Our Big Prediction

This Could be One of the Exciting Opportunities for Investors

- Home

- Views On News

- Jul 29, 2024 - Best IT Stock: Wipro vs Tech Mahindra

Best IT Stock: Wipro vs Tech Mahindra

Wipro logo source: https://www.wipro.com/

Wipro logo source: https://www.wipro.com/ Tech Mahindra logo source: https://www.techmahindra.com/

The Indian information technology (IT) services industry has emerged as a global leader in software services, IT consulting, and business process management.

Thanks to India's large pool of high skilled, cost effective IT professionals, the industry is experiencing a period of robust growth and transformation.

All Indian IT firms are at the forefront of helping businesses undergo digital transformation. They're focused on emerging technologies such as Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) to remain competitive.

With the entire world undergoing a global digital transformation wave, the Indian IT industry is well-positioned to capitalise on this growth.

While the top players such as TCS and Infosys are getting their share in the market, other companies such as Wipro and Tech Mahindra are also taking steps to remain competitive.

Let's compare Wipro and Tech Mahindra to see who has a better chance to rise to the top.

Business Overview

# Wipro

Wipro is the fourth largest software company in India after TCS, Infosys, and HCL Tech.

The company's IT services are organised into two segments, (i) consulting and data engineering, and (Ii) cloud, digital operations, and cyber security.

It also offers IT products to complement its IT services business to all major industries, including government, defence, manufacturing, and telecom.

# Tech Mahindra

Tech Mahindra is an IT services company offering a wide range of services, including infrastructure, cloud, engineering, application, data analytics, and network and testing services.

The company has a client base spread across various industries, including communications, manufacturing, banking, finance, insurance, technology, and media and entertainment.

| Particulars | Wipro | Tech Mahindra |

|---|---|---|

| Market Cap (in Rs billion)* | 2,650.8 | 1,496.6 |

If we compare the two companies in terms of marketcap, then Wipro's marketcap is almost twice that of Tech Mahindra at Rs 2,650.8 billion (bn). Tech Mahindra's marketcap is at Rs 1,496.6 bn.

Wipro is also leading in terms of employee count. At the end of financial year 2024, the headcount of Wipro is around Rs 234,000, across 167 countries, whereas Tech Mahindra's headcount is over 150,000 across 90+ countries.

However, with respect to attrition, Wipro has a higher attrition rate of 14.2% than Tech Mahindra which has an attrition rate of 10%.

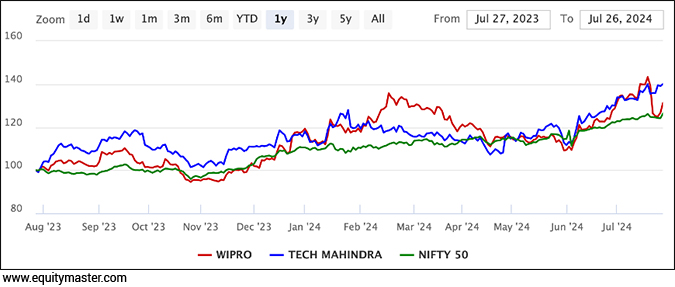

If we compare the two companies with respect to their performance on the stock market, then Tech Mahindra's shares have soared by 40%, whereas Wipro's shares zoomed by 31%.

Clearly, Tech Mahindra's shares have outperformed Wipro's shares.

However, if we compare them to Nifty 50 which gave a return of 26%, then both the companies have outperformed the market index.

# Revenue

In terms of revenue, Wipro is leading Tech Mahindra.

In the last five years, Wipro's revenue has grown at a compound annual growth rate (CAGR) of 8% on account of healthy demand for cloud and digital transformation services. This also supported the healthy order pipeline providing revenue visibility for the medium term.

Tech Mahindra's revenue has grown at a CAGR of 7.1% on account of new deal wins. The revenue growth was also supported by the company's diversification across business verticals, and wide geographical presence.

