India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Views On News

- Jul 27, 2021 - Semiconductors Are Big News. Here's What You Should Know...

Semiconductors Are Big News. Here's What You Should Know...

The global shortage of semiconductor chips has triggered concerns as companies around the world fail to meet rising demand for a wide range of essential as well as modern tech products.

The shortage has intensified over the past couple of months.

A recent analysis by Goldman Sachs suggested that at least 169 industries have been impacted by the global chip supply shortage.

So what are semiconductor chips and why are they so important?

What are semiconductors?

Semiconductors are components needed for manufacturing cars, televisions, refrigerators, washing machines, personal computers, laptops, mobiles, etc.

These components are made from silicon and fit into microcircuits that power various electronic goods and components.

Semiconductors play an important role in a variety of fields.

For example, operating air conditioners, improving automobile safety, laser treatment in cutting-edge medical care, the list is long.

What's behind the shortage and how long will it last?

When the pandemic struct worldwide in 2020, there was low demand for these goods. The situation is totally different now.

Demand for electronic goods and automobiles has boomed of late as people adjust to work from home life.

Companies are not able to deliver due to the chip shortage.

Carmakers like General Motors, Ford Motor, and Volkswagen among others, were forced to temporarily shut down production lines during the initial phase of pandemic. They anticipated a market slowdown.

Semiconductor chip manufacturers reassigned their spare production capacity to companies making smartphones, laptops and gaming devices, which were experiencing a surge in demand during the lockdown.

Now that electronic and car sales have bounced, companies are trying to ramp up production, but the chip factories are unable to respond quickly.

This situation is far from over. Experts are suggesting it will stretch to 2022.

Intel Corp is US's biggest chipmaker and its CEO Pat Gelsinger said they expects the shortage to last for another couple of years.

An overview of the semiconductor industry

The global semiconductor industry is dominated by the US, with 47% share. It's followed by Taiwan, South Korea, Japan, and Europe.

Globally, Taiwan's TSMC is the most dominant chip supplier.

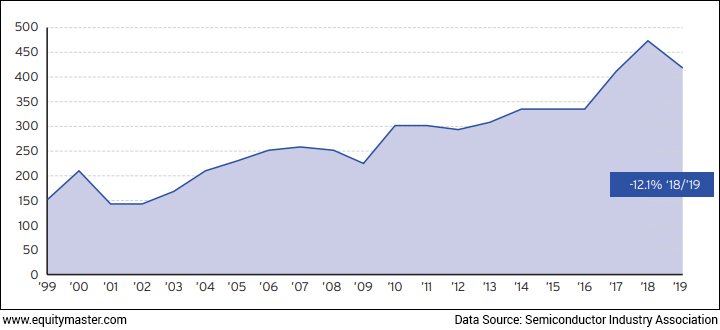

The US semiconductor industry has continued to maintain its strong position even though sales growth in 2019 was negative. It has maintained very high levels of investment in research and development (R&D) and capital expenditure.

In 2020, the global semiconductor industry reported a revenue growth of 6.5% to reach US$440 bn.

As per the 2021 Global Semiconductor Industry Outlook, the logic and memory chips segments were among the fastest growing with over 10% growth reported from each of these sub-categories in 2020.

In February 2019 the Semiconductor Industry Association (SIA) announced that in 2018, more than 1 tn chips were sold, a record.

Following record sales of US$468.8 bn in 2018, global sales in 2019 decreased 12% to US$412.3 bn, largely due to cyclicality in the memory market.

Global Semiconductor Sales (US$ bn)

A recent report by a leading financial daily states that semiconductors rank as the world's fourth most-traded product (imports and exports), after crude oil, refined oil, and cars.

Effect on automakers and other industries

Carmakers are the first to be hit by the shortage.

Almost every other auto company in India has excused itself for slightly lower volumes this quarter, attributing it to the global semiconductor chip shortage.

