- Home

- Todays Market

- Indian Stock Market News May 8, 2024

Sensex Today Ends 45 Points Lower | IT Stocks Drag | Why Bharat Forge Share Price is Rising Wed, 8 May Closing

After opening the day lower, Indian share markets pared losses as the session progressed but still ended lower.

Indian equities faced yet another volatile session on Wednesday as investors turned cautious amid the ongoing Lok Sabha elections.

At the closing bell, the BSE Sensex stood lower by 45 points.

Meanwhile, the NSE Nifty closed lower by 2 points.

BPCL, Tata Motors, and Hindalco were among the top gainers today.

Asian Paints, Grasim and HDFC Bank on the other hand, were among the top losers today.

The GIFT Nifty was trading at 22,388, down by 5 points, at the time of writing.

For a comprehensive overview of key players in the financial sector, check out list of Fin Nifty Companies.

For impact of the Bank Nifty companies and comprehensive overview of the index, check out Equitymaster's Bank Nifty Companies list

The BSE MidCap index ended 0.9% higher and BSE SmallCap index ended 0.6% higher.

Sectoral indices are trading mixed with socks in capital goods sector, power sector and auto sector witnessing most buying. Meanwhile stocks in banking sector and IT sector witnessed selling pressure.

Shares of ABB India, Hindustan Zinc, and Marico India hit their respective 52-week highs today.

Now track the biggest movers of the stock market using stocks to watch today section. This should help you keep updated with the latest developments...

The rupee is trading at 83.51 against the US$.

Gold prices for the latest contract on MCX are trading marginally lower at Rs 71,090 per 10 grams.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

How to Uncover High Potential Small Caps Opportunities

In This Market

Present market sentiment aside, there's an underlying economic force which could cause the Small Cap Index to soar over the next decade...

And with a few well-placed investments today, you could potentially build life changing wealth over the long term.

Explore this opportunity now

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

Meanwhile, silver prices were trading 0.3% lower at Rs 82,591 per 1 kg.

Speaking of stock markets, Kotak Bank has lost more than 10% of its market value following the ban by the RBI. It has pushed an already underperforming stock deeper into the underperforming zone.

HDFC has also disappointed investors in the last few years. ICICI Bank on the other hand has been a stellar outperformer.

Rahul Shah, Co-head of Research at Equitymaster discusses can HDFC and Kotak manage a turnaround in his latest video

Tune in to find out the result.

Make: Your Investing Stress-free with Value for Money Stocks

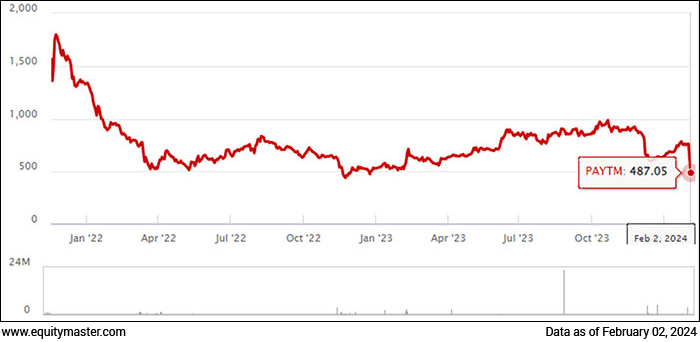

Paytm Nears All-Time Low. Here's Why.

In news from the fintech space, shares of Paytm, owned by One 97 Communications, saw a decline of over 4% to Rs 320 per share on 8 May.

This fall comes amid reports indicating that Aditya Birla Finance, one of the fintech firm's key lending partners, invoked loan guarantees due to repayment defaults from customers.

The stock hovered close to its all-time low of Rs 318, seen on 16 February 2024.

So far this year, the stock of Paytm has crashed nearly 50%, underperforming a 3% rise in the benchmark Nifty 50 index during the same period.

Apart from Aditya Birla Finance, other lenders such as Piramal Finance and Clix Capital also pulled the plug on their partnerships with Paytm after RBI barred Paytm Payments Bank from operations.

The fintech major continued to see a dip in Unified Payments Interface (UPI) transactions for the third straight month in April. The company registered 1,117.3 million transactions in April, down 9% month-on-month (MoM) in volume from 1,230.04 million transactions in March.

The company's market share in the UPI applications came at 8.4% in April, down from 10.8% in February and 9.1% in March.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Could the Bears Strike During Election Season?

Discover how this Safe Stock Strategy Could Protect Your Wealth & Potentially Lead to Big Long Term Gains

Full details here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

Why Bharat Forge Jumps 8%.

Moving on to news from the defence sector, Bharat Forge shares gained over 8% on NSE after the company reported a 59.3% year-on-year rise in net profit for Q4FY24 at Rs 3.9 bn.

At about 2 pm, the stock was trading at Rs 1,340. The positive management commentary regarding future profitability also seemed to have boosted the stock price.

In a statement, Bharat Forge Chairman and Managing Director Baba Kalyani expressed expectations for FY25 to be a period of growth, driven by the defence business, industrial casting business, and sustained improvement in capacity utilization of the overseas operations.

Kalyani emphasized that the turnaround of the overseas operations, along with margin enhancements in other business verticals, is anticipated to fuel robust profitability growth in FY25.

The company highlighted that the defence business significantly contributed to its strong fiscal fourth-quarter results.

According to an exchange filing, the fulfilment of defence export orders secured by Kalyani Strategic Systems Limited (KSSL) and the continuous strong expansion of export business across all business segments, except Oil & Gas, were key factors driving the impressive performance.

In FY24, the company said that it secured new orders worth Rs 13.5 bn across automotive & industrial applications.

Bharat Forge provides components and solutions to various sectors, including automotive, railways, defence, construction and mining, aerospace, marine and oil and gas.

Aadhar Housing Finance IPO booked 19%

Moving on, On the first day, Aadhar Housing Finance's initial public offer (IPO) garnered a 19% subscription.

QIB investors' portion was booked at 32% followed by a 14% subscription in the retail investor category. As for non-institutional investors, the quota was booked at 12%.

Ahead of the issue opening, the company raised nearly Rs 8.9 bn from anchor investors.

The IPO comprises a fresh equity issue worth up to Rs 10 bn and an offer for sale (OFS) of up to Rs 20 bn by existing investors.

Under the OFS, BCP Topco VII will offload shares.

The funds raised through the fresh issue would be used for general corporate purposes and to meet future capital requirements towards onward lending.

For details, check out Aadhar Housing Finance IPO: A Promising Play on the Affordable Housing Boom.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Ends 45 Points Lower | IT Stocks Drag | Why Bharat Forge Share Price is Rising". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!