Demonetisation: How Black Money Has Become White

- In this issue:

- » The biggest losers of demonetisation

- » How realty developers are getting increasingly desperate

- » A roundup of the stock markets

- » ...and more!

Dear reader,

I wrote to you last week about some very interesting statistics. The numbers essentially pointed towards one glaringly inconvenient fact: most of the black money in the form of demonetised notes seemed to be steadily marching its way back to the banking system.

Today Vivek Kaul, Editor of the Vivek Kaul Diary and The Vivek Kaul Letter, uses his keen insights into the ground realities of the economy to take it further.

He will show you how people across the country are using their ingenuity to convert their black money into white. And exactly what they are counting on to slip through the cracks in the system...

Regards.

Rahul Shah (Research Analyst)

Yesterday in a press conference after the monetary policy, R Gandhi, one of the deputy governors of the Reserve Bank of India, said that Rs 11.55 lakh crore of demonetised notes had made it back to the banks.

This essentially amounts to close to 75 per cent of the total value of the demonetised notes. With this, it is safe to say that by December 30, 2016, the last date of submitting demonetised notes, most of the demonetised notes will make it back to the banks.

This goes against the initial logic that the black money would form a certain portion of the demonetised notes and that won't make it back to the banks. Black money is essentially money which has been earned through legal and illegal means, but on which tax has not been paid.

People who had black money in the form of cash would not submit it to the banks for the fear of generation of an audit trail. And this is how black money would be destroyed.

But we Indians have turned out to be smarter than that. Various ways have been used to convert old demonetised notes into new ones. This is something that the brains beyond the current demonetisation process had not bargained for. Here are a few ways which I have come across, through which black money is being converted into white.

a) I have come across a number of stories where daily wage labourers are still being paid in old demonetised notes. It is a case of either take it or leave it, for them. They have no other option but to take these old notes and then go to a bank to submit these notes into their bank accounts. They then need to stand in another line to withdraw notes which continue to be legal tender.

b) Another story that I have come across is that merchants with black money are forcing their employees to deposit old demonetised notes in their bank accounts. So, the way this works is that the merchant hands Rs 50,000 to his employee and asks him to go and deposit the money into the bank account. He then tells the employee that this money will be deducted from the salary over the next few months. In the process, this becomes an interest free loan for the employee and the merchant's black money gets converted into white.

c) Another interesting story that I have heard is of those with black money buying dollars with it, at a very good rate. This clearly is a play against the rupee. People buying dollars don't want to take any further risk of holding their black wealth in the form of rupees.

It is then the responsibility of the person selling the dollars to go and deposit the money in the bank and ensure that it continues to have purchasing power. This is another way through which black money has been converted into white.

d) Then there have been cases of many households finding a lot of cash in their homes, which the women folk had saved up over the years. This money has been spread across various bank accounts that the household has and deposited into banks.

e) There have also been stories of black money being converted into white, by depositing it into Jan Dhan accounts.

Of course, the thing is that none of these methods are fool-proof. As revenue secretary Hasmukh Adhia told The Indian Express: "No black money hoarder will be spared. If someone has deposited Rs 50,000 in the accounts of 500 people each, he will also be caught."

With information technology, things can easily be tracked. If someone suddenly deposits Rs 1 lakh into an account, in which he normally does not deposit more than Rs 10,000 every month, this can easily be flagged by the information technology system. The income tax department can then enquire into this.

Of course, people who are depositing money into bank accounts and converting black to white in various ways, understand this. What they are essentially backing on is, how many people can the income tax department go after? There is a limitation to that. Also, how easy will it be prove things, if things do end up in court? Further, the more notices that are sent out, the more unpopular the demonetisation decision is likely to get.

And all this is something worth thinking about.

|

--- Advertisement ---

Has Demonetisation Got You Thinking About Stocks? It's almost a month now since Rs 500 and Rs 1,000 notes were demonetised with the aim of fighting black money. But in the last few weeks, we've seen the stock market panic... And many people are now thinking if they should put their money in stocks. If this is you... Then today, let me show you a way to find certain type of stocks that have the potential to withstand almost any economic environment. In fact, these stocks could possibly be among the safest to rely on, among numerous other companies. To know more about this easy way of finding high potential safe stocks in a post demonetized world... Just click here. ------------------------------ |

02:35 Chart of the day

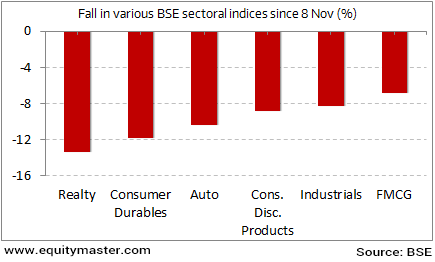

A month has gone by since the government's demonetisation announcement. Not surprisingly, sectors whose revenues have been hit the hardest by demonetisation have seen the biggest declines in their stock prices. Today's chart of the day illustrates the various BSE sectoral indices that have been hit the hardest over the last month.

