India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Views On News

- Mar 16, 2023 - Why Coforge Share Price is Falling

Why Coforge Share Price is Falling

A couple of weeks ago, all people could talk about was the Adani Hindenburg saga. Sentiment around the Indian stock markets fluctuated to a great extent. Either it was another allegation on the group, or it was another announcement of the group prepaying its debt to calm nerves.

But one way or the other, the Adani group was under the continuous limelight of investors. However, since 10 March 2023, their focus has shifted.

The news of a US based bank's fallout has reminded investors of the Lehman Brothers moment in 2008. This has shifted focus from Adani group stocks to the US based Silicon Valley Bank (SVB) and Indian banking stocks for that matter.

The SVB crisis put Indian banking stocks and Indian IT stocks under pressure. Once such IT stock which has fallen sharply is Coforge.

Let's take a detailed look into how Coforge share price is falling because of the SVB collapse.

#1 SVB fallout impact

Coforge, formerly known as NIIT Technologies, is an Indian multinational information technology company based in Noida, India and New Jersey, United States.

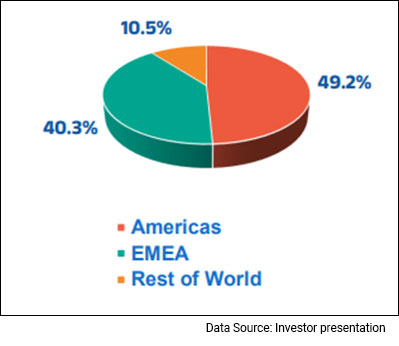

The company earns a big chunk of revenue from the US markets. For the quarter ended 31 December 2022, Coforge earned almost 50% revenues from the US.

Q3 Revenue mix of Coforge by Geography

When a company earns significant revenues from a particular country, it usually has significant banking transactions in the country. Hence, any crisis in the US banking system is also a threat to Coforge.

Reports state that Coforge has exposure to a regional bank namely Fifth Third Bank, whose shares fell over 13.5% on Monday this week and have declined nearly 30% over the last one week.

For this reason, investors are scared that if SVB collapses, it will create a domino effect on other banks and even Coforge.

However, this is all an assumption. Market analysts do not think that the SVB collapse is a trigger for a bear market.

It should be noted that SVB crisis may turn out to be a big concern. Reportedly, the recent developments may lead to banking clients procrastinating on IT spending decisions, given the capital constraints.

The budget cycle of calendar year 2023 may also be delayed. This would result in longer sale cycles which would in all probability, impact the sector's near-term visibility.

Also, the banking, financial service, and insurance (BFSI) segment which contributes nearly 30-35% of the total revenue of Indian IT services, is expected to face the cost-cutting brunt.

Hence, the SVB crisis puts an indirect pressure of Coforge share price.

The IT company's share price was falling even before the SVB collapse which brings us to the second reason.

#2 Promoter holding on a freefall

Promoter holding in a company indicate promoter's trust in the company. When promoters are buying shares in a company there could be two reasons, either they think that the share is undervalued or something big is about to happen in the company.

Asia's leading private equity firm, Baring Private Equity had taken over Coforge, earlier known as NIIT Technologies in 2019. Back then, it held a 63.99% stake in the company, which has significantly reduced to 40% (as on 31 December 2022) because of subsequent selling.

Promoter Selling in Coforge

| Quarter Ending | Mar-21 | Jun-21 | Sep-21 | Dec-21 | Mar-22 | Jun-22 | Sep-22 | Dec-22 |

|---|---|---|---|---|---|---|---|---|

| Total promoter holding | 63.99 | 55.73 | 50.18 | 49.97 | 40.09 | 40.09 | 40.06 | 39.99 |

To add insult to injury, in February 2023, the promoter of Coforge again sold a significant 9.8% stake in the software company.

How Coforge share price has performed recently

In the past five days, shares of Coforge are down 7.8%.

Coforge has a 52-week high of Rs 4,604.3 touched on 05 April 2022 and a 52-week low of Rs 3,210 touched on 19 September 2022.

About Coforge

Originally incorporated as NIIT Technologies, Coforge delivers services around the world directly and through its network of subsidiaries and overseas branches.

It renders Information Technology solutions to business and is engaged in application development and maintenance managed services, cloud computing, and business process outsourcing to organizations in a number of sectors, financial services, insurance, travel, transportation, and logistics, manufacturing and distribution, and government.

To know more about the company, you can check out Coforge fact sheet and its quarterly results.

You can also compare the company with its peers.

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Out Now

3 High Conviction Stocks

Chosen by Rahul Shah, Tanushree Banerjee and Richa Agarwal

Report Available

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Equitymaster requests your view! Post a comment on "Why Coforge Share Price is Falling". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!