India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Views On News

- Feb 13, 2024 - Best OMC Stock: BPCL vs HPCL

Best OMC Stock: BPCL vs HPCL

India is the third largest consumer of oil in the world after the US and China.

The country's oil consumption currently stands at around 5 million (m) barrels a day and is expected to double to 11 million barrels a day by 2045.

To meet the growing demand for oil, the government plans to increase its refining capacity to 450 million metric tonnes (MMT) per annum from the current 253.92 MMT per annum by 2030.

With respect to natural gas, the government aims to increase the pipeline coverage to connect all the states with the trunk natural gas pipeline network by 2027.

A high demand for oil and gas and supportive government policies is expected to drive the growth of oil marketing companies in the years to come.

Keeping that in mind, we compare two government companies that are major players in the refining industry, namely, Bharat Petroleum Corporation Limited (BPCL) and Hindustan Petroleum Corporation Limited (HPCL).

Business Overview

# Bharat Petroleum Corporation

BPCL is India's second-largest oil marketing company (OMC). It is also the third-largest company in terms of refining capacity and the sixth-largest in terms of turnover.

The company's product portfolio is spread across the value chain through which it caters to domestic and industrial clients.

It has three refineries located in India with a refining capacity of 35.3 million metric tonnes (MMT) per annum, which constitutes around 15% of the domestic refining capacity.

The company also has an extensive distribution channel, which includes 83 retail depots, 21,142 retail outlets, and 6,245 LPG distributors.

It is also establishing charging stations across the country and has tied up with Tata Motors for the same.

# Hindustan Petroleum Corporation

HPCL is a refining company and a marketer of petroleum products.

It is also engaged in the production of hydrocarbons and offers services to manage exploration and production (E&P) blocks.

The company has three refineries with a capacity of 23.2 MMT per annum.

It is the second largest retail network holder and operates 21,482 retail outlets, 6,321 LPG distributors, and 4,435 pipeline networks in India.

The company also operates 2,355 electric vehicle (EV) charging stations across India.

| Particulars | BPCL | HPCL |

|---|---|---|

| Market Cap (in Rs billion)* | 1300.6 | 700.4 |

| Refining Capacity (in million metric tonne - MMT)** | 35.3 | 23.2 |

| Sales (in million metric tonne - MMT)** | 48.9 | 43.4 |

| Market Share *** | 25% | 19.4% |

Between the two companies, BPCL has a higher market cap of Rs 1,300.6 billion (bn), whereas HPCL has a market cap of Rs 700.4 bn.

BPCL also has a higher refining capacity, higher sales volume, and higher market share when compared to HPCL.

As of September 2023, BPCL's market share is 25%, whereas HPCL's market share is 19.4%.

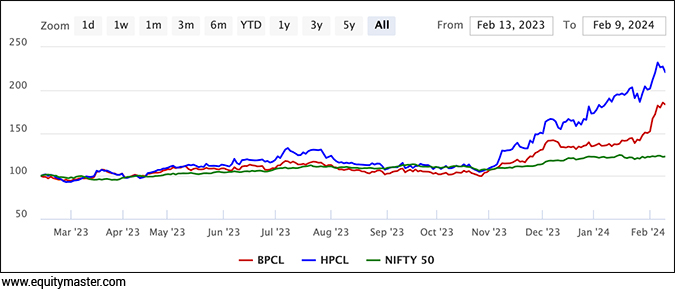

If we compare the performance of both companies on the stock market, HPCL has outperformed BPCL by giving a 112% return in the last year. BPCL, on the other hand, gave a 74% return.

# Revenue

In terms of revenue, both BPCL and HPCL have similar revenue and revenue growth.

In the last five years, the revenue of BPCL and HPCL has grown at a compound annual growth rate (CAGR) of 10%.

Higher demand has helped both companies improve their sales volume and hence the revenue.

Revenue

| Net Sales (in Rs m) | Mar-2019 | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | 5-Year CAGR |

|---|---|---|---|---|---|---|

| BPCL | 2,555,720 | 2,393,466 | 1,560,672 | 2,610,125 | 4,128,271 | 10.1% |

| HPCL | 2,537,590 | 2,504,410 | 1,959,189 | 3,256,994 | 4,149,199 | 10.3% |

For BPCL, the higher capacity utilisation has helped the company manufacture and sell more crude oil and allied products.

