India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Views On News

- Aug 11, 2024 - Which Company Manufactures Speciality Chemicals in India?

Which Company Manufactures Speciality Chemicals in India?

Image source: Tsikhan Kuprevich/www.istockphoto.com

Image source: Tsikhan Kuprevich/www.istockphoto.comThe speciality chemicals market in India has been experiencing rapid growth.

Both domestic and multinational manufacturers are seeing abundant opportunities.

This is being driven by strong demand from end-user sectors such as food, automotive, real estate, apparel, cosmetics, and more.

This trend is expected to continue, positioning India to potentially outpace global growth in this industry over the coming years.

As a preferred manufacturing hub for domestic and export markets, the speciality chemicals sector accounts for about 20% of India's total chemicals market.

Top Indian speciality chemicals companies are currently making their highest-ever capital expenditures, supported by robust revenue and earnings growth. This has made the sector a top choice for investors.

With that in mind, let's take a closer look at some of the leading speciality chemicals manufacturers in India.

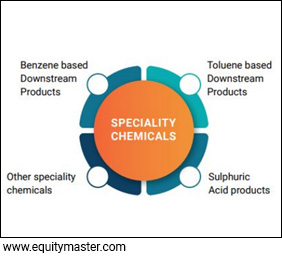

#1 Aarti Industries

Leading the list is Aarti Industries.

Aarti Industries Limited (AIL) is one of the world's leading benzene-based speciality chemical companies.

Founded in 1984, the company has grown into a global supplier of chemicals used in pharmaceuticals, agrochemicals, polymers, dyes, pigments, additives, and more.

Over the years, the company has transformed from an Indian company servicing global markets to a global company manufacturing out of India.

The company operates over 16 manufacturing plants across India, with a significant portion of its products exported to international markets.

In May 2024, to strengthen its position further, the company entered into a 50%-50% joint venture (JV) partnership with UPL for manufacturing and marketing of speciality chemicals that find application in multiple downstream industries.

UPL is the largest agrochemical company in India and a leading player in the Indian speciality chemicals industry.

This arrangement is a first-of-its-kind partnership between two large Indian companies to develop, manufacture and market the downstream and value-added chemical intermediates for global markets.

The JV company is expected to commence commercial supplies by Q1 FY27 with a peak annual revenue potential of Rs 4-5 billion (bn) in the next 2-3 years.

Aarti Industries signed a long-term agreement with a multinational conglomerate to supply a niche speciality chemical. The contract is worth over Rs 600 bn and will last four years.

Aarti Industries is actively exploring new product lines and markets to reduce its reliance on existing segments. This diversification strategy will help mitigate risks and tap into emerging opportunities.

For more details, see the Aarti Industries company fact sheet and quarterly results.

#2 Alkyl Amines

Alkyl Amines Chemicals Limited is an India-based company, which is engaged in the business of manufacturing and marketing various aliphatic amines, amine derivatives and other specialty chemicals.

The company supplies amines and amine-based chemicals to the pharmaceutical, agrochemical, rubber, chemical and water treatment industries.

Its products include Methylamine, Ethylamine, Isopropylamine, Propylamines, Cyclohexylamines, Butylamines, Ethylhexylamines and Furfurylamine.

Apart from a strong domestic presence, the company exports its products to the USA, Mexico, Thailand, UAE, and China.

It operates over 20 production plants in three manufacturing sites with an installed capacity of 158,000 tonnes per annum.

Alkyl Amines has a leadership position in several product categories, giving it an edge over its competitors. It is currently focussing on the speciality chemicals segment and setting up two new plants for the same.

Moreover, it is expanding capacities across all its product categories to remain competitive and capture the demand for chemicals.

Going ahead, the company is focused on customer growth and market opportunities.

It anticipates a stable growth market for ethylamines, growing 5-7% annually, with ethylamines' margins already improving in the last 3-4 months due to price stabilisation.

For more details, see the Alkyl Amines company fact sheet and quarterly results.

#3 Ami Organics

Next on the list is Ami Organics.

