India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Views On News

- May 4, 2024 - Best Chemical Stock: Deepak Nitrite vs SRF

Best Chemical Stock: Deepak Nitrite vs SRF

India is a preferred chemical manufacturer due to pre-existing adherence to quality and waste management standards.

On top of that, the sector enjoys huge long-term benefits in the form of China plus one megatrend.

In addition to that, government initiatives such as the Product Linked Incentive (PLI) scheme are also pushing chemical manufacturing within the country.

It's safe to say that all chemical manufacturing companies are set to benefit from this growth in the coming years.

However, our research suggests that two companies from the entire chemical space can benefit the most given their role in diverse industries and various use cases.

These chemical stocks are none other than SRF and Deepak Nitrite. In today's article, we'll compare them to examine which one is better.

Business Overview

# Deepak Nitrite

Deepak Nitrite is engaged in manufacturing chemical intermediaries, fine and speciality chemicals, products, and phenolics.

It has a wide product portfolio of over 100 products, with leadership in the majority of its products.

The company's products have several use cases, such as in colourants, petrochemicals, rubbers, agrochemicals, pharmaceuticals, paints, adhesives, personal care, thinners, ply, laminates, and foundry.

It has one research and development (R&D) centre and six manufacturing facilities in India, where it manufactures all its products.

Deepak Nitrite mainly supplies the domestic market but also exports to Europe, the USA, Asia, and the Middle East.

It has a client base of over 1,000 customers, and some of them include Bayer Corp, Unilever, L'Oreal, Nirma, Reliance Industries, and Lubrizol.

# SRF

SRF manufactures and sells fluorochemicals and speciality chemicals such as refrigerants, pharma propellants, and industrial chemicals.

It has a wide product portfolio, with leadership in most of its products. The company's products are mainly used in agriculture and pharmaceutical industries.

Apart from chemicals, the company also manufactures packaging films, fabrics such as belting fabrics, tyre cord fabrics, polyester industrial yarn, and coated and laminated fabrics.

The company has manufacturing facilities across India through which it produces all its products. It also has a state-of-the-art R&D center through which it drives innovation. So far, the company has over 132 patents on its name.

SRF supplies its products in domestic and international markets across 86 countries.

| Particulars | Deepak Nitrate | SRF |

|---|---|---|

| Market Cap (in Rs billion)* | 331.9 | 783.2 |

| Market Share | 75% | NA |

If we compare the two companies with respect to marketcap, SRF has a higher marketcap of Rs 783.2 billion (bn) compared to Deepak Nitrite's Rs 331.9 bn.

In terms of market share, both companies are market leaders in their respective fields.

Deepak Nitrite has a 75% market share in sodium nitrite, and nitrotoluenes in India. It also has over 50% market share in phenol and acetone.

It's among the top three global players for xylidines, cumidines, and oximes.

SRF, on the other hand, is a market leader in the fluorochemicals business, with a dominant presence in fluorination chemistry and non-fluorinated chemistries.

It is also among the top five global manufacturers of key fluorochemical products, and one of the few global manufacturers of pharma grade 134a/P - propellant in metered dose inhalers.

Apart from this, it has a 40% market share in India's nylon tyre cord market and is the 5th largest player globally.

It is also the second-largest manufacturer of conveyor belting fabrics in the world.

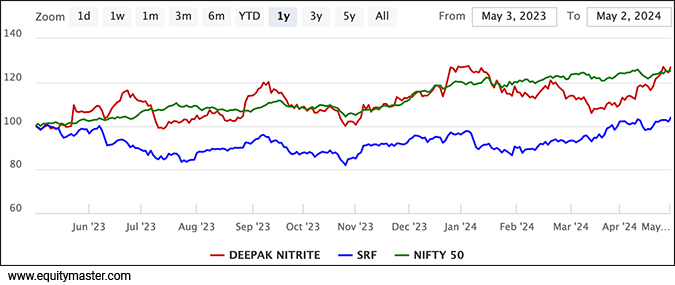

In terms of stock market performance, Deepak Nitrite outpaced SRF by giving close to 30% return. SRF, on the other hand, has given a 5% return in the last year.

Healthy revenue and profit growth in the last year have helped Deepak Nitrite deliver superior performance.

# Revenue

In terms of revenue growth, Deepak Nitrite outpaces SRF.

In the last five years, Deepak Nitrite's revenue has grown at a compound annual growth rate (CAGR) of 24.2%, whereas SRF's revenue has grown at a CAGR of 15.9%.

However, in terms of revenue numbers, SRF's revenue is almost 1.9x times higher than Deepak Nitrite.

The primary reason behind a very high revenue growth of Deepak Nitrite is volume growth. Healthy demand for chemicals across various industries has helped Deepak Nitrite to grow its revenue despite global destocking.

Moreover, the company has a diversified client base, with no customers accounting for more than 10% of its revenue. This, along with market leadership in several product categories, also supported revenue growth.

SRF, on the other hand, saw its revenue grow primarily due to volume growth led by new innovations. The company launched several products in a category that it already has market leadership.

Apart from this, a wide product portfolio and ramp-up in capacities also supported the revenue growth.