On the other hand, for HPCL, the capacity addition made in the financial year 2022 has helped the company in improving its sales volumes.

# Profitability

In terms of profitability, BPCL has higher profits than HPCL.

However, both companies saw their earnings before interest tax and depreciation (EBITDA) and net profit fall in the last five years.

High crude oil prices increased the pressure on marketing margins, which couldn't be offset by refining margins.

Hence, the EBITDA and net profit fell drastically for both companies.

However, BPCL is leading when compared to HPCL as it has reported profits, whereas HPCL reported a loss in the last financial year.

Profitability

| EBITDA (in Rs m) | Mar-2019 | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | 5-Year CAGR |

|---|---|---|---|---|---|---|

| BPCL | 160,496 | 82,539 | 262,374 | 218,056 | 114,363 | -6.6% |

| HPCL | 124,570 | 42,014 | 161,420 | 117,024 | -47,156 | -182.3% |

| PAT (in Rs m) | Mar-2019 | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | 5-Year CAGR |

| BPCL | 85,279 | 36,658 | 173,198 | 116,815 | 21,311 | -24.2% |

| HPCL | 66,906 | 26,387 | 106,629 | 72,942 | -69,802 | -200.9% |

| Gross Profit Margin | Mar-2019 | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | |

| BPCL | 6.3% | 3.4% | 16.8% | 8.4% | 2.8% | |

| HPCL | 4.9% | 1.7% | 8.2% | 3.6% | -1.1% | |

| Net Profit Margin | Mar-2019 | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | |

| BPCL | 3.3% | 1.5% | 11.1% | 4.5% | 0.5% | |

| HPCL | 2.6% | 1.1% | 5.4% | 2.2% | -1.7% |

Going forward, both companies are expected to report moderate profits in the medium term due to healthy refining operations and a diversified product portfolio.

# Debt Management

To know if a business is using too much debt, you should check its debt-to-equity ratio.

BPCL has a debt-to-equity ratio of 0.8x, whereas HPCL has a debt-to-equity ratio of 1.5x.

Debt Management

| Debt to equity ratio (x) | Mar-2019 | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 |

|---|---|---|---|---|---|

| BPCL | 0.9 | 1.0 | 0.7 | 0.7 | 0.8 |

| HPCL | 0.4 | 0.7 | 0.7 | 0.8 | 1.5 |

BPCL is investing heavily in capex, which led to an increase in its debt metrics in the last two years.

The company is planning to invest Rs 130 bn in capex to improve the efficiency of its refineries and expand its marketing infrastructure. It is also investing in exploration projects and in its gas pipeline network.

HPCL, on the other hand, is investing Rs 110 bn in capex for capacity expansion at refineries, to expand the pipeline network, and to contribute its share to various joint venture projects. It is also investing to foray into petrochemicals.

Given the scale of operations of both companies, a high capex requirement is necessary. However, HPCL has a higher debt-to-equity ratio than BPCL, indicating it is overleveraged.

# Financial Efficiency

To understand how efficient a company is in running its business, it is important to look at its return ratios.

Two important ratios are return on capital employed (RoCE) and return on equity (RoE). These ratios tell us how much return a company generates from its capital.

Financial Efficiency

| ROCE | Mar-2019 | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 |

|---|---|---|---|---|---|

| BPCL | 20.1% | 8.4% | 27.6% | 21.1% | 6.9% |

| HPCL | 25.5% | 4.6% | 24.0% | 13.8% | -9.7% |

| ROE | Mar-2019 | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 |

| BPCL | 22.0% | 10.0% | 32.9% | 22.5% | 4.0% |

| HPCL | 22.0% | 8.5% | 28.0% | 17.6% | -21.6% |

The RoE and RoCE of BPCL and HPCL fell drastically in the last five years.

High pressure on profit margins due to rising crude oil prices has affected the company's return ratios.

The RoE and RoCE of BPCL in the financial year 2023 stood at 4% and 6.9%, respectively, whereas for HPCL, the ratios are -21.6% and -9.7%, respectively.

Despite being a large refinery, BPCL is better than HPCL in terms of return ratios.

# Dividend

A company distributes its profits to its shareholders in the form of dividends. Two ratios to look at when you are assessing the dividends of a company are dividend yield and dividend payout ratio.

