The Case of the Disappearing Money

- In this issue:

- » Does India need giant banks?

- » Will the FMCG sector's valuations hold up?

- » Weekly market roundup

- » ...and more!

Today, we're sharing an interesting essay from Anisa Virji, our colleague and the Managing Editor over at Common Sense Living, who has some great lifestyle and wealth building ideas. Below, she shares her thoughts on some basic lessons for investors.

Happy reading!

Devanshu Sampat

'You don't have a clue where your money is!'

'You don't have a clue where your money is!'

Lee Gates (George Clooney), an overly dramatic host of a financial investment show in the new Hollywood movie Money Monster, reminds his viewers that their hard-earned money is not bricks of gold in a vault or rolls of bills stuffed under their mattresses. It is, in fact, nothing but a bunch of numbers in a computer that can, at any given time - poof! - just disappear...

The movie goes on to investigate, in the typical loudly entertaining fashion of Hollywood, what happens to $800 million dollars that disappears overnight in one stock that Gates has recommended as 'safer than your savings account'.

Where's the money gone? According to the company's CEO it has gone down an algorithmic 'glitch'... An answer that apparently satisfies everyone until one frustrated common man who lost all his savings in that stock pulls out a bomb vest and a gun and asks: What on Earth does that mean???

In a somewhat clumsy, obnoxious but sometimes funny way, the movie reminds us to question what the rich and powerful our doing with our money... Because we find that it was not the algorithm after all...but the 'human fingerprints' of a corrupt CEO that caused the loss.

In the equally obnoxious, equally incomprehensible real-life stock market, we must continue to wonder: Who is handling our money and what are they doing with it?

In spite of all the noisy information overload (in the movie and markets), here are some lessons we as investors take away from it:

Lesson 1: For heaven's sake, do not put all your money in one stock

If you put all your eggs in one basket, (sorry to use that tired but brilliant cliche) and the eggs break, you cannot blame the chicken. In fact, you will get no sympathy from the other farmhands - and the farmer's wife will probably get really mad at you for losing all the eggs.

If you put all your eggs in one basket, (sorry to use that tired but brilliant cliche) and the eggs break, you cannot blame the chicken. In fact, you will get no sympathy from the other farmhands - and the farmer's wife will probably get really mad at you for losing all the eggs.

So here's another cliche: Diversify, diversify, diversify!

If you haven't seen Equitymaster's asset allocation strategy (they should put it on a plaque for investors to hang over their computers) take a look at it now. You also need an asset allocation strategy that extends beyond stocks (i.e. cash, gold, property, other asset classes...). If you're a reader of Mark Ford's Creating Wealth, you have access to his three-legged stool of safety that provides iron-clad protection to your wealth.

Lesson 2: If you don't know the company, do not give them your money

If you don't understand how a company runs, what they do, what their management is like, you have no business investing in them. If you do not have the willingness, time, or wherewithal to do the level of research you need before you invest, you need to get recommendations from a research house you trust.

And, by the way, it's shocking what some of these guys are up to. Have you read Equitymaster's new book yet? It gives away all the secrets of rotten managements and what happened to their stocks.

For example, did you know what happened to Ranbaxy? A greedy, corrupt management that as per whistleblower Dinesh Thakur...'used fraudulent data to get USFDA approvals' and when the Forbes ranking of the company fell ten places, the management blamed the decline on a 'lack of employee loyalty'.

What happened to the market cap of Ranbaxy and its Indian peers? Between 2008 and 2013, it fell 15% while that of three of its competitors rose 200-600% (page 130 of the book).

This is just one example of how management greed and recklessness can ruin a great business. And devalue a great stock. The book is full of eye-opening stories and scandalous examples including laying bare Satyam's fall, Jindal's greed, Jet Airways' manipulations...and so many more that can teach you not to put blind faith in the letters and numbers listed on the stock ticker.

Lesson 3: If you do not have an emergency fund, and extra streams of income, get on that now

Why-oh-why would you put all your money at risk? Actually, there is a good reason. Many people believe that to get big rewards, you have to take big risks. Or that to build great wealth, you have to, again, take big risks. But that, readers, is what we call a fallacy. An untruth. Or at least not the complete truth. Before you risk any money, you need to lay yourself out a nice, soft, money-stuffed mattress on which you can land in case your 'risk' blows up.

Surveys show that a large number of people in the Western world already have extra income streams bringing them money in addition to their primary sources of income. And more and more people in the rest of the world, especially Asia, are catching up.

Do you have extra streams of income? If not, then please don't tell me you don't have time, energy, skills - if the whole world is doing it, you can too.

And we can tell you exactly how to focus on and develop your wealth-building prowess. How to build wealth, use it, protect it, and live a wonderful, rich, secure life while you do it. No one is talking about these ideas. Which is so wrong, because everyone should know these ideas. Well, we are talking about them. And we hope that you will listen in.

Editor's Note: Ideas that will change not just your understanding of wealth...but the actual numbers in your bank account...are shared in the Creating Wealth newsletter. You can try this now as part of a free thirty-day trial. Consider this our way of giving you a nice safe mattress to land on.

What are the income opportunities you look for outside of equities? Let us know your comments or share your views in the Equitymaster Club.

Size does matter. This is especially true for enterprises. It doesn't take a rocket scientist to figure out that the larger the size, the bigger the base available for fixed costs to spread over and lower the costs. And this applies as much to the service sector as it does to a manufacturing output. However, is this the right course of action for banks? Is the consolidation of smaller banks in order to create a mammoth banking entity worth all the effort? We don't think so. Given the systemic risks a failure of a large bank can pose; its creation may not be the right way to go.