Ami Organics Limited is a prominent player in the speciality chemicals sector, primarily known for its focus on advanced pharmaceutical intermediates and speciality chemicals.

Ami Organics specializes in the development and manufacturing of high-value intermediates used in Active Pharmaceutical Ingredients (APIs) and other speciality chemicals.

The company's products cater to a wide range of therapeutic areas including anti-cancer, anti-retroviral, anti-psychotic, anti-coagulant, and more.

Ami Organics' expertise in complex chemistry has established it as a trusted partner for numerous leading pharmaceutical companies around the globe. The company runs advanced manufacturing facilities in Gujarat, India.

For FY24, Ami Organics generated Rs 14.9 bn from its speciality chemical segment. Moving forward, the company aims to explore and develop new applications while enhancing operational efficiency.

For more details, see the Ami Organics company fact sheet and quarterly results.

#4 Atul

Next on the list is Atul.

Established in 1947, Atul has evolved into one of India's leading chemical companies, with a strong global presence.

The company's speciality chemicals division focuses on a wide range of products, including agrochemicals, pharmaceuticals, polymers, dyes, and intermediates.

Atul's product portfolio is notable for its high-quality standards and advanced technology, which cater to various industries such as textiles, automotive, healthcare, and consumer goods.

Atul is an improvement-driven, integrated chemical company serving about 6,000 customers belonging to 27 industries across the world.

The company has established subsidiary companies in the USA, the UK, China, Brazil, and the UAE to serve its customers and thus enhance the breadth and depth of its business.

The company also manufactures pharmaceuticals, with a focus on APIs (active pharmaceutical ingredients) and intermediates and has a presence in over 100 countries worldwide.

Atul is all set to introduce Sindica, its novel and patented herbicide formulation designed for post-emergence use in sugarcane cultivation.

The innovative product combines 2, 4-D sodium, metribuzin, and chlorimuron ethyl to effectively combat major weeds that plague sugarcane fields.

Going forward, the company plans to expand its capacity.

For more details, see the Atul company fact sheet and quarterly results on our website.

#5 Balaji Amines

Next on the list is Balaji Amines.

Balaji Amines enjoys a dominant position in an oligopolistic industry. The company is a leading manufacturer of aliphatic amines and a leader in oligopolistic amines.

It is also the sole producer of certain speciality chemicals catering to the pharmaceuticals (51% of total revenues) and agrochemical sectors (26%) and others (23%), such as paints, oil and gas, etc.

The company is the only manufacturer of almost 60% of its products in India, giving it a clear monopoly status.

This leadership status across an array of speciality chemicals catering to India and other countries (15% of revenues in FY23) helps Balaji Amine diversify the business.

It has five manufacturing facilities with a capacity to produce 231,000 metric tonnes per annum of amines and their derivatives and 45,000 metric tonnes per annum (MTPA) of speciality chemicals.

It has a strong domestic and international presence, exporting its products to several countries, including the USA, UK, Latin America, Italy, Germany, Bangladesh, and Pakistan.

Some of its clients include Sun Pharmaceuticals, Jubilant Lifesciences, ZydusCadila, Dr. Reddy's, Aurobindo Pharma, Indian Oil, Hindustan Petroleum, Teva API, Hetero Drugs, Kores India Limited, and Venky's (VH Group).

The company operates advanced manufacturing facilities in Maharashtra and Karnataka, India.

Apart from amines and chemicals, it also operates a 5-star hotel in Solapur that has an occupancy rate of 47%.

The company's new plants and projects will be commissioned in FY25.

For more details, check out Balaji Amines company fact sheet and quarterly results.

#6 BASF India

Next on the list is BASF India.

BASF India Limited is a prominent player in the speciality chemicals sector, with a broad portfolio of products and solutions catering to various industries.

As a subsidiary of BASF SE, one of the world's largest chemical companies, BASF India leverages global expertise and innovation to serve the Indian market and beyond.

BASF India offers a wide array of speciality chemicals, including performance chemicals, coatings, construction chemicals, agricultural solutions, and advanced materials.