With demand for chemicals expected to remain high, the revenue of both companies are expected to grow in the medium term.

Revenue

| Net Sales (in Rs m) | Mar -2019 | Mar -2020 | Mar -2021 | Mar -2022 | Mar -2023 | 5-Year CAGR |

|---|---|---|---|---|---|---|

| Deepak Nitrate | 26,999 | 42,297 | 43,598 | 68,022 | 79,721 | 24.2% |

| SRF | 70,996 | 72,094 | 84,000 | 124,337 | 148,703 | 15.9% |

# Profitability

To analyse the profitability of a company, it is important to look at earnings before interest tax depreciation and amortization (EBITDA), net profit, gross profit and net profit margin.

In terms of EBITDA, Deepak Nitrite is leading with CAGR growth of 25.5%, followed by SRF with 22.2% CAGR growth in the last five years.

Even in terms of net profit growth, Deepak Nitrite outpaced SRF with a growth of 37.4%, and SRF's net profit grew by a CAGR of 29.6%.

Healthy revenue growth has helped Deepak Nitrite grow its profits at a healthy rate. However, the profit growth softened primarily due to volatility in raw material prices. Hence, margin expansion was minimal.

With respect to SRF, the chemical business primarily drives the profit and margins.

High growth in volumes has supported the profit growth. Moreover, since the company has a presence in the textile and packaging film business, the volatility in raw material prices hasn't affected the margins much.

Going forward, new product developments and its ramp-up in capacities could help SRF drive its profit.

Profitability

| EBITDA (in Rs m) | Mar -2019 | Mar -2020 | Mar -2021 | Mar -2022 | Mar -2023 | 5-Year CAGR |

|---|---|---|---|---|---|---|

| Deepak Nitrate | 4,141 | 10,285 | 12,446 | 15,948 | 12,913 | 25.5% |

| SRF | 12,970 | 14,549 | 21,333 | 31,032 | 35,292 | 22.2% |

| PAT (in Rs m) | Mar -2019 | Mar -2020 | Mar -2021 | Mar -2022 | Mar -2023 | 5-Year CAGR |

| Deepak Nitrate | 1,737 | 6,110 | 7,758 | 10,666 | 8,520 | 37.4% |

| SRF | 5,916 | 9,159 | 11,983 | 18,889 | 21,623 | 29.6% |

| Gross Profit Margin | Mar -2019 | Mar -2020 | Mar -2021 | Mar -2022 | Mar -2023 | |

| Deepak Nitrate | 15.3% | 24.3% | 28.5% | 23.4% | 16.2% | |

| SRF | 18.3% | 20.2% | 25.4% | 25.0% | 23.7% | |

| Net Profit Margin | Mar -2019 | Mar -2020 | Mar -2021 | Mar -2022 | Mar -2023 | |

| Deepak Nitrate | 6.4% | 14.4% | 17.8% | 15.7% | 10.7% | |

| SRF | 8.3% | 12.7% | 14.3% | 15.2% | 14.5% |

# Debt Management

Deepak Nitrite is a debt-free company as the company prepaid all its debt obligations in the financial year 2023.

The company was actively working on deleveraging its books since the last five years and has successfully managed to do so by financial year 2023.

During the last five years, it hasn't compromised on capex investments despite concentrating on repaying its debt.

Deepak Nitrite has acquired land parcels across India with a capital outlay of Rs 14.1 bn to set up manufacturing facilities to ramp up its capacities.

It has also committed to invest Rs 40 bn in new products based on environment-friendly technologies and brownfield expansion of existing products.

The company is also planning to add high-value solvents and has set aside Rs 70 bn for the same.

The company has sufficient cashflows to fund all its capex plans through internal accruals.

SRF, on the other hand, has a debt-to-equity ratio of 0.2x at the end of financial year 2023. The company recently announced a large capex plan of Rs 150 bn, which will be implemented between FY24 and FY28.

Out of the Rs 150 bn, Rs 120 bn will be invested in the chemicals business to ramp up the capacities and develop new products.

The remaining Rs 30 bn will be invested in the textiles and packaging film business to expand the manufacturing capacities.

With a new capex plan, the debt-to-equity ratio is expected to go up in the medium term. However, the company is generating enough cashflows to meet its financial obligations.

Debt Management

| Debt to Equity Ratio (x) | Mar -2019 | Mar -2020 | Mar -2021 | Mar -2022 | Mar -2023 |

|---|---|---|---|---|---|

| Deepak Nitrate | 0.80 | 0.50 | 0.20 | 0.10 | 0.00 |

| SRF | 0.50 | 0.50 | 0.30 | 0.20 | 0.20 |

# Financial Efficiency

The five-year average RoCE and RoE of Deepak Nitrite are 33.3% and 28.2%, respectively, whereas for SRF, the numbers are 20.2% and 18.7%, respectively.

Deepak Nitrite is again leading in terms of financial efficiency as it has a higher RoCE and RoE than SRF.

High-profit growth has helped the company improve its financial efficiency metrics.

