The Right Number of Stocks for Your Portfolio

In this issue:

» Will aggressive marketing campaign help e-com firms in the long run?

» Positive macro data unlikely be reflected in earnings soon

» A round up on markets

» ....and more!

00:00 |

|

|

|

I eventually came to understand how this man had accumulated so many stocks. His 'action itch' prompted him to seek new investment ideas all the time. As a result, he was acting on almost every stock idea that came his way. But he had little clue about those stocks and their underlying businesses. So, his level of conviction was poor.

He would invest small amounts in each stock...sell off his winners prematurely...and the losers run, as he was unwilling to sell them at a loss. I don't know his actual returns, but seeing his haphazard investing strategy, my guess is he did worse than the benchmark Indian indices.

I know another gentleman, an astute investor, who follows a sharply contrasting approach. His top four stock picks account for over 80% of his entire stock portfolio. Doesn't that sound highly risky? Not necessarily. He follows a highly disciplined approach and invests only in stocks in which he has supreme conviction.

So here are two very different investors...two approaches that are poles apart.

What do they tell us about portfolio diversification? What is the right number of stocks that an investor should have? Should you have four stocks...30...or as many as 60 stocks in your portfolio?

Let's consider what some of the world's greatest investors did...

Peter Lynch, the famous fund manager at Magellan Fund, is known for achieving the best 20-year average return compared to any other mutual fund manager on record. But did you know that when he retired, his fund had over 1,500 stock positions?

As of 30 June 2015, Warren Buffett's Berkshire Hathaway held close to 50 stocks. But guess what, his top five holdings accounted for about two-thirds of the total stock portfolio worth over US$107 billion.

What does all this mean? Does the search for the 'right number' get more and more confusing?

Let me tell you that there cannot be a one-size-fits-all answer for this. Each investor has to find what works best for him. In your quest for the ideal portfolio diversification, keep these two guiding principles in mind...

- The real risk is not knowing

- Follow their principles, not their actions

You could have a diversified portfolio and have a feeling that your portfolio is safe. But you could still lose money. If you do not have a sound stock selection process, if you have no clue about the businesses that you have bought...the risks that underlie those businesses...then you are certainly treading a risky path. So, understanding where you are putting your money is a key investing principle.

If Buffett has about 50 stocks in his portfolio, that doesn't mean it's the right number of stocks for you. Despite the fact that he has nearly 50 stocks, he has a highly concentrated portfolio. The top five stocks account for the bulk of the total portfolio value. So, is high concentration the right answer for you?

If you are a full-time investor...if you have a deep understanding of businesses...if you have your own independent views on stocks...if you have high conviction about your stock ideas...if you have high risk appetite...then having a concentrated portfolio may make sense for you.

But if you are an amateur investor with moderate risk appetite, then having a well-diversified portfolio is the right way to go.

Investment guru Joel Greenblatt has said that owning about 16 stocks eliminates about 93% of the non-market risk. Again, one-size-fits-all portfolios don't exist. But we agree that this is a reasonable ballpark figure for the average serious long-term investor.

But this number is not the Holy Grail. A few more or less might work better for you.

In your view, what is the right number of stocks for your portfolio? What works best for you-concentrated or diversified portfolio? Let us know your comments or share your views in the Equitymaster Club.

|

--- Advertisement ---

Why Little-Known Companies Could Make You Big Returns... Some little-known and barely heard of companies could be the star performers in your portfolio. It's because these companies have a huge potential for profit. A potential unrecognized by most investors as of now. And you need more than a magnifying glass to go through the details of such companies to pick the winners. Believe it or not, Equitymaster has been researching and recommending such companies for more than 7 years now. And our subscribers have made returns like 124% in 7 months, 217% in 3 years and 11 months, 250% in 2 years and more from such little-known small companies we've recommended. So we now invite YOU also to be part of this amazing opportunity. Just click here for full details...

|

02:30 |

Chart of the day | |

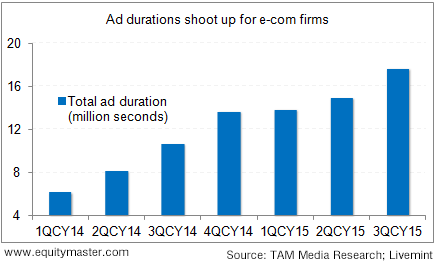

Even if these firms score high with regards to gross merchadise value (GMV)of goods sold, final benefits are likely to be limited for them. The customers' lack of brand loyalty, lack of product/service differentiation and neck to neck competition between these firms offering mouth watering huge discounts is in fact likely to add to losses.