While announcing its results yesterday, Tata Motors said Jaguar Land Rover's (JLR) performance was much lower than expected as operations were affected by shortage of semiconductors.

Its wholesale volumes plunged 50% to just 84,400 units. It lost production volumes of around 30,000 units due to the chip shortage.

In May this year, Bosch had stated chip shortfalls would impact its production, as supply chains were getting disrupted. It saw the scarcity continuing until 2022.

Daimler and BMW said the lack of chips has forced it to shut down some of their assembly lines, which will cut the companies' output by tens of thousands of vehicles.

Consumer goods and smartphone manufacturers are also under pressure.

Apple reported last month that the shortage will incur a cost of US$3 bn to US$4 bn in its third financial quarter to June, with the biggest impact felt on Mac and iPad products.

Later, it was reported that deliveries of the new high-end iPad Pros were slipping to July on strong work-from-home demand as well as the component shortages.

Samsung India smartphone sales team has been informing retailers verbally that there could be up to 70% shortfall in supplies of handsets in July.

Supplies from brands like HP, Lenovo, Dell, Xiaomi, OnePlus, and Realme too are badly affected.

But there are few companies like Tesla who have been able to overcome the chip shortage problems.

In an earnings call yesterday Tesla CEO Elon Musk said the company is weathering the global chip shortage by rewriting its vehicle software to support alternative chips.

This approach has helped Tesla maintain high levels of production, delivering over 200,000 vehicles to customers over the last three months.

Efforts taken to alleviate the problem

The shortage is expected to at least last for another eighteen months. This raises the question - when will India have its own semiconductor plant?

Rajeev Khushu, chairman of the India Electronics and Semiconductor Association (IESA), believes the country should take the first step towards manufacturing semiconductors by setting up ATMPs (assembly, testing, marking, and packaging).

Under the 'Make in India' initiative, India is offering more than US$1 bn in cash to each semiconductor company that sets up manufacturing units in the country. The government has already received 20 expressions of interest (EoIs) for setting up plants.

Amitabh Kant, chief executive officer (CEO), NITI Aayog, said at a recent webinar that a lot of work is going on in the direction of getting a semiconductor ecosystem into the country. He also said they are in touch with TSMC (Taiwan Semiconductor Manufacturing Company).

TSMC is responsible for producing about 80% of microcontroller chips used in cars. TSMC, Intel and other companies are already investing huge amount in upgrading equipment and building new production lines to meet the demand.

TSMC recently unveiled the industry's largest-ever investment, allocating US$100 bn over the next three years to boost capacity.

Intel Corp pledged US$20 bn for two sites in Arizona and signaled that further investment commitments are to come this year.

South Korea's Samsung Electronics has earmarked US$116 bn in investment by 2030 to diversify chip production.

It must be noted that building a semiconductor ecosystem needs big investments and critical infrastructure to support it. The plants need a continuous supply of electricity and water.

A study showed that even a single manufacturing plant can use anything between two and nine gallons of water per day.

To conclude, the chip shortage seems to be far from over and the demand for chips is expected to rise.

In a recent editorial, Co-head of Research at Equitymaster, Tanushree Banerjee, shared some insights on this topic.

Here's an excerpt...

- Nevertheless, a few Indian companies are global leaders when it comes to chip design and research.

Thanks to the ready pool of talent in IITs and NITs, all major global semiconductor companies have their chip design houses in India.

Some estimates predict the Indian semiconductor design market will reach US$38 bn by the end of 2021.

Even as India gets less dependent on China for chip manufacturing, the chip designers are already tying up with companies in South Korea, Taiwan, and Vietnam.

Tanushree has identified a technology company in India, which is grossly underrated despite its dominant role in semiconductor chip designing.

The company has set up management teams in Taiwan, South Korea, and Vietnam in recent months seeing the growth potential of this business.

With its disruptive capabilities, Tanushree believes the company's future seems far more promising than its past.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "Semiconductors Are Big News. Here's What You Should Know...". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!