We don't have to go too far back to show the perils of such a move. As a leading daily points out, four of the five largest banks in the world are Chinese. And these aren't exactly paragons of virtue. The Japanese have also had their own tryst with large banks and the experience left a bad taste. The banking giants had to be eventually bailed out by tax payers after years of capital erosion. In fact, there are quite a few examples of a similar kind, all highlighting the risks associated with letting a bank become too big for its boots. Consequently, all the talk of India going ahead with a similar plan should be met with stiff resistance if not dismissed outright. On the contrary, the need of the hour for India is more banking competition and not less.

3.05 Chart of the Day

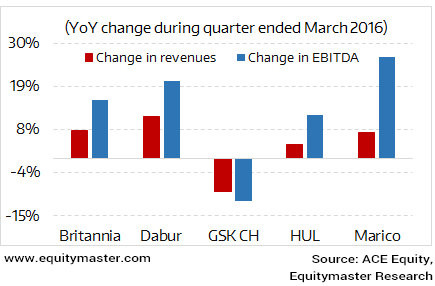

FMCG companies' results for the quarter ended March 2016 indicate continued volume and pricing pressures. Volume pressures are led by slowdown in rural markets and subdued sentiments in urban zones. As management of most companies did indicate, rural volume growth came in lower as compared to urban volume growth - which was not the trend earlier.

FMCG: Facing Demand Headwinds...

With inflationary pressures now building in, it may seem to be a favourable ground for the sector as it would allow them now to up prices. Having said that, the margins for most of the players are at their all-time highs - or are hovering close to them. And with increasing market share and volume being the priority for most players, how this will translate to future pricing strategies - especially at a time when the favourable cost scenario seems to be behind it - will be interesting. Not to mention the rising competitive intensity. With valuations of FMCG companies holding up (despite the surge in profits over the past year), market expectations are that of a volume bounce back going over the short to medium term. We believe investors should well consider how this could possibly trickle down into profit growth. With all eyes on the monsoons, this expected trend however is still some time away.

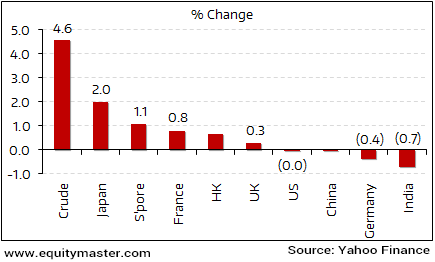

Global markets witnessed a mixed trend last week. The US markets ended flat on rising concerns that the Federal Reserve may hike interest rates as early as June. This follows the release of minutes of the Fed's latest meeting that stressed on the central bank's intent to raise interest rates soon provided the economy continues to recover. Even the Chinese markets ended weak on fears that the government may be taking a cautious stance on further stimulus in the backdrop of growing bad loans. As per finance ministry, the government will earmark $4.23 billion to help local governments pay for capacity closures in the steel and coal sectors this year.

Within Asia, the Indian markets also closed the week in the negative zone. Investor sentiments were frayed by record losses posted by public sector banks and possible interest rate hike by the Fed. Even the tightening of P-note norms on money laundering further dampened sentiments. Indian markets were down by 0.7% for the week. Stocks from all the sectors, barring realty, ended in the red. The least favoured were those from the capital goods, power and banking spaces.

The rest of the Asian markets ended in the positive territory with the Japan being the biggest weekly gainer at 2%. Barring Germany, all the other European markets managed to post gains in the week gone by. Meanwhile, crude oil continued to firm up as the Nigerian output fell to 22-year low. However, the price remained below the $50 a barrel mark.

Performance During the Week Ended 20th May, 2016

The Equitymaster Android App has been a huge hit with more than 10,000 users and an average rating of 4.2. And we released the Equitymaster App for iOS. It already has a few hundred users and an average rating of 4.5. Our apps are a convenient way for you to access our honest views and opinions on investing in India. And we are super excited that both apps have received such a great response. Download the Equitymaster iOS App here. If you are an Android user, you can join more than 10,000 Equitymaster Android App users here.

4:50 Weekend Investing Mantra

"We don't get paid for activity, just for being right. As to how long we'll wait, we'll wait indefinitely."-Warren Buffett

This edition of The 5 Minute WrapUp is authored by Devanshu Sampat (Research Analyst).Today's Premium Edition.

Today being a Saturday, there is no Premium edition being published. But you can always read our most recent issue here...

Recent Articles

- All Good Things Come to an End... April 8, 2020

- Why your favourite e-letter won't reach you every week day.

- A Safe Stock to Lockdown Now April 2, 2020

- The market crashc has made strong, established brands attractive. Here's a stock to make the most of this opportunity...

- Sorry Warren Buffett, I'm Following This Man Instead of You in 2020 March 30, 2020

- This man warned of an impending market correction while everyone else was celebrating the renewed optimism in early 2020...

- China Had Its Brawn. It's Time for India's Brain March 23, 2020

- The post coronavirus economic boom won't be led by China.

Equitymaster requests your view! Post a comment on "The Case of the Disappearing Money". Click here!

2 Responses to "The Case of the Disappearing Money"

Asok

May 22, 2016What about people who do not use borrowed money aka credit card for purchase? Debit card payment option is not there in EM's payment portal. Any other way to purchase the book?

Vijay

May 23, 2016What are your plans for bringing out the equitymaster app for windows phone, now that iOS and Android is already out.