The worst affected has been real estate. It's no hidden secret that the conduct of business in this industry here in India has for long had one of the highest proportion of black money involved. Its index is down a huge 13%. Perhaps, also a reflection of how real estate prices will move in the months to come.

Consumer durables too have been decimated. Straddling the sweet spot between big ticket purchases and small, the Indian junta may have been used to conveniently using cash to make purchases here. Short term demand may be hit. The auto, consumer discretionary and industrial sectors are not too far behind either.

One Month On, The Biggest Losers of Demonetisation

Talking of real estate, desperate times call for desperate measures. And hardly anyone seems more desperate than the realty developers in the country. A leading daily reports that in light of real estate enquiries taking a nosedive, developers have started offering home buyers a near guarantee that they would be compensated should prices go down. Yes, you read that right. If you purchase a house in the current environment and if its price suffers a fall of say 20%, developers will compensate you for the difference.

Demonetisation has indeed created a heavy fog of uncertainty on the future of real estate in the country. And this move is seen as some kind of a last ditch effort to try and persuade buyers into buying properties.

While these are still early days, we don't think the move is going to cut any ice with the buyers. It is high time the real estate developers in the country realize that although there's a huge potential for growth, the current prices have moved real estate far beyond the limits of affordability. And there's real hope only when prices suffer a drop of meaningful proportions. It can either come in the form of prices themselves correcting or in the form of a time correction where prices remain stagnant for few years at a stretch.

The Indian stock markets were trading strong today on the back of sustained buying activity across most index heavyweights. At the time of writing, the BSE-Sensex was trading up by around 375 points. Gains were largely seen in auto and metal stocks.

04:56Investment mantra of the day

"Only buy something that you'd be perfectly happy to hold if the market shut down for 10 years." - Warren Buffett

This edition of The 5 Minute WrapUp is authored by Rahul Shah (Research Analyst).Today's Premium Edition.

How to Pocket 46% Gains on the Market's Inability to Distinguish Risk from Uncertainty

Why Oil Prices *Should* Stay Above US$50 per barrel

Read On...

| Get Access

Recent Articles

- All Good Things Come to an End... April 8, 2020

- Why your favourite e-letter won't reach you every week day.

- A Safe Stock to Lockdown Now April 2, 2020

- The market crashc has made strong, established brands attractive. Here's a stock to make the most of this opportunity...

- Sorry Warren Buffett, I'm Following This Man Instead of You in 2020 March 30, 2020

- This man warned of an impending market correction while everyone else was celebrating the renewed optimism in early 2020...

- China Had Its Brawn. It's Time for India's Brain March 23, 2020

- The post coronavirus economic boom won't be led by China.

Equitymaster requests your view! Post a comment on "Demonetisation: How Black Money Has Become White". Click here!

9 Responses to "Demonetisation: How Black Money Has Become White"

Bharat

Dec 10, 2016I write this to check the understanding of Mr. Pradip Shah, whose comment appears as the most recent one.

a) What is the problem for black money holders if the money remains black, as long as it is legal tender? Demonetisation does NOT make NEW cash illegal tender. He will continue to park his black money in the EXISTING avenues, which continue to be available

I think Mr. shah's point is that the money remains black.

I guess what Mr. Vivek intended to say was that the new black money (legal tender) is usable, as much as it was before demonetisation

evaman

Dec 10, 2016This happens to be a moderated site, so dont know how much of what we write really becomes 'white'.

Yet, couldnt resist the temptation to respond, especially wondering about those comments such as 'clarity of thought and expression is commendable'

On the employer paying advance and bonus in old notes, I guess the exercise would pass on the burden of exchanging them to the employee and is an indirect means to convert them to legal tender, not necessarily white. What happens to this money, post 31-Dec actually depends on the thoughts, power and systems used by the employer. If there is no payroll and all is in cash, then this payment just gets adjusted and the employer has his notes converted to new either from new source of cash (if any) or in the bank account with less withdrawal (towards salary) later. The latter would mean, the employer switched from cash transactions to cashless which can help detect both the income increase and spend (salary) decrease

Ety

Dec 8, 2016The demonetisation decision by P.M. Modi wanted to upset the political parties sitting on a lot of cash.and put them into some form of disadvantage in the forth coming UP elections. According to the RBI Governor the decision was deliberated. Surely it may have been discussed that the opposition could create a disruption in Parliament and this could disrupt the GST process.

