong boost to and is ready to make a comeback.

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Out Now

3 High Conviction Stocks

Chosen by Rahul Shah, Tanushree Banerjee and Richa Agarwal

Report Available

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here.

Equitymaster requests your view! Post a comment on "Best Specialty Chemical Stock UPL vs Aarti Industries". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!