Their product offerings include solutions for industries such as automotive, construction, electronics, textiles, and personal care.

BASF India has a significant market presence, serving a diverse customer base across various sectors.

The company's global network and local expertise enable it to offer tailored solutions and support to its clients in India and neighbouring regions.

BASF India Limited will increase the production capacity of its Ultramid polyamide (PA) and Ultradur polybutylene terephthalate (PBT) compounding plant in Panoli, Gujarat and Thane, Maharashtra.

With the production capacity increase of over 40% in Panoli and Thane, BASF is well-positioned to meet the strong market demand for high-performance material solutions in India. The increased capacity will be available in the second half of 2025.

It can further harness the know-how, synergies and competencies within our existing global polyurethane network, to provide fast and advanced technical service to customers.

Further, the company recently launched Efficon, a new insecticide, in India to help farmers tackle sucking pests.

For more details, see the BASF India company fact sheet and quarterly results.

#7 Gujarat Fluorochemicals

Next on the list is Gujarat Fluorochemicals.

Gujarat Fluorochemicals Limited (GFL) is a major player in the speciality chemicals sector, particularly known for its expertise in fluorochemicals.

As a part of the INOX Group, GFL has established itself as a leader in the production of fluoropolymers, fluorospecialty chemicals, and refrigerants.

The company is a leading producer of a wide range of fluoropolymers, including PTFE (Polytetrafluoroethylene), FKM (Fluoroelastomer), and other high-performance materials.

The company manufactures various fluoro speciality chemicals that serve as intermediates in the production of pharmaceuticals, agrochemicals, and other speciality chemicals.

Gujarat Fluorochemicals arm GFCL EV Products plans to invest Rs 60 bn to increase the production capacity of electric vehicle battery materials in the next 4-5 years.

The company is poised to enter high-demand regions of the US, Europe, and India.

Going forward, the company is investing in research and development to develop new products and improve existing processes.

In the long term, the strong focus of the governments on green hydrogen and hydrogen fuel cells is expected to boost the demand for PTFE and other fluoro-polymers.

The market for fluoropolymers is projected to grow with increasing demand for oil and gas, water treatment, electric appliances, electronics, healthcare, and chemicals as drivers of growth.

For more details, see the Gujarat Fluorochemicals company fact sheet and quarterly results.

#8 Navin Fluorine

Next on the list is Navin Fluorine.

Navin Fluorine is engaged in producing refrigeration gases, inorganic fluorides, and speciality organofluorines, and also offers contract research and manufacturing services.

The company has been engaged in the speciality chemicals business for more than two decades.

This division produces niche fluorine-based molecules that have downstream applications in crop science, pharma key starting materials, and industrial chemicals.

The company's product portfolio includes fluorinated intermediates, fluoropolymer additives, and other complex fluorine-based compounds.

Its products find downstream applications in life science, crop science, petrochemicals, air conditioning, and stainless steel companies.

It owns three production facilities and is one of the largest producers of BF3 gas in the world and inorganic fluorides in India.

However, the company has secured a supply agreement for a patented agrochemical product targeting the Japanese market. This is expected to contribute an incremental annual revenue of approximately Rs 200-300 million (m) starting from 2025.

Additionally, Navin Fluorine is making progress on its project in Surat. Rs 300 m has been allocated to developing a completely new capability, set to be completed by Q2FY25.

The company has also added a new agro molecule at its Surat facility for a global major, which has an annual peak revenue potential of around Rs 400-500 m.

Furthermore, the agro speciality capex project at Dahej, involving an investment of Rs 5.4 bn, is on track to commence commercial production by September 2024.

For more details, see the Navin Fluorine company fact sheet and quarterly results.

#9 PI Industries

Next on the list is PI Industries.

PI Industries is known for its strong presence in agrochemicals and custom synthesis and manufacturing (CSM) services.

Established in 1947, the company has grown to become one of India's leading agrochemical companies with a robust portfolio of speciality chemical products and a significant global presence.

