India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Views On News

- Aug 1, 2022 - Top 5 IT Companies in India by Revenue

Top 5 IT Companies in India by Revenue

"Mirror, Mirror on the wall, who had the hardest fall?

IT Sector, O Investor, fell the hardest of them all."

You tell this to IT sector investors, and they will blow their cool!

Because for investors in Indian IT companies, 2022 was not just a little disappointing, it was outright devastating. The sector that was rallying like there is no tomorrow post the March 2020 crash is now falling unstoppably.

Thankfully, it showed some signs of recovery in the week gone by.

However, if we consider the half year performance, the Nifty IT index fell by over 39% in the first six months of 2022. Resultantly, fundamentally strong stocks in the IT sector also fell.

The stocks which seemed like they would be the multibagger stock for the next 10 years also started falling.

However, on Thursday and Friday this week, Indian IT stocks rallied, following the rally of the Tech-heavy Nasdaq.

Just like Indian benchmark indices follow the movements of SGX Nifty, Indian IT stocks follow the movements of tech heavy Nasdaq.

This begs the question, are IT stocks bottoming out?

Well, it seems so. In this scenario, it becomes important to know which IT companies earned the most in 2022.

Read on to find out about the IT companies in India which have the highest revenues.

Top 5 Indian IT Companies by Revenue

#1 Tata Consultancy Services

No surprises here. You guessed this Tata group company when you opened this article.

Explore. Understand. Invest and Conquer.

This has been Tata Group's modus operandi, and it has been successful in all fields. Tata Consultancy Services (TCS) is no exception to it.

TCS' full services portfolio combines traditional IT and remote infrastructure services with knowledge-based services such as consulting and business process outsourcing.

TCS is the second largest Indian company by market capitalisation (Reliance being the first) and is among the most valuable IT service brands worldwide.

TCS' total revenue in 2022 was Rs 1,957.8 bn, higher by 17% on a YoY basis.

In the past 5 years, sales have grown by over 10%. Net profit in the same period grew by 8%.

Financial Snapshot of the Company

| Particulars (Rs in m) | FY18 | FY19 | FY20 | FY21 | FY22 |

| Total Income | 12,67,460 | 15,07,740 | 16,15,410 | 16,73,110 | 19,57,810 |

| Growth (%) | 4% | 19% | 7% | 4% | 17% |

| Net profit | 2,58,800 | 3,15,620 | 3,24,470 | 3,25,620 | 3,84,490 |

| Net profit margin (%) | 20% | 21% | 20% | 19% | 20% |

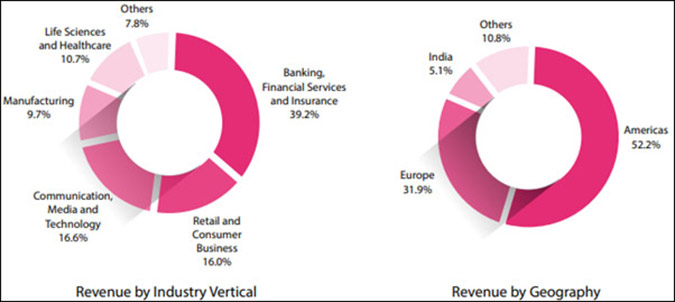

For 2022, the highest earning revenue segment of TCS was banking, financial services, and insurance. It earned 39.2% of the total revenue.

The next in line was the communication, media, and technology segment. It earned 16.6% of total revenue.

TCS Segmental Performance

Have a look at the chart below to see how the company's stock has performed on the bourses in the past five years.

To know more about TCS, check its factsheet and quarterly results.

#2 Infosys

Once led by the legendary Narayan Murthy, Infosys has remained investors' favourite stock for a long time.

And why not. After all, it is among the fastest growing companies in India and people often look for traits which Infosys has when they search for the best multibaggers stocks.

Infosys provides business consulting, information technology, and outsourcing services. The company was founded in Pune and is headquartered in Bangalore.

Infosys is the second-largest Indian IT company after Tata Consultancy Services by 2022 revenue figures.

Infosys' total revenue in 2022 was Rs 1,239.4 bn, higher by 20% on a YoY basis.

In the past 5 years, sales have grown by over 11%. Net profit in the same period grew by 9%.

