India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Views On News

- Jan 24, 2022 - What Next for Sensex? 40,000 or 100,000?

What Next for Sensex? 40,000 or 100,000?

Today's bloodbath was so intense that around 22% of the stocks trading on the Bombay Stock Exchange (BSE) were locked in the lower circuit limit.

That's not all. Out of the 3,844 stocks listed on BSE, around 3,000 ended in the red.

The two words 'stock market' and 'BSE Sensex' suddenly start finding much more frequent mention in everyday conversations when the markets are falling rapidly or rising and touching new highs.

Indeed, with the Sensex falling more and more in the past five days, interest level in the stock market is currently running high.

The big question now on everyone's mind is what lies ahead for BSE Sensex?

Will it fall to 40,000 levels before heading towards 100,000? Or will it be a direct smooth journey towards 100,000?

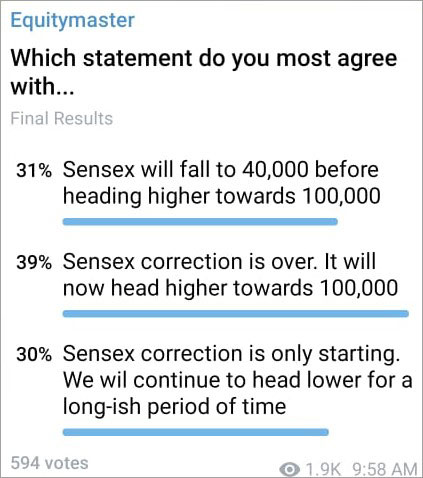

For understanding what our readers are thinking, we ran a poll on Equitymaster's Telegram Channel over the weekend.

Here's what we asked our readers...

Which statement do you most agree with?

- Sensex will fall to 40,000 before heading higher towards 100,000

- Sensex correction is over. It will now head higher towards 100,000

- Sensex correction is only starting. We will continue to head lower for a long-ish period of time

With a response from 594 participants, here's what we found -

About 30% participants think that the BSE Sensex correction is just starting and we will continue to head lower for a long period of time.

Meanwhile, 31% think that the Sensex will fall to 40,000 first before heading higher towards 100,000.

Both these statements are reflecting a strong pessimistic view at least for the time being.

But is the pessimism justified with Sensex already losing over 3,500 points in the past five days? Surely.

There are definite reasons why investors are being pessimistic now.

Investors often turn anxious ahead of the crucial US Federal Reserve meeting outcome. And this time around, there are more reasons to worry.

Reasons such as geopolitical tensions in the Russia-Ukraine border, sustained FII outflows and nervousness ahead of the upcoming Budget announcements.

As long as foreign portfolio investors (FPIs) take out money from Indian share markets, there will be added volatility.

The Union Budget 2022-23 is also exerting pressure as markets have historically been volatile with negative bias in the fortnight preceding the presentation of the budget.

Moving on...

Around 39% people are of the optimistic view and voted that the Sensex correction is over. They believe the Sensex will now head higher towards 100,000.

This statement received the maximum number of votes which shows that there's still optimism.

By the way, we also ran a poll asking our readers where the price of Bitcoin is headed next. You can check it out here: What Next for Bitcoin? Poll Suggests a 50% Crash

In case of Bitcoin, a majority of people expect a 50% decline. Whereas in stocks, there's divided opinion.

Getting back to our question...

The first year of the new decade was stellar for Indian equities when the BSE Sensex returned 21%. But as 2022 begins, investors now seem more worried than elated.

And they should be given the above list of concerns we mentioned.

That is why, investors should bring down expectations and think from a conservative approach that Indian equity markets may not deliver as good returns as they delivered in 2021.

All being said, Sensex touching 100,000 in the long run is inevitable. (Sounds hard to believe but then again, did you think the Sensex would scale peaks of 62,000 in just 19 months after falling as low as 26,000 in March 2020?)

Higher earnings will no doubt drive Sensex to 100,000 at some point of time. But how soon these figures will be breached is anybody's guess. Therefore, investing based on Sensex targets can be as risky as driving blindfolded!

The Sensex breached the 1,000-mark for the first time on 25 July 1990. It took just a year for the index to double. And another two years to double once again. However, after that it was a long 13-year wait for investors to see their money multiply.

That is why, irrespective of the Sensex milestones, Co-head of Research at Equitymaster Tanushree Banerjee believes investing in companies with ability to bounce back from temporary crisis...such stocks could add to your fortune consistently.

No matter whether Sensex stays at 40,000 or leapfrogs to 100,000 in the next few years, these stocks will be the biggest winners.

Happy Investing!

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "What Next for Sensex? 40,000 or 100,000?". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!