As e-commerce firms plan to list, those who claim the top slot with regards to GMV will make it a selling proposition. This is because there are no profits to talk about. And there are unlikely to be any for a long time we believe. As such, one would do well to limit one's engagement to shopping only and not invest in these firms.

|

03:30 |

|

|

However, the false positive alarms may not be over yet. Take the case of recently released capital goods production data. The same suggests 22% year on year (YoY) growth in the month of August. Not to mention a 14 month high. Finally, the government has got something positive to show on the report card. That may again lift market sentiments. However, investors must note that while the public capital investing has gone up, it has come at the cost of loosening fiscal deficit targets. With major global economies showing signs of vulnerability, India is unlikely to remain shielded. The stress in the banking sector, high corporate debt and unused capacities are not helping either. Hence, long term investors would do well to remain sceptical of any kind of recovery talk and investing themes and stick to bottom up approach of investing.

04:30 |

|

|

The BSE-Sensex was trading lower by 42 (down 0.2%) and the NSE-Nifty was trading down by 17 points (down 0.2%). The S&P BSE Midcap index was trading down by 0.3%, while the S&P BSE Smallcap index was trading up by 0.3%.

04:55 |

Today's investing mantra |

Publisher's Note: With more than 21,000 views, in a matter of days, Asad has just concluded one of his biggest master series ever! In this 3-Part series, Asad has shared his own proprietary trading strategy called - Income At Will. He's also shared why he believes that it is one of the safest trading strategies he has ever designed and how it holds the potential to deliver regular income week-after-week, month-after-month and year-after-year. In fact, it had a 98.3% success rate (in its backtest) over a 5 year period. So, if you haven't viewed all the sessions already, we would recommend that you do it right away because these videos could go offline any time now. You can click here to view video #1 (with transcript); video #2 (with transcript) and the Most Important Video video #3 (with transcript). Asad also has a special surprise for all his viewers... so, do not delay.

Today's Premium Edition.

Caution and Opportunism: When Stock Prices and Company Profits Diverge

A big divergence between profits and stock prices often demands further attention.

Read On...

| Get Access

Recent Articles

- All Good Things Come to an End... April 8, 2020

- Why your favourite e-letter won't reach you every week day.

- A Safe Stock to Lockdown Now April 2, 2020

- The market crashc has made strong, established brands attractive. Here's a stock to make the most of this opportunity...

- Sorry Warren Buffett, I'm Following This Man Instead of You in 2020 March 30, 2020

- This man warned of an impending market correction while everyone else was celebrating the renewed optimism in early 2020...

- China Had Its Brawn. It's Time for India's Brain March 23, 2020

- The post coronavirus economic boom won't be led by China.

Equitymaster requests your view! Post a comment on "The Right Number of Stocks for Your Portfolio". Click here!

7 Responses to "The Right Number of Stocks for Your Portfolio"

Prem Sagar

Oct 18, 2015Dear Sir,

I have subscribed to Hidden Treasure, India Letter and Stock Select service, each of which gives one recommendation per month. As on date there are about 60 open positions in the three categories as above.

In the above scenario what should be the number of stocks which the portfolio should have? What strategy should be followed to make full use of the three services and yet keep the number of stocks in the portfolio to the manageable number.

Please advice.

Regards

Prem Sagar

Troy Gomes

Oct 15, 2015I am a subscriber to wealth alliance and microcap millionaire since over a year and the total stocks recommendations till date (open positions) are around 55 stocks, so what should a subscriber do based on this article "The Right Number of Stocks for Your Portfolio"

NKN

Oct 15, 2015I generally keep my stock picks between 4 and 7, Mutual Funds=4, Liquid Fund=1. Its working well for me, as there is no tension for this.

I invest in stocks in a SEP plan (like SIP), and don't bother about the market fluctuations. If I find one of my stocks is available cheaper but still sound, I buy more to top up.

brave

Oct 14, 2015One can have MAJOR investment in about 10-15 stocks. However minor investments can be held in twice the number of major{10 to 15 }stocks for watch and trade purpose .

Rajagopalan Ramesh

Oct 14, 2015In my view, one can have the required number of shares as per his approach - if he has time to monitor, he can hold as many as 60 shares - as the risk will be spread over a large number of shares - as long as the shares are fundamentally sound. If he does not have time to analyze and monitor, he can have as small a portfolio size of 5 stocks. EQM Services always recommends A Pyramid for portfolio allocation - it only talks about wise allocation of stocks but not the number of shares one should hold.

In my experience, when I pick up stocks based on medium to long-term holding, invariably within a few weeks from selection at least half of the portfolio gains in value over 2 to 3 % p.m. which replicates the pattern on reinvestment. But the same shares do not gain in value - some may gain some may lag behind - but overall the portfolio gives a return of 2 to 3 % p.m. The turnover cycle is also fairly quick. Since the stocks are selected based on fundamentals, even the stocks which lose value in a particular month gains in the next month or so but the overall gains work out to be 2 to 3% p.m. As long as the PYRAMID of stock allocation is kept in mind and followed without much of deviation, the portfolio returns are fairly good.

RANDHIRSINGH DAHIYA

Dec 4, 2015One should not have more than 15 to 20 stocks at a time, keeping in mind ,when to buy, and when to sell.