Financial Snapshot of the Company

| Particulars (Rs in m) | FY18 | FY19 | FY20 | FY21 | FY22 |

| Total Income | 7,38,330 | 8,55,570 | 9,41,050 | 10,30,190 | 12,39,360 |

| Growth (%) | 3% | 16% | 10% | 9% | 20% |

| Net profit | 1,61,000 | 1,54,100 | 1,66,390 | 1,94,230 | 2,21,460 |

| Net profit margin (%) | 22% | 18% | 18% | 19% | 18% |

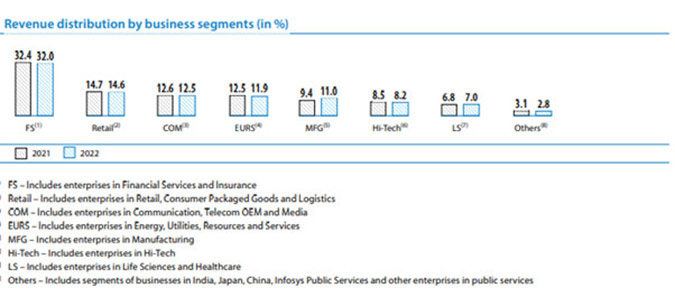

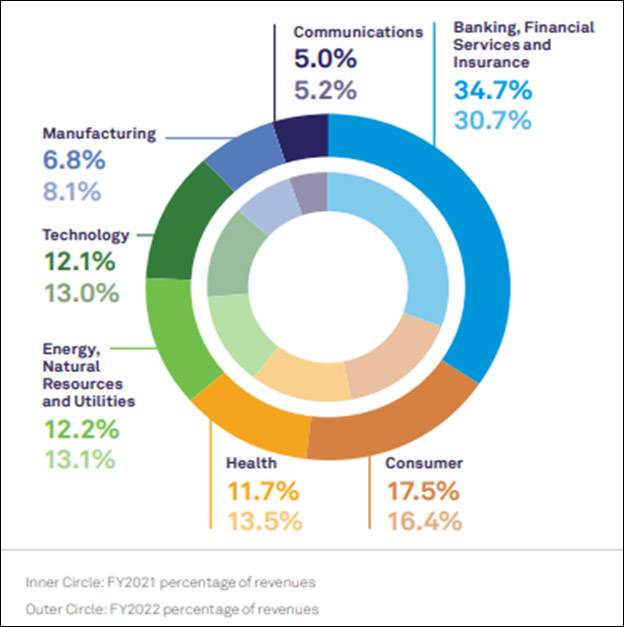

For 2022, the highest earning revenue segment of Infosys was financial services. It earned 32% of the total revenue.

The next in line was the retail segment. It earned 14.6% of total revenue.

Have a look at the chart below to see how the company's stock has performed on the bourses in the past five years.

To know more about Infosys, check its factsheet and quarterly results.

#3 HCL Technologies

HCL Technologies (Hindustan Computers Limited) is an Indian multinational information technology (IT) services and consulting company headquartered in Noida.

It is a subsidiary of HCL Enterprise. Originally an R&D division of HCL, it emerged as an independent company in 1991 when HCL entered into the software services business.

The company has offices in 50 countries and over 187,000 employees.

HCL Technologies' total revenue in 2022 was Rs 867.2 bn, higher by 14% on a YoY basis.

In the past 5 years, sales have grown by over 12%. Net profit in the same period grew by 9%.

Financial Snapshot of the Company

| Particulars (Rs in m) | FY18 | FY19 | FY20 | FY21 | FY22 |

| Total Income | 5,17,930 | 6,13,800 | 7,12,950 | 7,63,290 | 8,67,220 |

| Growth | 6% | 19% | 16% | 7% | 14% |

| Net profit | 87,090 | 1,01,200 | 1,10,570 | 1,11,690 | 1,35,240 |

| Net profit margin | 17% | 16% | 16% | 15% | 16% |

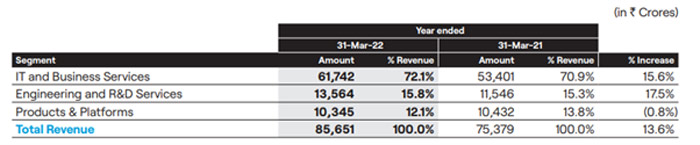

For 2022, the highest earning revenue segment of HCL Technologies was IT and business services. It earned 72.1% of the total revenue.