Revenue

| Net Sales (in Rs m) | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | Mar-2024 | 5-Year CAGR |

|---|---|---|---|---|---|---|

| Wipro | 611,376 | 619,349 | 793,120 | 904,876 | 897,603 | 8.0% |

| Tech Mahindra | 368,677 | 378,551 | 446,460 | 532,902 | 519,955 | 7.1% |

# Profitability

To understand how profitable the company is, we must look at the earnings before interest tax depreciation and amortisation (EBITDA) and net profit growth and margins.

The EBITDA for Wipro has grown at a CAGR of 5.2%, and the net profit grew by a CAGR of 2.6% on account of cost optimisation initiatives taken by the company.

However the profit margins witnessed a contraction on account of wage cost inflation. Nevertheless, the five-year average EBITDA margin and PAT margin stood at 23.7% and 14.7%, respectively.

Tech Mahindra, on the other hand, witnessed negative growth of 4.1% and 9.3% in EBITDA and PAT in the last five years, primarily due to a high increase in employee costs.

The EBITDA margin also contracted from 18.2% to 10.4%, and the PAT margin contracted from 10.6% to 4.6% during the same period.

Nevertheless, with attrition reducing, the profit margins are expected to stabilise in the medium term.

Profitability

| EBITDA (in Rs m) | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | Mar-2024 | 5-Year CAGR |

|---|---|---|---|---|---|---|

| Wipro | 150,673 | 171,621 | 187,454 | 191,193 | 194,066 | 5.2% |

| Tech Mahindra | 67,010 | 75,834 | 91,323 | 87,568 | 54,232 | -4.1% |

| PAT (in Rs m) | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | Mar-2024 | 5-Year CAGR |

| Wipro | 97,718 | 108,680 | 122,434 | 113,665 | 111,121 | 2.6% |

| Tech Mahindra | 38,974 | 43,530 | 56,301 | 48,570 | 23,968 | -9.3% |

| Gross Profit Margin | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | Mar-2024 | |

| Wipro | 25% | 28% | 24% | 21% | 22% | |

| Tech Mahindra | 18.2% | 20.0% | 20.5% | 16.4% | 10.4% | |

| Net Profit Margin | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | Mar-2024 | |

| Wipro | 16.0% | 17.5% | 15.4% | 12.6% | 12.4% | |

| Tech Mahindra | 10.6% | 11.5% | 12.6% | 9.1% | 4.6% |

# Debt Management

Both Wipro and Tech Mahindra are debt-free companies.

Being IT companies, both companies have high profits and, hence, healthy cashflows.

Wipro has acquired around 26 companies across different product and service categories, helping it expand.

Recently, it acquired Capital Markets Company for Rs 112 bn, and Aggne Global Rs 5 bn and despite this has maintained a debt-free status. This shows the company's ability to generate cash from its business.

Tech Mahindra is also a debt-free company and has grown through acquisitions in the past.

It continues to use the same strategy and has acquired over 24 companies in the last five years.

Even after this, the company is debt-free. Moreover, it is heavily investing in AI and other emerging next-generation technologies to remain competitive in the industry.

# Financial Efficiency

Two ratios that help measure financial efficiency are return on equity (RoE) and return on capital employed (RoCE).

RoE measures the return a company generates for equity investors, whereas RoCE measures the return a company generates on the capital. A high ratio is considered better.

The RoCE and RoE of Wipro averaged 22.1% and 17.2% respectively, whereas for Tech Mahindra they averaged 23.2% and 16.8% respectively.

Both companies are almost equal with respect to return ratios.

Financial Efficiency

| ROCE | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | Mar-2024 |

|---|---|---|---|---|---|

| Wipro | 23.3% | 26.0% | 22.2% | 19.0% | 19.9% |

| Tech Mahindra | 24.3% | 24.9% | 28.6% | 24.5% | 13.7% |

| ROE | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | Mar-2024 |

| Wipro | 17.7% | 19.9% | 18.9% | 14.7% | 15.0% |

| Tech Mahindra | 18.2% | 17.8% | 21.3% | 17.6% | 9.1% |

# Dividend

A company pays dividends from the profits. If a company is paying consistent dividends, it is considered more stable than other companies.