The company produces a range of speciality chemicals that find applications in various industries beyond agriculture, such as electronics, pharmaceuticals, and personal care.

PI Industries is widely recognised for its agrochemical products, including insecticides, herbicides, fungicides, and speciality plant nutrients.

These products are designed to enhance agricultural productivity and are used by farmers across India and other global markets.

The company is a leader in the CSM segment, offering contract research and manufacturing services to global chemical and pharmaceutical companies.

The company's expertise in complex chemistries allows it to develop and manufacture high-value speciality chemicals and intermediates tailored to specific customer requirements.

PI Industries operates state-of-the-art manufacturing facilities in Gujarat and Rajasthan, India.

PI operates in more than 30 countries worldwide and boasts an extensive distribution network comprising 10,000 active dealers/distributors and over 100,000 retailers nationwide.

In July 2024, PI Industries agreed to acquire UK-based Plant Health Care (PHC), a specialist in protein and peptide technology for agricultural applications, for £32 million.

Going forward, it plans on expanding global footprint to tap into new markets and reduce reliance on specific regions.

For more details, see the PI Industries company fact sheet and quarterly results.

#10 UPL

Next on the list is UPL.

UPL Limited (formerly United Phosphorus Limited) is a global leader in the speciality chemicals sector, particularly recognised for its strong presence in agrochemicals and crop protection products.

Founded in 1969, UPL has grown to become one of the largest agrochemical companies in the world.

It offers a broad range of products and solutions that enhance agricultural productivity and sustainability.

In addition to agrochemicals, UPL is involved in the production of speciality chemicals used in various industries, such as personal care, coatings, and polymers.

The company's speciality chemicals division focuses on developing innovative products that meet the specific needs of its industrial clients.

UPL operates numerous state-of-the-art manufacturing facilities across the globe, including in India, Europe, and Latin America. It has a significant global market presence, with operations in over 130 countries. This enables it to serve a diverse customer base efficiently.

In May 2024, UPL entered into a joint venture agreement with Aarti Industries for the manufacturing and marketing of speciality chemicals that have applications in multiple downstream industries.

UPL and Aarti Industries propose to initially invest Rs 125 m each, in equity share capital of Augene Chemical (proposed JV).

Subsequently, over about 24 months, it is proposed to invest Rs 1.4 bn each in one or more tranches in the form of equity capital/preference share capital/debt.

Further, UPL University of Sustainable Technology, a leading initiative by UPL group, has entered into a significant partnership with the Space Application Centre (SAC) of the Indian Space Research Organisation (ISRO) through a Memorandum of Understanding (MoU).

In addition to ISRO, UPL University has established MoUs with other national research organizations such as the Council of Scientific and Industrial Research (CSIR) and the Institute of Chemical Technology (ICT), Mumbai.

Going forward, UPL expects to return to a growth path in the ongoing financial year, with normalisation in margins driven by the ag chem market returning to normality.

For more details, see the UPL company fact sheet and quarterly results.

#11 Vinati Organics

Next on the list is Vinati Organics.

Established in 1989, Vinati Organics Limited (VOL) is a speciality chemical company, focusing on manufacturing speciality chemicals and organic intermediaries with a sustained market presence spanning over 35 countries.

The company has three state-of-the-art manufacturing facilities with an integrated B2B business model located in Maharashtra, India.

The company offers a wide range of products to some of the largest industrial & chemical companies across the US, Europe, and Asia.

It has a differentiated portfolio of speciality chemicals that find a range of applications across various industries, from pharmaceuticals, water treatment, flavours and fragrances to lithium-ion batteries, construction, agrochemicals, and plastics.

The following chart shows this different offerings of the company.

The company has a significant presence in the production of speciality aromatics, including Para Tertiary Butyl Phenol (PTBP) and other derivatives, which are used in the manufacture of resins, surfactants, and lubricating oil additives.

The company is vertically integrated, allowing it to control the entire value chain from raw material sourcing to the final product. This ensures consistent quality and supply reliability.

Vinati Organics has seen a demand recovery for Acrylamido Tertiary Butyl Sulfonic Acid (ATBS) this calendar year.