A company with a consistent increase in these ratios is considered a dividend paymaster.

In terms of dividends, both companies are paying less or no dividends when compared to the dividends five years ago.

In the financial year 2023, BPCL paid a Rs 3.9 dividend per share when compared to a Rs 17.2 dividend per share five years ago.

HPCL did not pay dividend in the financial year 2023, as opposed to a Rs 17.1 dividend in the financial year 2019.

Dividend

| Dividend Per Share (Rs) | Mar-2019 | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | 5-Year CAGR |

|---|---|---|---|---|---|---|

| BPCL | 17.2 | 15.0 | 76.2 | 15.7 | 3.9 | -25.6% |

| HPCL | 17.1 | 10.5 | 23.3 | 14.0 | 0.0 | -100.0% |

| Dividend Yield | Mar-2019 | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | |

| BPCL | 5.5% | 4.1% | 20.5% | 3.8% | 1.2% | |

| HPCL | 6.0% | 4.0% | 10.8% | 4.8% | 0.00% | |

| Dividend Payout Ratio | Mar-2019 | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 | |

| BPCL | 43.8% | 88.5% | 95.5% | 29.2% | 40.0% | |

| HPCL | 36.2% | 56.3% | 31.0% | 27.2% | 0.0% |

The five-year average dividend yield and dividend payout for BPCL is 7% and 59.4%, respectively. In the case of HPCL, the five-year average dividend yield and dividend payout are 5.1% and 30.1%, respectively.

Both companies are paying lower dividends when compared to their five-year average. However, BPCL is ahead of HPCL as it paid a higher dividend consistently when compared to HPCL.

# Valuation

To understand whether a company is overvalued or undervalued, it is important to look at its valuation.

Two important valuation ratios are price to earnings (P/E) and price to book value (P/B). A high ratio, when compared to peers, indicates the company is overvalued, and a lower ratio indicates it is undervalued.

| Valuations | BPCL | 5-Year Average | HPCL | 5-Year Average |

|---|---|---|---|---|

| P/E (x) | 4.9 | 15.2 | 4.8 | 4.7 |

| P/B (x) | 1.8 | 1.7 | 1.6 | 1.1 |

The P/E ratio of BPCL is 4.9x, whereas for HPCL is 4.8x. The P/BV ratio of both companies is in the similar range of 1.6x-1.8x.

Safe to say that both companies are valued similarly.

However, if we compare with their five-year average, BPCL is undervalued, and HPCL is trading in the same range as its five-year average P/E multiple.

If we compare with the industry average, then both the companies are undervalued.

Which OMC Stock is Better: BPCL or HPCL?

In terms of revenue growth, profitability, debt metrics, financial efficiency, and dividends, BPCL is leading ahead of HPCL.

Being the second largest oil marketing company in India, BPCL has made its mark in the industry. It has a well-recognised portfolio of brands, including MAK Lubricants and Bharat Gas.

BPCL is spending heavily in capex to improve the efficiency of its refineries, expand its market infrastructure and gas pipeline network, and engage in exploration activities.

To add to this, it is leveraging its strong retail network to start consumer retail outlets across India.

The company is also foraying into renewable energy and aims to build 1 gigawatt (GW) capacity of renewable energy by 2025 and plans to set up 7,000 charging stations in 2024.

HPCL, on the other hand, has big plans towards the EV charging space.

It plans to increase its refining capacity to 45.3 MMT by financial year 2028.

The company is also investing in expanding its pipeline network and enhancing its presence in petrochemicals, LNG, logistics, EV charging stations, retail chains, hydrogen, and fuel cells.

At present, it has a renewable energy capacity of 184 megawatts (MW), and it plans to increase it to 2.4 GW by the financial year 2028.

HPCL also has a green hydrogen plant of 3.5 tonnes per annum (TPA) and aims to expand it to 16,870 TPA by FY28.

All this shows that the company is gearing up for multi-legged growth.

With an increase in global demand for oil on the back of high industrial activity and growing domestic demand, the revenue and profit of oil marketing companies is expected to go up.

BPCL and HPCL, being major players, are expected to benefit from it.

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Out Now

3 High Conviction Stocks

Chosen by Rahul Shah, Tanushree Banerjee and Richa Agarwal

Report Available

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Equitymaster requests your view! Post a comment on "Best OMC Stock: BPCL vs HPCL". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!