India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Views On News

- Jun 23, 2022 - Shrinkflation: The Inflation You're Not Supposed to See

Shrinkflation: The Inflation You're Not Supposed to See

The other morning my domestic help, Nanda, pointed out the new dish washing soap looks much smaller. My wife laughed it off saying that she is just imagining it...

But the truth is, Nanda is not wrong. It's the inflation you're not supposed to see, but if you take a close look, it's everywhere.

As inflation surges worldwide, biscuits, noodles and soap and other staples aren't getting more expensive. They're just getting smaller.

For Rs 20, you can buy a 200 ml can of Coca cola now. A few months ago, it was a 250 ml can.

A Rs 10 packet of Parle-G biscuits now weighs 110 grams against 140 grams earlier. Dove body wash has been reduced from 709 ml to 650 ml, with no change in price!

And Nanda was not wrong. A bar of Vim dish soap has shrunk from 155 grams to 135 grams!

Everything we are buying is getting expensive. We are just not noticing it. Welcome to the world of 'Shrinkflation'.

Shrinkflation: "Less" Bang for Your Buck

Question: What can a manufacturer do to increase their operating margin and profitability by reducing costs while maintaining sales volume?

Answer: Shrinkflation!

Shrinkflation is a form of inflation. It is the practice of reducing the size or quantity of a product while keeping the price of the product unchanged.

Is it legal? Well, yes because manufacturers always mention the weight and quantity on their labels.

All purchases are based on the principle of Caveat emptor, a Latin phrase that can be translated as, "Let the buyer beware".

It is up to the buyer to examine and judge the product.

Generally, consumers are observant of a price change. Any increase may put off a purchase or lead to consumers looking for a substitute.

So instead of increasing the price, which would be immediately evident customers, manufacturers reduce the size of the product and maintain the same price.

Consumers end up paying a higher price per unit but as there is no increase in price, it does not impact indexes such as the Consumer Price Index. This is why shrinkflation is also termed as hidden inflation.

First usage of the term shrinkflation has been attributed to British economist, Pippa Malmgren and American author, Brian Domitrovic.

Buy Why?

Shrinkflation isn't really new. It raises its head in times of high inflation as companies battle with rising costs. The Indian economy has been hit by inflationary shocks of late. Inflation projection for the year has increased to 6.7%.

The RBI's the monetary policy committee said inflation is likely to remain above the upper tolerance band of 6% through the first three quarters of FY23.

And it's not just happening in India. Globally, inflation is projected to increase to 6.7% in 2022, more than twice the average of 2.9% during the last decade.

As production costs rise, it could lead to an acceleration in shrinkflation worldwide as most companies lack strong pricing power.

Increases in the cost of raw materials, fuel, and high labour costs, all increase production costs. This diminishes operating margins and eventually reduce profits.

FMCG companies in particular are battling inflation in key commodities, where significant increases in prices have dented their margins.

High inflation and slowing demand have made it a challenge to pass on any increases in costs to consumers.

The Ukraine-Russia conflict has created a supply shortage of several key commodities.

Prices of vegetable oil, including palm oil and sunflower oil, which are key commodities for FMCG companies, are up almost 50% over the last 12 months.

Reducing the grammage while keeping prices constant can help manufacturers maintain or in some cases, improve their margins.

Some companies also resort to shrinkflation to maintain market share. In a competitive industry, increasing prices could lead customers to jump ship to another brand.

Introducing small reductions in the size of their goods on the other hand, should enable them to boost profits while keeping the prices competitive.

Shrinkflation in India at 'Magic Price Points'

In India, shrinkflation has mostly been done in rural areas, where people are poorer and more price sensitive. In cities, companies have some leeway to increase prices.

However, many companies, especially FMCG companies, have resorted to the time-tested method of shrinkflation in both rural and urban markets to mitigate the unprecedented input cost rise.

Several major FMCG companies such as Nestle, Dabur, Britannia, Hindustan Unilever, P&G, Coca-Cola, and PepsiCo have adopted this method in recent times.

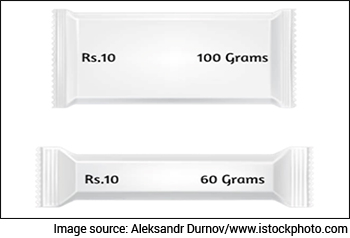

In India, companies rely on "Magic Price Points" such as ?1, ?5 or ?10. They target consumers who are reluctant to spend an extra rupee without having to cut back on something else.

The bulk of FMCG sales happens through single-use, small serve packs, from neighbourhood grocery stores.

Any move away from these price points can lead to a drop in sales volumes, which is why companies are wary of increasing prices.

Hence, size reduction typically happens in the lower unit packs, where price sensitivity is higher.

Companies find it easier to increase prices for products above Rs 20 per package but shrinkflation is the only choice in price ranges lower than that.

It is interesting to note that these small packages are the biggest drivers of sales volumes for FMCG companies.

It accounts for 30% of HUL's revenues. For Britannia, smaller packages make up close to 55% of its sales. Parle Products, which makes Parle-G biscuits, derives a massive 70% of its revenue from ?10 packs and below.

However, this is a balancing act because the reduction can't be huge. A company can get away with decreasing the weight of an item from 100 grams to 70 grams but can't slash it to 50 grams.

Companies like HUL are also trying different approaches such as "bridge packs" to give better value for consumers while ensuring affordability. At the same time, it gives scale to the company.

This has been done by bringing in newer packs where the cost of packaging is lower but the value to the consumer is higher.

A recent example of HUL implementing this bridge pack strategy is the introduction of a new size for its Lifebuoy soap between Rs 10 and Rs 35.