Going forward, the company is looking at 30-35% growth in the segment this year.

For more details, see the Vinati Organics company fact sheet and quarterly results.

#12 Rosaari Biotech

Next on the list is Rossari Biotech.

Rossari Biotech is an Indian chemical manufacturing company with a focus on speciality chemicals.

Founded in 2003 as Rossari Labtech, the company initially started as a partnership firm before being incorporated as Rossari Biotech in 2009.

Since then, it has grown into a key player in the speciality chemicals sector, offering a diverse range of products that cater to various industries.

Rossari Biotech is engaged in the production of speciality enzymes and chemicals that are integral to a wide array of sectors, including pharmaceuticals, paper, construction, textiles, nutrition, and animal health.

The company's ability to tailor its chemical solutions to meet the specific needs of these industries has made it a preferred partner for many leading brands both in India and internationally.

In a strategic move to expand its global footprint, the board of Rossari Biotech approved the incorporation of a wholly-owned subsidiary in Dubai, United Arab Emirates, during a meeting held on 6 April 2024.

This expansion into the Middle East is part of Rossari's broader strategy to tap into new markets and enhance its global presence.

Looking ahead, the company is forecasting a 10-12% increase in both revenues and EBITDA in FY25.

This growth is expected to be driven by the company's continued focus on innovation, expansion into new markets, and the strengthening of its product portfolio across its key business segments.

For more details, see the Rossari Biotech company fact sheet and quarterly results.

#13 SRF

Next on the list is SRF.

SRF manufactures and sells fluorochemicals and speciality chemicals such as refrigerants, pharma propellants, and industrial chemicals.

It has a wide product portfolio, with leadership in most of its products. The company's products are mainly used in agriculture and pharmaceutical industries.

Apart from chemicals, the company also manufactures packaging films, fabrics such as belting fabrics, tyre cord fabrics, polyester industrial yarn, and coated and laminated fabrics.

The company has manufacturing facilities across India. It also has a state-of-the-art R&D centre. So far, the company has over 132 patents on its name.

SRF supplies its products in domestic and international markets across 86 countries.

SRF's speciality chemicals are exported to over 75 countries, reflecting the company's strong global presence.

Going forward, SRF aims to invest Rs 150 bn over the next four years to ramp up its production capacities.

Out of this Rs 120 bn will be invested in the chemicals business, and the rest will be utilized for its packaging film and textile businesses.

Apart from this, the company is building a captive power plant to control its power costs and improve profitability.

SRF is also actively developing new products to expand its product portfolio.

For more details, see the SRF company fact sheet and quarterly results

#14 Himadri Speciality Chemical

Next on the list is Himadri Speciality Chemical.

Himadri Speciality Chemical is known for its expertise in carbon-based products.

The company is a key manufacturer of advanced carbon materials and chemicals that cater to various industries, including lithium-ion batteries, tyres, rubber, and speciality chemicals.

These products are critical in industries such as aluminium, graphite, and energy storage, where high-performance materials are essential.

The company also produces speciality oils and naphthalene, which are widely used in the rubber, plastic, and chemical industries.

Himadri Speciality Chemical has a significant global footprint, exporting its products to over 40 countries.

Recently, the board of Himadri Speciality Chemical approved the acquisition of a 40% stake in Invati Creations Private Limited for a consideration of Rs 451.6 m.

In December 2023, Himadri Specialty Chemicals announced that it will invest Rs 48 billion (bn) over the next 5-6 years to set up a manufacturing facility for lithium-ion battery components.

The company will set up a manufacturing facility for the production of lithium battery components with a total annual production capacity of 200,000 tonnes, either directly and/or through its subsidiaries.

This move is expected to help in the indigenisation of lithium-ion battery raw materials for global and India's EV & energy storage system (ESS).

For more details, see the Himadri Speciality Chemical company fact sheet and quarterly results.

#15 Fine Organic Industries

Next on the list is Fine Organic Industries.

Fine Organic Industries is known for its expertise in producing a wide range of oleochemical-based additives.