The next in line was the engineering and R&D services segment. It earned 15.8% of total revenue.

The remaining 12.1% of revenue comes from the products and platforms segment.

Have a look at the chart below to see how the company's stock has performed on the bourses in the past five years.

To know more about HCL Technologies, check its factsheet and quarterly results.

#4 Wipro

Founded by Azim Premji in 1945, Wipro is today one of the leading IT companies in India. It is headquartered in Bangalore, Karnataka, India.

Wipro's capabilities range across cloud computing, cyber security, digital transformation, artificial intelligence, robotics, data analytics, and other technology consulting services to customers in 67 countries.

Wipro's total revenue in 2022 was Rs 814.5 bn, higher by 26% on a YoY basis.

In the past 5 years, sales have grown by over 17%. Net profit in the same period grew by 8%.

Financial Snapshot of the Company

| Particulars (Rs in m) | FY18 | FY19 | FY20 | FY21 | FY22 |

| Total Income | 5,70,465 | 6,16,327 | 6,38,626 | 6,44,725 | 8,14,529 |

| Growth | -2% | 8% | 4% | 1% | 26% |

| Net profit | 80,020 | 90,222 | 97,689 | 1,08,550 | 1,22,377 |

| Net profit margin | 14% | 15% | 15% | 17% | 15% |

Out of Wipro's total revenue, IT segment contributed to 3.4% of revenue.

Have a look at the chart below to see how the company's stock has performed on the bourses in the past five years.

To know more about Wipro, check its factsheet and quarterly results.

#5 Tech Mahindra

Tech Mahindra is an Indian multinational information technology services and consulting company. The company is headquartered in Pune and has its registered office in Mumbai.

Tech has over 145,000 employees across 90 countries. The company was ranked #5 in India's IT firms and overall #47 on Fortune India 500 list for 2019.

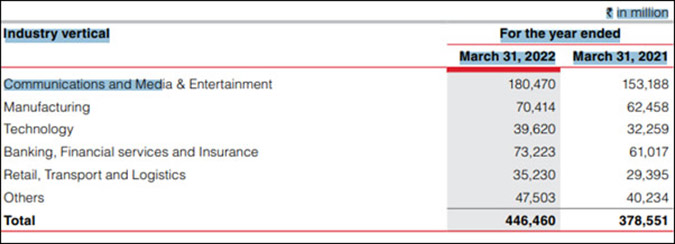

Tech Mahindra's total revenue in 2022 was Rs 457.9 bn, higher by 18% on a YoY basis.

In the past 5 years, sales have grown by over 9%. Net profit in the same period grew by 15%.

Financial Snapshot of the Company

| Particulars (Rs in m) | FY18 | FY19 | FY20 | FY21 | FY22 |

| Total Income | 3,22,165 | 3,52,763 | 3,80,601 | 3,86,422 | 4,57,880 |

| Growth | 7% | 9% | 8% | 2% | 18% |

| Net profit | 37,861 | 43,543 | 39,029 | 43,518 | 56,273 |

| Net profit margin | 12% | 12% | 10% | 11% | 12% |

For 2022, the highest earning revenue segment of Tech Mahindra was communications. It earned 40.4% of the total revenue.

The next in line was baking, financial services and Insurance segment. It earned 16.4% of total revenue.

Have a look at the chart below to see how the company's stock has performed on the bourses in the past five years.

To know more about Tech Mahindra, check its factsheet and quarterly results.

The trees that will stand tall, possibly forever...

A giant old fruit-bearing tree with deep roots will stand tall against all kinds of weather. During difficult times it may shed leaves and even lose fruits, but it will never fall.

The top 5 IT companies in India are exactly like this tree. 2020 and 2021 - the pandemic years robbed many companies of their wealth but these companies have stood firm.

Wipro faced an initial shakedown in 2020 but it recovered in 2022 the company is back to its pre-covid-19 performance.

Hence, these companies may have given tasteless fruits for the 2022 season but overall they might still make it to investors' portfolios because of their deep pockets and long-standing goodwill.

These 5 IT companies are blue-chip companies hence they generate steady returns over time.

Hence, an investor should carefully analyse the investment time horizon before he makes any decision.

Happy Investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Equitymaster requests your view! Post a comment on "Top 5 IT Companies in India by Revenue". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!