Hence, companies are trying different ways to overcome inflationary pressures while maintaining market share.

Shrinkflation: A Necessary Evil or Profiteering?

There is no doubt that many companies are struggling with labour shortages and higher raw material costs.

But no matter how you look at it, shrinkflation does seem like a sneaky way to conduct business.

And it makes one wonder if some of these companies are using supply constraints as a weapon to make more profits.

Let's take a look at the performance of five leading FMCG companies over the last 12 months.

Revenue

| Company | Mar-22 | Dec-21 | Sep-21 | Jun-21 | % Change |

|---|---|---|---|---|---|

| Hindustan Unilever Ltd | 13,462.00 | 13,092.00 | 12,724.00 | 11,915.00 | 12.98% |

| Dabur India Ltd | 1,852.34 | 2,224.43 | 2,119.89 | 1,982.84 | -6.58% |

| Nestle India Ltd | 3,980.70 | 3,739.32 | 3,882.57 | 3,476.70 | 14.50% |

| Britannia Industries Ltd | 3,336.45 | 3,373.70 | 3,425.30 | 3,236.17 | 3.10% |

| Marico Ltd | 1,686.00 | 1,855.00 | 1,916.00 | 2,043.00 | -17.47% |

Profit Before Depreciation & Tax

| Company | Mar-22 | Dec-21 | Sep-21 | Jun-21 | % Change |

|---|---|---|---|---|---|

| Hindustan Unilever Ltd | 3,389.00 | 3,279.00 | 3,219.00 | 2,877.00 | 17.80% |

| Dabur India Ltd | 414.97 | 561.47 | 574.05 | 506.21 | -18.02% |

| Nestle India Ltd | 910.52 | 612.93 | 929.77 | 825.78 | 10.26% |

| Britannia Industries Ltd | 594.04 | 531.21 | 545.67 | 644.21 | -7.79% |

| Marico Ltd | 365.00 | 365.00 | 416.00 | 364.00 | 0.27% |

Operating Margins (%)

| Company | Mar-22 | Dec-21 | Sep-21 | Jun-21 | % Change |

|---|---|---|---|---|---|

| Hindustan Unilever Ltd | 25.44 | 25.24 | 25.5 | 24.24 | 4.95% |

| Dabur India Ltd | 22.76 | 25.52 | 27.24 | 25.65 | -11.27% |

| Nestle India Ltd | 23.77 | 17.56 | 25.28 | 25.24 | -5.82% |

| Britannia Industries Ltd | 18.73 | 16.77 | 16.99 | 20.88 | -10.30% |

| Marico Ltd | 22.12 | 20.11 | 22.13 | 18.11 | 22.14% |

These companies have been under a lot of pricing pressure. The operating margins are shrinking for three of the five companies.

HUL, the largest FMCG company in India, as well as Nestle, have been able to increase revenues and profits but the other companies have performed dismally.

Dabur India and Britannia Industries have been struggling to pass on higher input costs to its customers. Their operating environment remains challenging with inflation causing a sharp drop in consumption across their product portfolio.

Nestle leads the pack in terms of revenue growth at 14.50% YoY. HUL has the highest growth in PBT at 17.8%.Interestingly, Nestle's Maggi noodles has been an exception to the rule of shrinkflation. The price of a single packet has increased from Rs 10 to Rs 12, while the size decreased from 100 grams to 70 grams.

These leading players enjoy economies of scale and larger portfolios to tweak around with to retain customers.

On the other hand, smaller companies do not have such a luxury in managing costs. Their performance is negatively impacted especially in rural areas.

Conclusion

Companies are expected to continue opting for 'shrinkflation'. This is because unprecedented inflation poses a significant challenges in the near term.

But some experts caution that there must be a limit or a maximum ceiling to the use of shrinkflation else it may lead to loss of market share as consumer sentiment could deteriorate towards the brand.

Instead companies could think of this as a cycle in which there will be short-term pain.

Once inflation has subdued and supply chains are back to normal, volumes should return and bring pricing power back to the companies which are able to maintain good market share.It is possible the trend can reverse as inflation eases. This could force manufacturers to lower prices or reintroduce larger packages to take on competition. However, upsizing is rare. Once a product has shrunk, it usually stays that way.

In the meantime, how do you spot shrinkflation?

As a consumer, an easy way to notice shrinkflation is by spotting a redesign on the packaging or a new slogan.

Companies deflect attention from product shrinkage with "less is more" messaging.

This results in the customer being led to believe the product is very useful to them and is good in terms of health benefits.

Another trick used to lure customers is by creating packaging that is much larger than it should be!

A good example of this is a bag of your favourite chips. Almost all chips manufacturers create large packages which have a small number of chips. The rest is just filled up with air in the name of "preserving freshness" of the product.

And it's not just restricted to groceries and packaged foods. Even restaurants have been saving on rising costs by reducing the size of the meal they serve to consumers without cutting prices.

For now, continue to pay more and get less. Shrinkflation is all around us.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yazad Pavri

Cool Dad, Biker Boy, Terrible Dancer, Financial writer

I am a Batman fan who also does some financial writing in that order. Traded in my first stock in my pre-teen years, got an IIM tag if that matters, spent 15 years running my own NBFC and now here I am... Writing is my passion. Also, other than writing, I'm completely unemployable!

Equitymaster requests your view! Post a comment on "Shrinkflation: The Inflation You're Not Supposed to See". Click here!

1 Responses to "Shrinkflation: The Inflation You're Not Supposed to See"

salim tabbani

Oct 31, 2022you are rightn. customer are cheated by the co policy. nogne knows of reducing weight.