The company is a leading manufacturer of speciality additives that are used across various industries, including food, plastics, cosmetics, coatings, and rubber.

These additives include emulsifiers, anti-fogging agents, anti-static agents, and plasticizers, among others.

Fine Organic has a significant global presence, with exports to over 70 countries. The company's products are used by leading multinational companies, reflecting its strong position in the global speciality chemicals market.

Fine Organics is exploring opportunities to expand its global footprint, targeting key markets with high growth potential.

For more details, see the Fine Organic Industries company fact sheet and quarterly results.

#16 Galaxy Surfactants

Next on the list is Galaxy Surfactants.

Galaxy Surfactants is a leading manufacturer of surfactants and other speciality chemicals in India.

Surfactants are speciality chemicals used in household and personal care, industrial, and institutional cleaning products.

The company caters to the domestic (43% of sales) and international markets (57%).

Over the years, it has become a preferred supplier to leading MNCs (54% of revenues), regional (12%), and local FMCG brands (34%).

Going forward, the company wants to focus on increasing volume growth, improving operating profit, and stabilising demand and supply cycles.

The company is emphasising innovation, customer acquisition, and product mix for sustained growth.

Even though it has faced challenges due to geopolitical tensions impacting its supply chain, it's optimistic about future growth and its strategic plans for new products.

The company is confident of a strong recovery led by easing raw material prices, freight rates and recovery in developing markets and North America, a key market.

Home and personal care (HPC) manufacturers are taking action to address pricing concerns in North America.

This includes price reductions or adjustments, a move aimed at stimulating demand in the region. Early signs suggest a potential revival in the North American HPC market.

This price-focused strategy is also being implemented domestically. HPC manufacturers are implementing similar price reductions to encourage buying activity in the home market.

For more details, see the Galaxy Surfactants company fact sheet and quarterly results.

#17 Sudarshan Chemical Industries

Last on our list is Sudarshan Chemical Industries.

Sudarshan Chemical Industries is a leader in the production of colour pigments.

The company produces a wide variety of organic, inorganic, and effective pigments that are used to add colour and enhance the appearance of products in industries such as coatings, plastics, inks, and cosmetics.

The others segment comprises project engineering and manufacturing business of grinding solutions, clean air solutions, power handling solutions, and others.

It offers a complete palette of colours for everyday use, durable colours, and special effects. Its coatings applications include decorative, industrial, and automotive paints.

Recently, LBB Specialties (LBBS), a leader in speciality chemicals and ingredient distribution in North America has partnered with Sudarshan Chemical Industries.

LBB Specialties will be Sudarshan's exclusive channel partner in the United States and Canada for its effect pigment, filler, oxide and lake lines specifically designed for colour cosmetics, personal care and home care.

The company plans to expand its product portfolio to cater to a wider range of industries and applications.

For more details, see the Sudarshan Chemical Company fact sheet and quarterly results.

Conclusion

Going forward, India's speciality chemicals industry is projected to grow at a CAGR of 12% from 2020 to 2025.

This is expected to be driven by a combination of factors including increased demand in domestic and international markets, advancements in chemical technology, and a strategic shift towards high-value chemicals.

Amid rising geopolitical tensions and stringent safety regulations imposed by the Chinese government, the global supply chain for raw materials in the chemical sector has faced disruptions.

This has led to an increase in demand from Indian companies, compelling the industry to look beyond China for sourcing these crucial inputs.

In recent years, there has been a significant improvement in R&D capabilities and process engineering know-how. This evolution places India at the forefront of innovation in the speciality chemicals sector.

This is further set to bolster Indian manufacturer's position in the global market.

Nevertheless, it is always prudent to conduct thorough research before making any investment decisions.

Ensure that the investment aligns with your financial objectives and matches your risk tolerance level.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Out Now

3 High Conviction Stocks

Chosen by Rahul Shah, Tanushree Banerjee and Richa Agarwal

Report Available

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Equitymaster requests your view! Post a comment on "Which Company Manufactures Speciality Chemicals in India?". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!