In terms of dividends, Tech Mahindra has been paying consistently high dividends to its shareholders. The company's dividend per share grew by a CAGR of 22% in the last five years.

Its dividend payout and dividend yield averaged 86.4% and 3.6%, respectively, during the same period.

Wipro, on the other hand, has maintained its dividend per share at Re 1 and the dividend yield at 0.4%. The dividend payout, however, averaged at 9%.

Clearly, Tech Mahindra is superior with respect to dividends compared to Wipro. However, Wipro has announced several buybacks over the last few years returning excess cashflows back to the shareholders.

In the last eight years, the company has completed five successful buybacks, whereas Tech Mahindra has announced only one buyback during the same period.

Dividend

| Dividend Per Share (Rs) | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | Mar-2024 | 5-Year CAGR |

|---|---|---|---|---|---|---|

| Wipro | 1.1 | 1.1 | 6.3 | 1.1 | 1.0 | -1.7% |

| Tech Mahindra | 13.4 | 40.2 | 40.4 | 45.0 | 36.1 | 22.0% |

| Dividend Yield | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | Mar-2024 | |

| Wipro | 0.5% | 0.2% | 1.0% | 0.3% | 0.2% | |

| Tech Mahindra | 2.7% | 4.5% | 3.0% | 4.5% | 3.2% | |

| Dividend Payout Ratio | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | Mar-2024 | |

| Wipro | 5.8% | 5.0% | 26.9% | 4.8% | 4.7% | |

| Tech Mahindra | 33.5% | 90.3% | 70.1% | 90.6% | 147.3% |

# Valuation

Valuation ratios help in estimating the actual worth of the company. Two valuation ratios that are widely used are price-to-earnings (P/E) and price-to-book value (P/B).

Both help in assessing whether a company is overvalued or undervalued.

The PE and PB ratio of Wipro is 23.5x and 3.4x, respectively, whereas Tech Mahindra's ratios stand at 62.7x and 5.7x, respectively.

Clearly, Tech Mahindra's shares are overvalued when compared to Wipro.

However, if we compare the two companies with their three-year averages, then both companies are overvalued.

| Valuations | Wipro | 3-Year Average | Tech Mahindra | 3-Year Average |

|---|---|---|---|---|

| PE (x) | 23.5 | 20.1 | 62.7 | 35.6 |

| PB (x) | 3.4 | 3.1 | 5.7 | 4.5 |

Which IT Stock is Better: Wipro or Tech Mahindra?

In terms of revenue growth, profit growth, profit margins, and valuation, Wipro clearly leads against Tech Mahindra.

However, Tech Mahindra has the upper hand in terms of dividend payments.

Being part of the Mahindra Group, Tech Mahindra has outlined clear focus areas for accelerating growth and driving innovation.

It is heavily investing in AI and automation to improve efficiency and generate new revenue streams.

The company is also expanding its footprint in key industries like banking, financial services, insurance, and healthcare.

Apart from this, it is investing in upskilling its talent, and is entering into strategic partnerships with technology partners to strengthen its capabilities.

Wipro, on the other hand, is one of the largest IT companies, and it has charted its plan for the future.

It is heavily investing in digital transformation initiatives and is leveraging cloud computing, artificial intelligence, and data analytics to offer creative solutions for its clients.

The company is expanding its cloud services portfolio to meet the growing demand for cloud-based services.

It is also exploring the potential of AI to drive growth and efficiency in its business. With the growth of cyber threats, the company is also focusing on strengthening its cyber security solutions.

To stay ahead of the curve, Wipro has also acquired several companies, entered partnerships with technology providers, and is establishing innovation hubs to foster creativity and develop new products.

With the growing adoption of digital transformation, the shift towards cloud computing, and the increasing usage of AI and ML, the demand for IT services is expected to be high.

Both companies are well prepared to cater to this demand and benefit from it.

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Out Now

3 High Conviction Stocks

Chosen by Rahul Shah, Tanushree Banerjee and Richa Agarwal

Report Available

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Equitymaster requests your view! Post a comment on "Best IT Stock: Wipro vs Tech Mahindra". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!