The RSS has not been happy with GST and the FM was successful in the passing of the bill in the last session. He would have surely objected to demonetisation and seen the risk to GST. Therefore it is plain to see why the FM was left out. Mr. Modi who in his heart does not want to implement GST has now an opportunity to blame the opposition disruptions of Parliament on the delay in implementation of GST.

It is another matter that the decision makers have not thought out the implementation and the consequences to the economy.

The country and countrymen are suffering.

Kumar

Dec 8, 2016So your great Mr Vivek Kaul writes stories based on stories he hears over the internet. :) and you send out your recommendations biased o these stories.

If the black money has turned into white, they are also brought in income tax. You will see this in time to come

evaman

Dec 8, 2016It would be really sad if this exercise ends up with just inconveniencing the general public and we are back to where we started and that the black got converted to a new form of black.

There have been some raids, confiscation etc., but if people who made large violations are let go scot-free then it would make a large dent in the usefulness and credibility of this exercise.

One need not chase all of them, especially the smaller ones, but they could be put in a watch mode. If these people mend themselves and show signs of reform, that in itself is a good achievement. By and large, the majority would comply, if they know that the is system is credible, trust worthy and unbiased. I think many do not want to comply to a corrupt system or one that lacks credibility.

G Shiva Sai

Dec 8, 2016Low value, high volume cash transactions like buying vegetable, meat, grocery, provisions, local travel etc are still alive with old notes changing hands for goods/services procured.

As on this day, buying goods with old Rs. 500/- notes was still going on. I have seen this in provision shops, meat shops and even in a Arts and Craft exhibition in Chennai. Till Dec 31, old notes can be deposited. So what if who does deposits it.

Demonitisation has many goals. Reduction of black money is just one. Unaccounted money finds its way into the mainstream. Though reduction cash in the economy is a benefit for the banking system, the offenders get away. If future the unorganised sector will get converted to some degree into organised sector.

R.Thirumurthy

Dec 8, 2016The clarity of thought and expression is commendable.

We are all heavily investing in this mammoth exercise of remonetization by way of the hardships being endured. It's hard to imagine all this would be frittered away. I would imagine the Government and the Opposition would play their roles willy nilly to ensure those gaming the system now will play a heavy price in due course. By and by politicking and posturing would become muted. Data Analytics backed by a strong digital infrastructure would play a critical role in taking the whole exercise to its logical conclusion and institutionalising a more ethical universe of economic activity. Human resources for all this would not be wanting either.

It is a safe bet that kicking and screaming the tax cheats would change their wicked, wicked ways. It is a question of time, patience and determination. That is all. Whatever needs to be done will be done based on expanding loops of learning. Critics and supporters alike would feed and enrich this collective process of learning. It won't hurt to be positive of the outcome in the medium to long term, unless, of course, one really has to face the music because of one's own shady shenanigans. Even such people are not being put to the guillotine, after all! Only their black money and black wealth would say a painful and lingering goodbye to them.

Pradip Shah

Dec 8, 2016Dear Sir,

Sorry to say that your knowledge of "white", "Black" and process of its conversion is abysmally poor. Let us examine each case referred to in your analysis.

(b) Rs. 50,00 to employees - since employer has paid black money, it can not become white as on today as he is not getting anything today. At the time of salary falling due in future, naturally employer will withdraw cash from bank and keep with him as there is no question of paying it to employee again. So what was black remained black.

(c) When did buying US$ from illegal market become white? Strange logic. Buyer of US$ is paying black money in INR. In turn, he is getting US$ which is black and illegal currency.

(d) If any amount deposited in bank account becomes white this country would not have the problem of black and white. Everybody would have deposited black money in the bank and enjoyed. Life is not simple as you make out to be.

(e) Jan Dhan Account - Once again the case of poor knowledge. By depositing money in some ones bank account it does not become white for either of the party. What happens is that instead of money lying with some one at his home gets deposited in the bank account of some other person. How will it change the colour of money?

Please update yourself thoroughly.

allen peter

Dec 11, 2016It is now apparent that demonetisation would cause much distress and reduce our GDP in the near term. But what is not clear is how long the negative effects would last. Positive effects like greater tax collections would be experienced as a gradual increase in tax collections . Meanwhile many in the villages and sick people in ques would have died of lack of ability to cope with this extra stress. Why are we so callous to the poor in our society? Even when we talk of development,we talk of only industries and smart cities. In fact there is diminishing utility of investment in our urban areas,as the world is buying less and less of our goods, even as our factories are working at 70% capacity utilisation. Exploiting our natural resources like rain water and providing better facilities in our villages will develop more Indians and put more financial resources in their hands to buy goods made by our existing factories