However, SRF's return ratios haven't experienced a drastic drop in financial year 2023, unlike Deepak Nitrite, due to a diversified nature of revenue.

Financial Efficiency

| ROCE | Mar -2019 | Mar -2020 | Mar -2021 | Mar -2022 | Mar -2023 |

|---|---|---|---|---|---|

| Deepak Nitrate | 18.3% | 39.3% | 39.0% | 41.7% | 28.4% |

| SRF | 15.4% | 15.4% | 19.8% | 26.2% | 24.0% |

| ROE | Mar -2019 | Mar -2020 | Mar -2021 | Mar -2022 | Mar -2023 |

| Deepak Nitrate | 16.2% | 38.9% | 33.1% | 32.0% | 20.8% |

| SRF | 14.3% | 18.6% | 17.5% | 22.1% | 21.0% |

# Dividend

Deepak Nitrite's dividend per share has grown at a CAGR of 30.3% in the last five years, whereas SRF's dividend per share has grown at a CAGR of 25.3%.

The five-year average dividend yield and dividend payout for Deepak Nitrite is 0.6 and 11.3%, respectively, whereas for SRF, the numbers are 0.4% and 13.7%.

In terms of dividend payment, both companies are roughly on the same level.

Dividend

| Dividend Per Share (Rs) | Mar -2019 | Mar -2020 | Mar -2021 | Mar -2022 | Mar -2023 | 5-Year CAGR |

|---|---|---|---|---|---|---|

| Deepak Nitrate | 2.0 | 4.5 | 5.5 | 7.0 | 7.5 | 30.3% |

| SRF | 2.3 | 2.7 | 4.8 | 16.8 | 7.2 | 25.3% |

| Dividend Yield | Mar -2019 | Mar -2020 | Mar -2021 | Mar -2022 | Mar -2023 | |

| Deepak Nitrate | 0.8% | 1.1% | 0.5% | 0.3% | 0.4% | |

| SRF | 0.6% | 0.4% | 0.6% | 0.2% | 0.3% | |

| Dividend Payout Ratio | Mar -2019 | Mar -2020 | Mar -2021 | Mar -2022 | Mar -2023 | |

| Deepak Nitrate | 15.7% | 10.0% | 9.7% | 9.0% | 12.0% | |

| SRF | 11.7% | 8.8% | 11.9% | 26.3% | 9.9% |

# Valuations

The two important valuation ratios that are used widely price to earnings (P/E) ratio, and price to book value (P/B).

A high P/E or P/B ratio indicates the company is overvalued when compared to its peers, whereas a low ratio indicates it is undervalued.

Deepak Nitrite shares are trading at a P/E and P/B of 42x and 7.3x, whereas SRF is trading at a P/E and P/B of 53x and 7x respectively.

If we compare the valuations of both these companies with their five-year averages, both are overvalued.

These companies are overvalued even if we compare it with the industry averages.

| Valuations | Deepak Nitrate | 5-Year Average | SRF | 5-Year Average |

|---|---|---|---|---|

| P/E (x) | 42.0 | 21.7 | 53.0 | 41.8 |

| P/B (x) | 7.3 | 5.8 | 7.0 | 8.5 |

Which Chemical Stock is Better: Deepak Nitrite or SRF?

In terms of revenue growth, profit growth, debt management, and financial efficiency, Deepak Nitrite is ahead of SRF.

SRF, on the other hand, isn't far behind when compared to Deepak Nitrite. However, SRF is a larger company in terms of marketcap, absolute revenue and profit numbers.

Being a large company, it has leadership in several products, primarily due to ramping up its production capacities to cater to the growing needs of its clients.

It is planning to do the same further to expand its market share across various product categories.

SRF aims to invest Rs 150 bn in capex for the next four years to ramp up its production capacities.

Out of this Rs 120 bn will be invested in the chemicals business, and the rest will be utilized for its packaging film and textile businesses.

Apart from this, the company is building a captive power plant to control its power costs and improve profitability.

SRF is also actively developing new products to expand its product portfolio. All these efforts are expected to drive growth in the medium term.

Deepak Nitrite, on the other hand, is a pure chemicals business and is the fastest-growing chemicals intermediary company in India.

It has actively invested in acquiring companies over the past to grow its business inorganically. It has also invested in developing new products to expand its product portfolio.

At present, the company is aiming to ramp up its production capacities to cater to the growing needs of its clients.

For this, it has invested over Rs 14 bn to acquire land parcels. Moreover, it is planning to invest Rs 40 bn to develop new products and acquire companies that are manufacturing some of its existing products.

Overall, the company is working towards improving its market share in the chemicals business.

Government initiatives such as the product linked incentive (PLI) scheme Atmanirbhar Bharat and the shift in production and consumption towards Asian and Southeast Asian countries, are increasing the demand for chemicals and petrochemicals.

With Deepak Nitrite and SRF being established players in this space, both are set to benefit from this rising demand.

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Out Now

3 High Conviction Stocks

Chosen by Rahul Shah, Tanushree Banerjee and Richa Agarwal

Report Available

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Equitymaster requests your view! Post a comment on "Best Chemical Stock: Deepak Nitrite vs SRF". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!